Extend Agentforce Financial Services

Learning Objectives

After completing this unit, you’ll be able to:

- Define add-on features to use with Financial Services Cloud.

- Describe the capabilities of Regulations and Policy Management.

- Discuss how Digital Lending transforms the lending lifecycle.

Add-on Features for Common Financial Services Needs

To meet the goals of your financial institution, you can add specific Salesforce-developed feature sets to Financial Services Cloud. For example, add helpful compliance options to stay within the bounds of government regulations and internal policies. You can also add digital-lending features to bring lending products to your customers on one platform.

Comply with Regulations and Policies

Use Process Compliance Navigator to follow financial rules and regulations with tracking and auditing capabilities. Technology and compliance staff can use additional features to make sure the entire institution stays in line with internal and external laws and policies.

Compliant Data Sharing

Compliant Data Sharing helps Salesforce admins and compliance managers configure advanced data-sharing rules. Your team gets precise control and monitoring of data sharing without complex code, keeping you easily in compliance with regulations and policies.

Regulations and Policy Management

Use Regulations to define, manage, and track rules. Compliance officers can share versions of the rules and inform everyone who must follow them. Compliance officers can also connect business processes to specific regulations, and create and revise policies for different functions to stay compliant with internal and external policies.

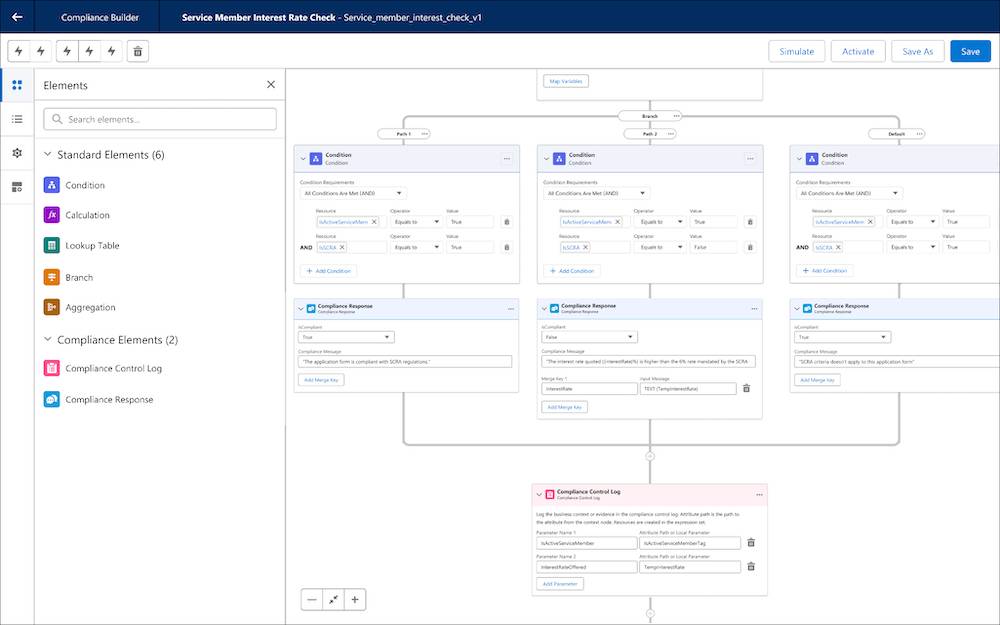

Control Management

Identify control gaps in a process, implement new controls using low-code or pro-code tools, and embed those controls directly into business workflows with Control Management.

When you design a process—for onboarding a client, approving a loan, or servicing a policy—you can make sure that compliance requirements are part of the flow. Plus, these controls are reusable and visible to everyone in the process, from the front office to compliance and audit.

Deliver Modern Lending

The Digital Lending feature set supports the entire lending lifecycle across loan products and channels. Instead of different systems for different loan products, use Digital Lending for all products in a combined point-of-sale and loan-origination system. Create loan-application processes that simplify the process for borrowers. Here are some of the key features.

Self-Service Experience

Use the configurable Experience Cloud template to quickly build branded digital-loan experiences. Applicants can browse loan products through a product list page, view detailed information on a product detail page, then apply for the product they want. And they can do all of this with minimal interaction from your staff, for quick and easy application completion.

Loan Calculator and Loan Product Assistance

Implement the easy-to-use loan calculator so clients can understand the impact of loan terms and interest rates at any phase of the application journey. They can input values for the loan amount, loan term, and interest rate to view payment options, the principal, and interest. The calculator shows diverse repayment structures—like amortization and balloon—and can calculate the impact of additional payments.

Plus, you can use the Loan Product Assistance skill for Agentforce to design an AI agent that guides potential borrowers through the process of finding loan options. It can retrieve loan product categories, details, and programs to help a borrower identify the right product without taking a loan officer’s time.

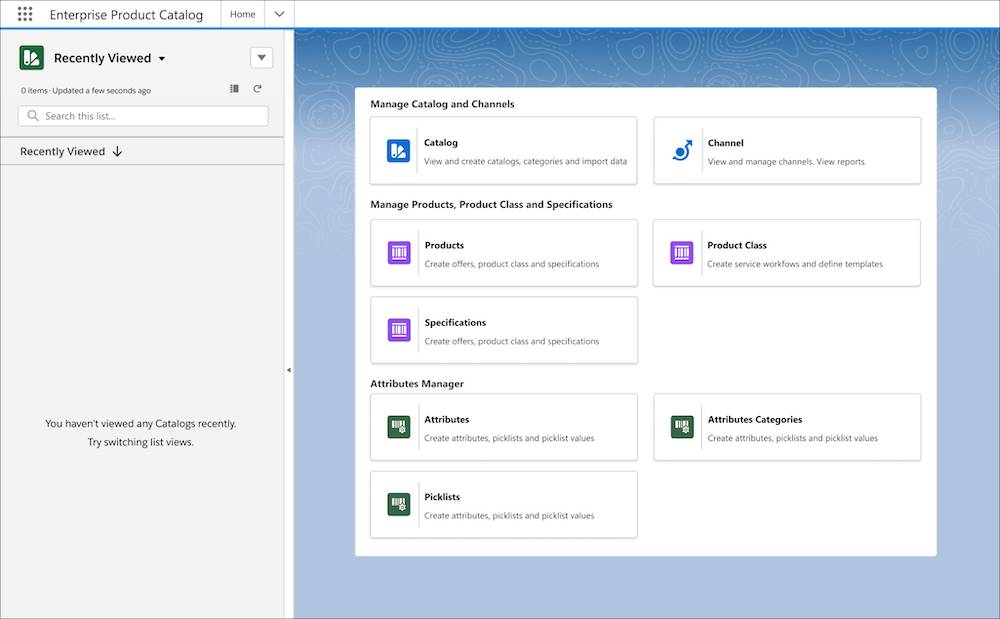

Product Catalog

Behind the scenes for all of these features is a loan products catalog set up with Product Catalog Management features.

Define, organize, and show loan products to self-serve applicants and reps. With your product catalog configured, potential applicants can easily browse and apply for loans, while you can manage your offerings efficiently.

Put Financial Services Cloud to Work

In this module, you learned about Financial Services Cloud and how it offers ways to make interactions more personal, simplify onboarding, and scale service for your financial institution.

Built on the Salesforce Platform with a common metadata framework, it provides data models, features, and automations that are specific to sectors like retail banking, wealth management, and commercial banking. You explored solutions and features that help your institution nurture client relationships, offer efficient customer service, deliver specialized banking services, and much more.

With this knowledge, you’re ready to continue exploring all that Financial Services Cloud has to offer. To learn more about how Financial Services Cloud can help you respond to today’s customer and compliance demands—and to get a free trial learning org to experiment with—visit the links in Resources.

Resources

- Salesforce Help: Process Compliance Navigator

- Salesforce Help: Set Up and Manage Digital Lending

- Salesforce Help: Set Up and Manage Digital Lending—India

- Trailhead: Product Catalog Management: Quick Look

- Salesforce Website: Financial Services Cloud

- Salesforce Help: Create a Financial Services Cloud Trial Org and Explore