Explore Financial Account Roles and Financial Goals

Learning Objectives

After completing this unit, you’ll be able to:

- Describe and create a financial account role.

- Create a financial goal.

What’s a Financial Account Role

A financial account role describes the nature of a client’s involvement with a financial account, such as joint owner, beneficiary, or trustee.

Here are some examples of financial account roles in the sample data found in your trial org.

- Rachel Adams is the primary owner of the Bank of BAS checking account.

- The Adams Charitable Trust is the primary owner of the cash account.

- Rachel Adams is the joint owner of Nigel Adams’ investment account.

You set up a financial account role for Claire Johnson when you created her brokerage account in the previous unit. She’s the primary owner.

By default, Financial Services Cloud provides these financial account roles.

- Primary Owner

- Joint Owner

- Beneficiary

- Accountant

- Trustee

- Corporation

- Foundation

- Grantor

- Business Manager

You can also add financial account roles to meet your client or business requirements. Talk to your Salesforce admin to make that happen.

The Special Case of Primary and Joint Owners

Of the default financial account roles, primary and joint owners are deactivated by default and managed directly by Salesforce. What this means is that you won’t see these two roles as options when you create a new financial account role, which we cover this in the next section of this unit.

However, when you create a financial account, at a minimum, you must assign a primary owner—even in the case of an individual account. In the case of a joint or trust account, you must also assign a joint owner.

Let’s revisit Nigel’s Investment Account to see this in action. Here, Nigel is the primary owner of the financial account while Rachel is a joint owner.

It’s important to note that you can’t assign a joint owner to an account whose ownership type is Individual. Set an account’s ownership type to either Joint or Trust before setting up a joint owner.

Details on Financial Account Roles

Financial account roles are extremely versatile—you can use them to slice and dice the same data in different ways. But what if you want to see all the financial account roles associated with a financial account?

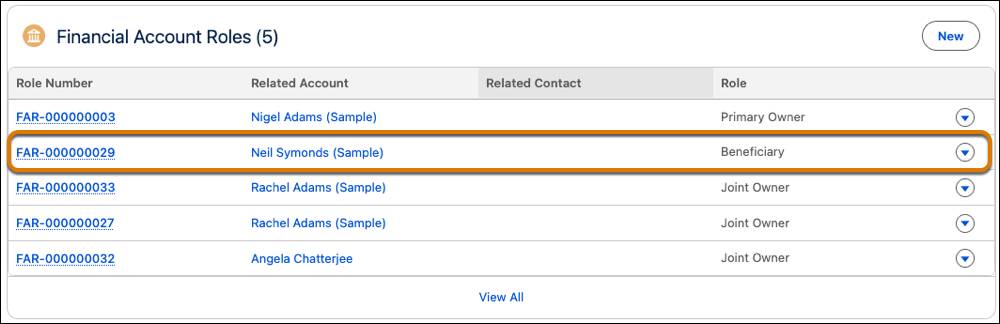

Let’s dive a little deeper into Nigel Adams’ investment account and find out. Select the Related tab and scroll down to the Financial Account Roles section. You’ll find that while Nigel and Rachel are joint owners—primary and secondary, respectively—Neil Symonds is a beneficiary.

How’s that for a 360-degree customer view!

Looking at the Financial Account Roles, you’re probably wondering: Why is the Joint Owner role listed three times, but assigned to Rachel Adams only twice? That’s not a bug, but a feature! Select View All under the Financial Account Roles section for an expanded view and you’ll see some interesting things going on there.

First, check out the Active flag next to each role. This tells you that of the given roles, only three are active: Nigel as primary owner, Rachel as joint owner, and Neil as beneficiary.

Now, look at the start and end dates for each role. The active roles don’t have an end date, which makes sense because they’re still active. You’ll see that only inactive roles have an end date associated with them.

By working through those dates chronologically, you have a clear audit trail of the various roles associated with this account over time—all readily available at your fingertips. Rachel started as the account’s joint owner. She was then replaced by Angela briefly, but finally, Rachel reverted to a joint ownership role for Nigel’s investment account.

Any changes made to the roles related to a financial account are automatically reflected in the Financial Account Roles related list for that account. Now that you know how financial account roles work, let’s create one!

Create a Financial Account Role

You can create a new financial account role easily from the Financial Account Roles related list on either of the following objects:

- Account

- Financial Account

Financial account roles are supported as two record types: account roles and contact roles. Choose account roles for institutions (say, the Adams Charitable Trust) and contact roles for individuals, such as Rachel or Nigel Adams.

Let’s see how we can do this from a financial account.

- From the App Launcher (

) in your trial org, find and select Wealth Management.

) in your trial org, find and select Wealth Management.

- Select Financial Accounts.

- From the list view, find and select Claire Investment Account, then select the Related tab.

- Scroll to the Financial Account Roles related list and click New.

- Select the Account Role type and click Next.

- Specify this information:

- Related Account: Rachel Adams (Sample)

- Role: Beneficiary

- Financial Account: Claire Investment Account, which is selected by default

- Save your work.

And just like that, you set up Rachel Adams as a beneficiary of her sister Claire’s investment account.

Create a Financial Goal

We’ve talked a fair bit about financial account roles. Let’s now see how financial advisors and retail bankers can help clients identify and meet their financial goals.

Your client can create a goal before funding it. The actual value of the amount a client has put aside for a goal can be zero.

Remember Claire? She wants to buy a second home in Maui. The condos she likes cost around $750,000. Her goal is to save a 20% down payment.

Let’s set up that financial goal for Claire.

- In Accounts, select Claire Johnson, and go to her Goals tab.

- Select New in the Goals related list.

- Specify this information.

- Financial Goal Name:

Vacation home - Type: Home Purchase

- Primary Owner: Claire Johnson, which is selected by default

- Target Value:

150000 - Target Date: January 1 of next year

- Actual Value:

97000

- Save your work.

Claire can now make sure she’s on target to move into that vacation home.

To learn more about creating and maintaining financial account records, check out the Resources section. In the next unit, we connect to clients by logging calls and tasks.

Resources