Create Loss and Expense Payments

Learning Objectives

After completing this unit, you’ll be able to:

- Create loss and expense payments.

- Identify the records created when generating loss and expense payments.

- Describe how services create loss and expense payments.

Define Loss and Expense Items

In the previous unit, Phil, the claims adjuster, opened a claim coverage for Ernie Newton’s stolen property. Now, with more details about the losses, it's time for Phil to create loss and expense items to detail the specific costs associated with Ernie's claim.

The main types of insurance payments cover losses and expenses.

-

Loss payments cover the actual damages or losses incurred by the policyholder, such as property damage or bodily injury.

-

Expense payments cover managing, investigating, and settling claims, including legal fees, adjuster expenses, and other administrative costs.

The Claim Coverage Payment Details record stores information about loss and expense payments. This record links payments to their corresponding claim coverages for detailed recording and tracking of all monetary transactions associated with a particular claim coverage.

In this unit, explore how to add these payments to a claim coverage. While the scenario focuses on loss payments, you can create expense payments in the same way.

Add Loss and Expense Items

Soon after Ernie files a claim for personal property losses, Phil collects more concrete details about Ernie’s losses. That means it’s time to create a loss item.

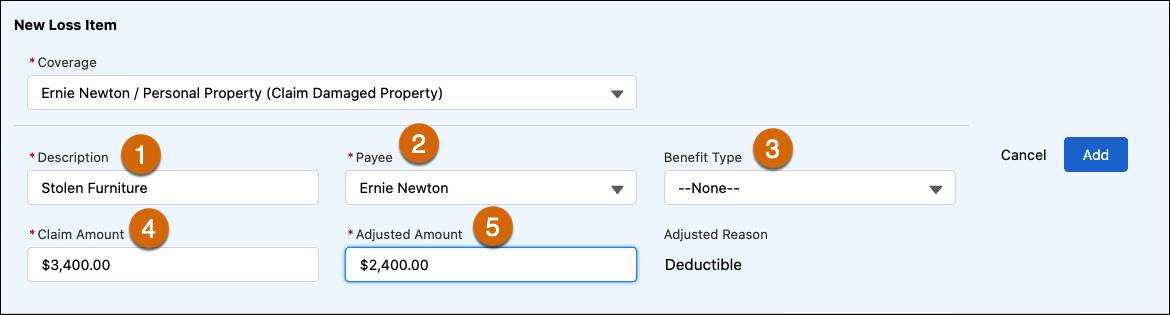

You create new loss and expense items directly from the Financials tab. First, select the appropriate coverage. Then, enter the basic details: a description, the payee, the benefit type, and the claim amount.

In this example, the claim coverage has the following details.

- Description (1) of 'Stolen Furniture' with context.

- Payee (2) as Ernie Newton. If the payee isn’t a current claim participant, you can create an account directly from the dropdown.

- Benefit Type (3) of ‘None’ since the furniture doesn't fall under any of the sublimit categories.

- Claim Amount (4) of $3,400.

The Adjusted Amount (5) automatically calculates to $2,400, reflecting the applied $1,000 Deductible. Because the deductible attribute has a claim scope, the deductible is now met and won't apply to other loss items on this or any other coverage.

After you add the new item, the Financial Summary chart instantly reflects pending losses of $2,400.

Since there are no payments yet, the remaining reserves maintain the adjusted reserve of $95,000.

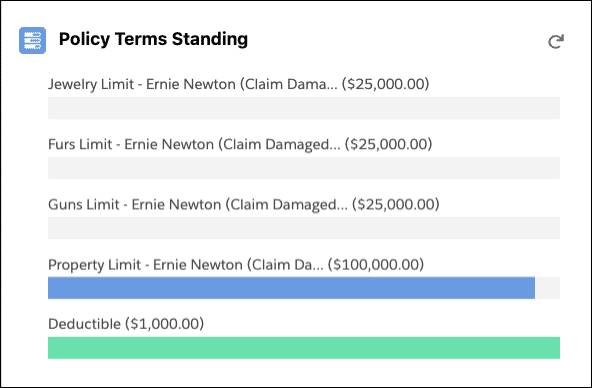

The Policy Terms Standing chart also updates.

The deductible of $1,000 now shows as fully used, but the property limit still displays a pending amount of $95,000 for the remaining reserves.

Review Related Records

The Related tab shows a newly generated Policy Terms Tracking Entry record for the deductible. This record stores details like the initial amount, posted amount, and remaining amount for the term. The record also links to several related records, including the policy term.

Revisiting the claim coverage reveals a new Claim Coverage Payment Detail record with an open status.

This record contains specifics about the created loss item, including its type, description, claim coverage, recipient, benefit type, and both the claimed and adjusted Amounts.

Understand Payment Detail Services

Different services work behind the scenes to create payment detail records.

After the adjuster enters the loss details and selects Add, the InsClaimItem:add service (1) performs several tasks.

- Retrieves the claim record, policy record, and associated attribute values.

- Invokes additional services, including InsPolicyTermsService:process (2) and InsClaimItemService:calculateCoverages (3). The latter service calculates all policy term obligation amounts such as deductible, copay, coinsurance, and out-of-pocket max. Expense payment details don't influence the calculation of policy terms, while loss types do.

- Creates a Claim Coverage Payment Detail (4) record. This record stores the initially claimed amount and the computed adjusted amounts.

- Generates a Claim Coverage Payment Adjustment (5) record that tracks the adjustment amount and rationale, in this case, due to the deductible.

- Saves a record to the Insurance Policy Term Tracking Entry (6) to note the consumption of the policy term.

The Digital Insurance Platform handles these interconnected calculations in a snap, greatly easing the adjuster’s burden. With just a few clicks, complex tasks like claim creation, reserve management, and loss payment detail addition become manageable and efficient.

Phil is feeling good about creating loss and expense items, but his work isn’t done yet. With the loss items defined and the claim details updated, the next logical step is to issue payments to Ernie for his covered losses.

In the next unit, learn how to handle the payment process.

Resources