Meet Individual Policy Administration

Learning Objectives

After completing this unit, you’ll be able to:

- Describe the policy-administration lifecycle.

- Identify some challenges the insurance industry is facing with policy administration.

- Explain how Individual Policy Administration helps solve the business challenges.

- List some benefits of using Individual Policy Administration in your business.

- Explain how Individual Policy Administration fits in with the Digital Insurance Platform.

Before You Start

Before you start this module, consider completing the following content.

The Policy Lifecycle

New to insurance? Let’s start by reviewing what a policy is and describing the key stages of the policy lifecycle.

An insurance policy is a financial contract between an insurance company, in this case the insurer, and the individual or entity purchasing the policy, also known as the policyholder. This contract typically defines:

- Insured parties, meaning who’s insured

- Insured items, meaning what’s insured

- The coverages, which are the benefits

- The policy terms, such as limits, deductibles, and copays

- The premium, which is the amount the policyholder pays the insurer

- The policy period, which defines the date and time the policy is active

The lifecycle of a policy includes the following stages.

This table introduces each stage.

Stage |

Description |

|---|---|

Quote |

The customer provides information about who or what to cover and how much coverage they want. In turn, they receive the likely price for purchasing a policy in the form of a quote. |

Underwrite |

Rules and services determine the eligibility of the policyholder and the final rate of the policy. |

Issue & Pay |

The policyholder buys the policy. The services in the Digital Insurance Platform create the policy record and activate the coverages. |

Endorse |

The policyholder can update or change an existing policy, for example, to add riders, to modify the terms of existing coverages, or to add or remove insured parties and items. Endorsements often result in premium updates and may require underwriting reviews. |

Renew |

The policyholder can extend the insurance coverage offered by an expiring policy. Renewals can be automated or manual. |

Cancel |

The policyholder can terminate a policy if they no longer want or need it. |

Let’s first look at some significant challenges associated with policy-administration systems. Then, we explore how Individual Policy Administration for Insurance provides robust solutions to manage the policy lifecycle.

Challenges in Policy Administration

Remember Anna Murphy? She’s a professional in her early 40s who works as a data scientist at Cloud Kicks.

Anna is a long-standing customer of Cumulus Insurance, a large, well-diversified provider of insurance services nationwide. Anna has Cumulus health insurance from her employer. Recently, she bought a new car, so she’s shopping for auto insurance. Anna decides to check out what Cumulus has to offer.

Unfortunately, Anna discovers that Cumulus still relies on a legacy system for its policy-administration processes. She finds the experience of going from quote to policy issuance incredibly slow and cumbersome.

What goes wrong? Anna faces extra work at every stage of the policy process.

She needs to provide details about her preferred coverages and terms in multiple formats—pdf, email, and over the phone. Even more frustrating, she’s forced to reach out to the support team at Cumulus for help on many occasions. Each time, a different service rep treats Anna like an entirely new customer, asking her the same series of questions. She feels like it’s taking forever to get nowhere.

Eventually, the new policy is issued, but Anna’s problems don’t end there. It’s hard for her to access basic policy details. And forget about quickly making changes to her policy. She needs to run through a maze of obstacles to add her fiance as an insured driver. When she wants to adjust her Collision coverage to a higher limit, she hits a dead end. When they purchase a new car, she can’t add it to the existing policy and needs to go through the initial issue process all over again.

When her policy comes up for renewal, Anna reflects on her sour experience over the past year and decides to terminate the policy. She searches for a solution elsewhere that better meets her needs and expectations.

Now let’s meet Justus Pardo, an independent consultant hired by Cumulus Insurance to improve customer experiences.

Justus is acutely aware of how flawed the existing policy-administration system is for meeting the needs of a savvy customer like Anna.

He also knows how frustrating it is for everyone at Cumulus. Sales reps, customer service reps, and admins perform extra work at every stage of the policy lifecycle. Plus, they need to spend much of their day appeasing dissatisfied customers.

At Cumulus, profits are down and morale is low.

After consulting with Anna and the entire insurance team, Justus recommends Policy Administration for Insurance, built on the Digital Insurance Platform.

Meet Individual Policy Administration

Individual Policy Administration for Insurance enables carriers to efficiently manage the entire policy lifecycle across quoting, underwriting, issuance, endorsements, billing, renewals, and commissions. Unlike with conventional core systems, Salesforce integrates these lifecycle processes seamlessly into the complete digital journey of the customer.

Individual Policy Administration simplifies and optimizes policy administration for all involved parties. The solution provides several capabilities.

- Serves as the system of record for all policies

- Contains a repository of policy-level data related to objects of insurance, coverages, limits, conditions, and exclusions

- Manages all core policy transactions, including quote, issue, payment, endorsements, renewals, cancellations, and reinstatements

- Provides tools to manage the complex interactions that occur throughout the policy lifecycle

- Enables carriers to define and develop new products across lines of business

- Offers omnichannel access for policyholders, brokers, and agents

- Provides integration capabilities to plug into third-party data providers and support business intelligence, analytics, and reporting

With Policy Administration for Individual Insurance, companies like Cumulus can transform their policy systems and delight customers with modern, integrated digital experiences.

The solution helps insurers like Cumulus improve their key performance indicators and see results like:

- Higher policyholder acquisition

- Higher policyholder retention

- Increased producer efficiency

- Higher customer satisfaction scores

- Faster time to market for new products

- Lower service costs

Solve Industry Challenges

Individual Policy Administration solves many problems across the policy lifecycle. Here are just some ways.

Industry challenge |

How does Individual Policy Administration meet the challenge? |

|---|---|

Single system of engagement |

Instead of using scattered and disconnected platforms, everything is part of the Salesforce Platform. All customer information is in one place, so users can complete all their business processes and transactions without accessing another tool. |

Simple experiences with minimal typing |

Gone are the days of long, ugly, text-heavy applications: Configure simple, intuitive guided workflows for all policy processes. |

Digital transaction management |

Instead of lengthy approval processes with a legacy rating engine and manual underwriting, insurers can easily enact a full range of real-time and scheduled policy transactions, including policy changes, out-of-sequence endorsements, automated renewals, and cancellations. |

Streamlined policy billing |

Customers increasingly expect all billing tasks to be easy. Calculate all policy values and integrate with external or on-platform billing solutions for set-up, statement generation, one-time and scheduled payments, and automation of policy lapses and grace periods. |

Integrated producer commission management |

Set up, manage, and adjust commission calculations and calculate commissions in real-time for user-configured transactional events. Brokers can easily visualize their performance and track commissions activity. |

Omnichannel access |

Using policyholder and broker portals, customers and brokers can manage their policies and book of business anytime and anywhere. |

Ready to use analytics |

Identify unique instances of insured properties and people. Provide carriers with the ability to track and distribute changes across multiple policies and run robust analytics. |

API first |

Simplified business APIs allow users to create, view, and manage policies on the platform or from an external system. |

Integration with claims platform |

Policy data fully integrates with the claims platform, and the data model, guided flows, and services all work together. |

The Bigger Picture

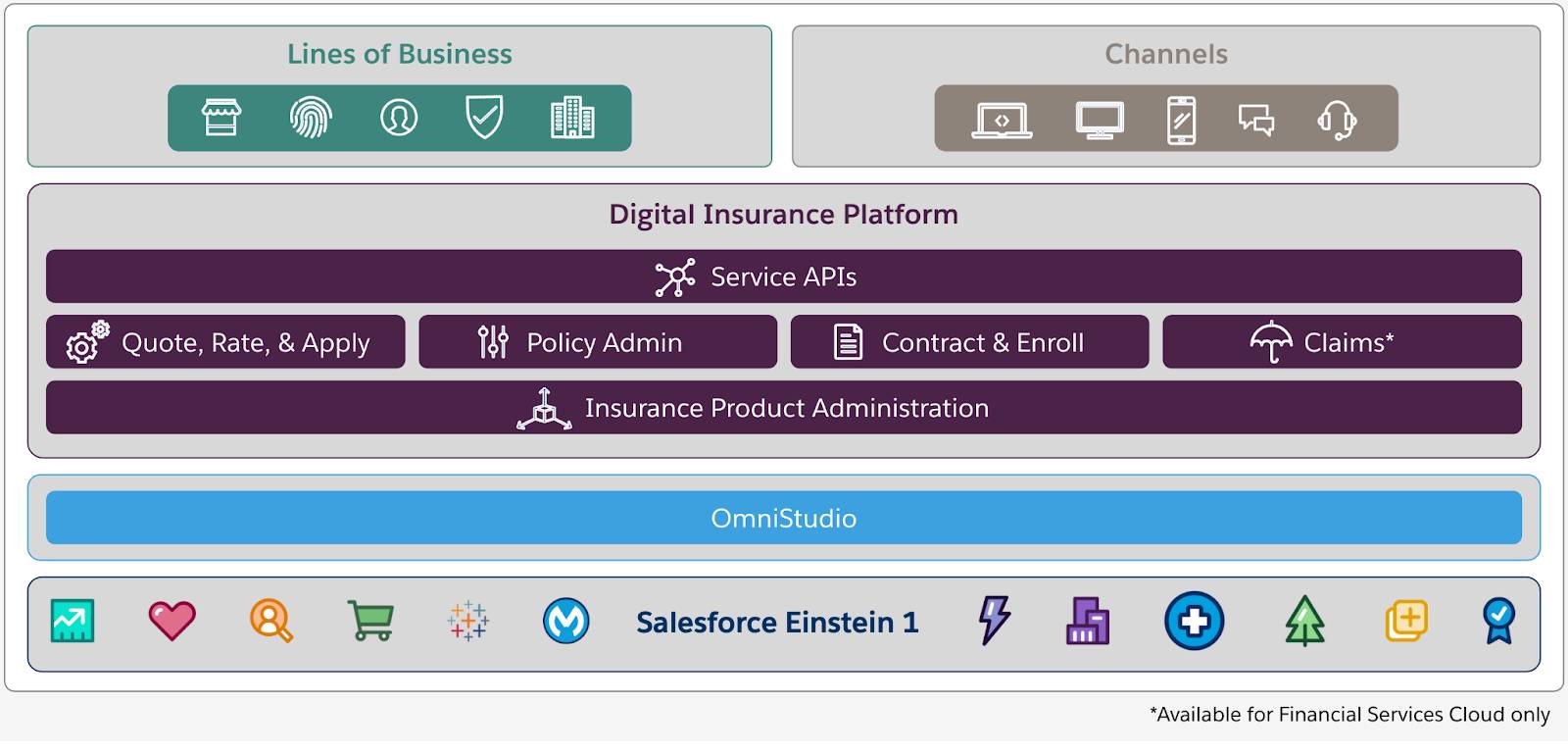

Policy Administration runs on top of Salesforce and uses all the Clouds and apps you know and love. Here’s the Digital Insurance Platform solution map, which shows how the pieces fit together.

The overall solution gives you several policy-administration capabilities.

-

Support for lines of business: Depending on your desired lines of business, the Digital Insurance Platform works with Financial Services Cloud and Health Cloud to support auto insurance, property insurance, life & annuity, specialty lines, and more.

-

Delivery across multiple channels: Members want to use their laptop to purchase a policy? No problem. Use their mobile phone to make changes? Done. You want to set up a custom portal site for brokers? Of course. They still want the option to call a contact center with questions? Sure, that too.

-

OmniStudio: OmniStudio provides tools such as OmniScripts for building and customizing self-guided experiences. Those are a great way to create top-notch experiences to walk users through policy issuance, endorsements, and renewals.

-

Salesforce: The full Salesforce gives you so many possibilities, enabling you to create a single view of your customer across market-leading applications in Sales, Service, Marketing, and Commerce.

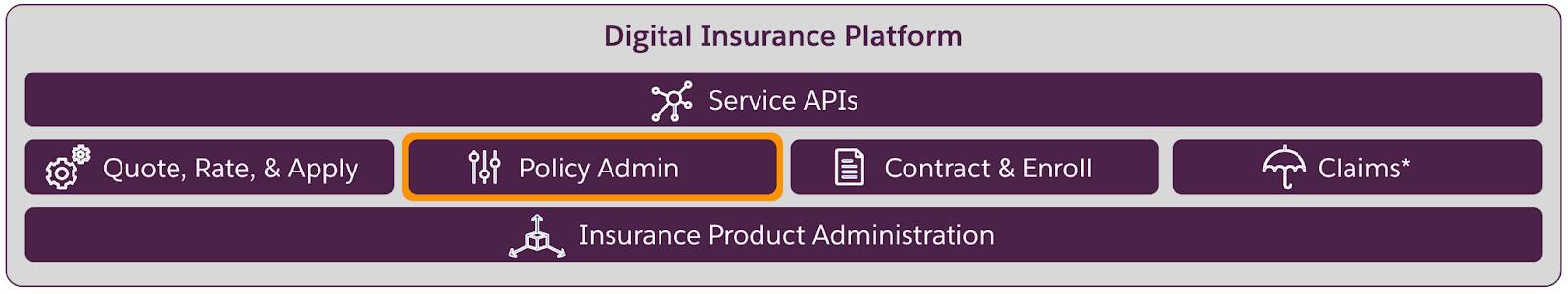

Inside the Digital Insurance Platform

Now let’s focus on the role of Policy Administration alongside the other modules and services in the Digital Insurance Platform.

Policy Administration integrates seamlessly with the other parts of the Digital Insurance Platform, including:

-

Service APIs: The Service APIs eliminate the need for custom programming by providing a range of out-of-the-box services that carry out key insurance functions.

-

Quote, Rate, & Apply: The Quote, Rate, and Apply module enables digital quoting for policyholders, brokers, and underwriters.

-

Contract and Enroll: The Contract and Enroll module creates contracts with employers and enrolls participants in group benefit plans.

-

Claims: The Claims module enables rapid and transparent claims processing across the entire claims lifecycle.

-

Insurance Product Administration: The Insurance Product Administration module drives agile insurance product development, policy rating, and more.

The Policy Administration module provides the key capabilities of any policy-administration solution, but other Digital Insurance Platform components also play a role in administering the policy.

- The Service APIs handle common policy administration tasks, such as issuing, modifying, renewing, and canceling policies.

- The Quote, Rate, & Apply component fully integrates with Policy Administration, with all the product and rating information from the quote used to define the policy.

- The Contract and Enroll component also works seamlessly with Policy Administration, allowing users to easily manage group member policies.

- The Claims module is closely linked to Policy Administration, with policy information forming the basis of all claims.

- With the Insurance Product Administration module, you create dynamic, reusable product models that underpin all policies.

Now you should have a clear idea of the main advantages of the Digital Insurance Platform for policy administration. Next, let's get more insight into the key jobs to be done for policy administration and who does them.