リレーション管理とカスタマーサービスに役立つデータモデルについて知る

学習の目的

この単元を完了すると、次のことができるようになります。

- チームが個人や B2B のクライアントと関係を構築して管理するうえで役立つデータモデルについて説明する。

- カスタマーサービスと回収を管理するためのデータモデルについて説明する。

リレーション管理とプラン

前の単元では、新しいお客様のオンボーディング、その情報の検証、責任をもってお客様に対応するために必要なデータの収集と同意の取り付けなど、クライアントジャーニーの開始時に役立つデータモデルについて検討しました。実際の業務は、お客様のジャーニーが開始されればそれでよいというわけではありません。銀行、保険会社、ウェルス関連事業は、お客様といかにうまく関係を育み、お客様に必要とされたときに的確に対応することでその評判を築いていきます。

この単元では、この点を可能にするデータモデルを紹介します。今回取り上げるデータモデルは、チームがクライアントとのミーティングの本質をとらえ、反復的なプロセスを一貫した方法で処理し、苦情、取引にまつわる係争、回収のような慎重を期すべきシナリオを常に把握しておくうえで役立ちます。

インタラクション概要データモデル

インタラクション概要データモデルは、バンカーやファイナンシャルアドバイザーがお客様とのやり取りに関するメモを保存して共有する場合に役立ちます。次の ERD に、インタラクション概要オブジェクトと、ほかのオブジェクトとの結び付きが示されています。

このデータモデルの主なオブジェクトであるインタラクション概要は、ミーティングのメモを保存し、コンプライアンスに準拠した方法で共有できるようにします。たとえば、このスクリーンショットには、取引先レビューとニーズ調査のミーティングをまとめたインタラクション概要が示されています。

ERD からわかるように、このインタラクション概要は取引先に関連付けられています。また、上の画像に示すとおり、商談やアカウントプランの目的に関するメモを維持するためにも使用できます。インタラクション概要は、安全なメモが役に立つ任意のレコードに関連付けることができます。子インタラクションオブジェクトは、ミーティングの出席者や、場所や時間などの詳細を追跡します。

こうした詳細が、クライアントとのやり取りに関する、コンプライアンスに準拠した安全かつ永続的な記録になるため、取引先を担当することになった人がクライアントのニーズや金融機関との取引履歴をすぐに把握することができます。

アクションプランデータモデル

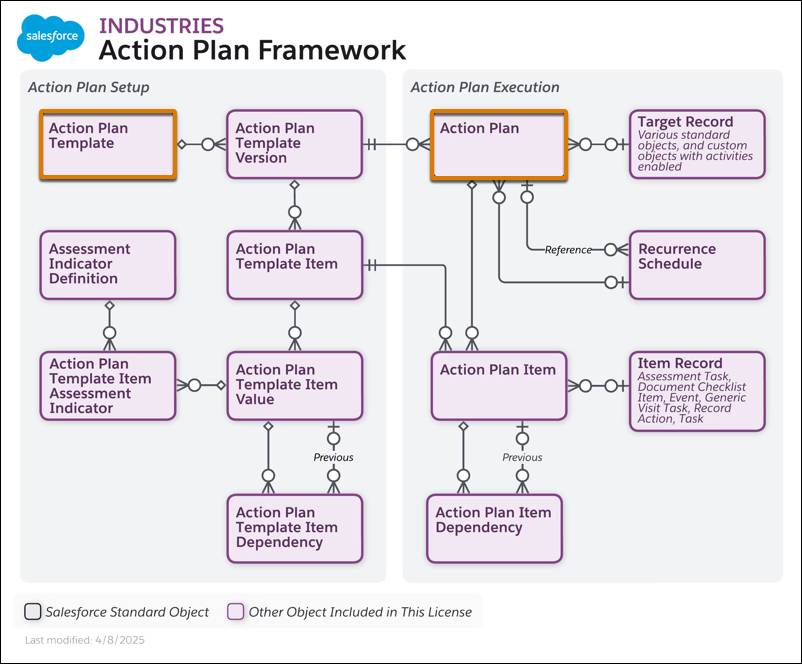

Financial Services Cloud のアクションプランデータモデルは、ユーザーがアクションプランテンプレートオブジェクトを使用して、ToDo やドキュメント要件のテンプレートセットを作成する場合に役立ちます。ユーザーがこのテンプレートを使用すると、特定のクライアントエンゲージメントの ToDo 所有者や期限が自動的に割り当てられた詳細なアクションプランレコードを作成できます。こうすれば、チームが一般的なプロセスを標準化できます。

以下は、プランの設定ステップと実行ステップで、これらのオブジェクトがどのように結び付いているかを示しています。

たとえば、クライアントとの財務プランのレビューミーティング用のアクションプランテンプレートを作成して、ToDo をテンプレートに関連付けることができます。アクションプランテンプレート項目オブジェクトを使用して、ToDo をテンプレートに結び付けます。

ウェルスマネージャーがクライアントとのレビューミーティングを予定している場合、このテンプレートを基にアクションプランを作成できます。テンプレートで定義されているすべての ToDo が、その特定のクライアントとのミーティング用の新しいアクションプランに作成されます。どの ToDo も、アクションプラン項目オブジェクトを使用してアクションプランに結び付けられます。

アクションプランデータモデルは、さまざまな Salesforce Industries 製品で使用される共通機能です。詳細は、Salesforce ヘルプの「アクションプラン」を参照してください。

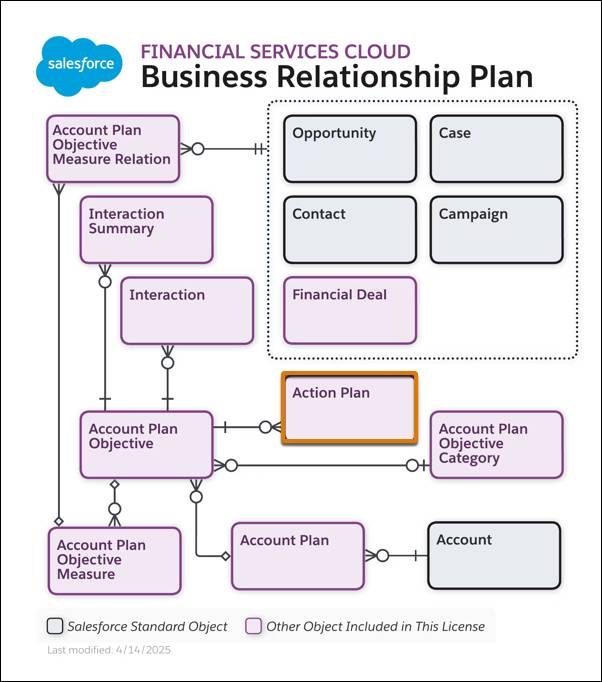

ビジネスリレーションプランデータモデル

ビジネスリレーションプランデータモデルは、Salesforce アカウントプランオブジェクトを拡張し、インタラクション概要、アクションプラン、その他のオブジェクトを使用して、B2B のクライアントのニーズに関する情報を追跡します。

たとえば、B2B のクライアントのプランに、製造事業を拡大する資金を調達するアカウントプランを作成するとします。このアカウントプランに、金融取引、新たな販売機会、クライアントの目標達成に向けた評価基準などが盛り込まれ、そのクライアントに対するチームの取り組みと進行状況を追跡する一元的なハブになります。

カスタマーサービスとケース管理

Salesforce では、標準のケースオブジェクトを使用してカスタマーサービスを追跡します。金融サービス機関には、ケースのデフォルトの機能では対応しきれない特有のニーズがあります。Financial Services Cloud には、クライアントの苦情、取引にまつわる係争、回収業務など、追跡する必要がある業務に応じてケースの機能を拡張するデータモデルが用意されています。

苦情管理データモデル

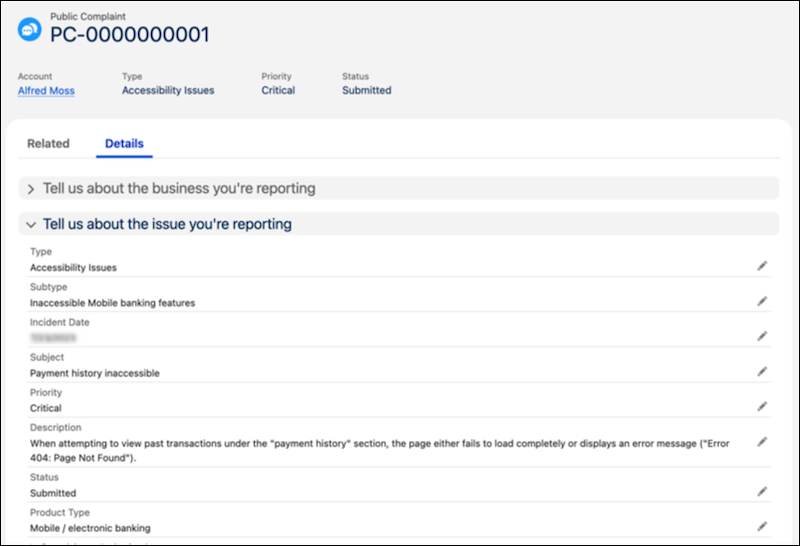

苦情管理データモデルは、サービス担当がクライアントからの苦情を受け付けて送信し、追跡する場合に役立ちます。ここでは、公的な苦情とケース関係者という 2 つの有用なオブジェクトを使用します。

公的苦情は、お客様との金融取引にまつわる係争を追跡します。苦情情報を専用のオブジェクトで追跡するようにすれば、標準のケースオブジェクトへの項目の追加が煩雑になりません。次のスクリーンショットは、オンラインバンキングに関する問題を追跡する公的な苦情を示しています。

ケース関係者オブジェクトで、このような公的な苦情における個人のロールを関連付けて定義することができます。たとえば、ケース関係者レコードに、個人が直接的な苦情の申立人なのか、クライアントの代理人なのかを記録できます。また、各関係者にとって都合のよい連絡手段や、承認の詳細も収集します。

取引の係争管理データモデル

取引の係争管理データモデルは、お客様との金融取引にまつわる係争をユーザーが把握して送信し、追跡して解決する場合に役立ちます。

係争オブジェクトが係争の詳細を取得する一方で、関連する係争項目オブジェクトは、係争があった 1 件の金融取引の詳細を追跡します。係争はケースオブジェクトにも関連し、ケース管理プロセスに従います。

このデータモデルとそのオブジェクトは Service Process Studio に統合されるため、サービスプロセスを迅速に設定できます。したがって、ユーザーがステップバイステップのガイド付きエクスペリエンスで係争を迅速に解決できます。

回収データモデル

回収データモデルでケースをほかのオブジェクトと併用すれば、回収プロセスの効率化、延滞の軽減、顧客関係の維持に役立ちます。このデータモデルの鍵を握るのは、回収プランオブジェクトです。

回収プランには、クライアントの未払残高に関する包括的な情報が保存され、金融口座、請求取引先、ケース、取引先責任者、取引先などにリンクできます。金融口座参照項目を使用すれば、回収プランがどの金融口座に関連付けられているかを簡単に把握できます。

回収プランの子オブジェクトである回収プラン項目は、延滞している特定の請求書または金融口座明細書の詳細を追跡します。こうしたオブジェクトやその他のオブジェクトを使用して、回収に優先順位を付け、債務となっている金額をお客様に支払ってもらうための支払約束への同意を取り付けます。

たとえば、お客様のクレジットカードの支払が遅れている場合、未払金額に対する回収プランを作成します。金融口座参照項目を使用して、回収プランをクレジットカード金融口座に関連付けます。同様に、クライアントに未払いの請求書が 3 件ある場合は、回収プランを 1 つ作成し、期限に達した請求書ごとに 1 つずつ、合計 3 つの回収プラン項目を設定します。

回収プランが金融機関の高優先度基準を満たしている場合は、キューで優先的に処理できます。

次のステップ

この単元では、Financial Services Cloud のリレーション管理とカスタマーサービスに役立つデータモデルについて学習しました。すばらしいですよね?

特記すべき点は、 組織全体のデータをこれまでに学んだデータモデルに統合できることです。

次の単元では、サイロ化された分散システムのデータを活用できるようにして、このモジュールで学習した優れたデータモデルのすべてを利用する方法を見ていきます。