Meet Agentforce Financial Services

Learning Objectives

After completing this unit, you’ll be able to:

- Discuss how Financial Services Cloud fits into the Salesforce Platform.

- Describe the benefits and beneficiaries of Financial Services Cloud.

Get to Know Financial Services Cloud

As a financial services professional, you know that institutions like yours face tremendous challenges. Customers expect consistent and personalized service across all channels of engagement. Bankers, advisors, service reps, and brokers need the tools to meet those needs at scale. On top of it all, compliance and regulatory requirements keep changing.

Financial Services Cloud helps you tackle these issues and reach your business goals. It’s a set of features, components, and data models designed specifically for financial institutions. This includes banks, wealth-management firms, lenders, insurance companies, and others.

Built on the Salesforce Platform that you know and trust, Financial Services Cloud unlocks data from across your entire institution. The purpose-built automation and AI give your core banking, wealth, and insurance divisions a single view of each customer to personalize engagement.

Solutions for the front-, mid-, and back-office help bankers, advisors, service reps, brokers, and operations staff engage with your prospects and customers at scale while building trust to grow long-term, profitable relationships.

In this module, you learn the basics of Financial Services Cloud: What it offers, which segments it serves, and its ready-built solutions for different tasks. Let’s get started!

Tools for the Entire Client Lifecycle

Financial Services Cloud helps you with every stage of your relationships with clients. Streamline onboarding, personalize and scale service, analyze data, and improve the experience of your institution's stakeholders. Customers benefit from improved interactions, and Financial Services Cloud can bring a smile to the faces of bankers, relationship managers, insurers, business leaders, technology staff, and other employees, too.

Simplify Onboarding

Whether your business is banking, wealth management, or insurance, make positive first impressions with customers as they get started with your financial products and services. Onboarding is traditionally complicated, but with Financial Services Cloud's automation and integration tools, you can save money and make more money. For example, onboarding specialists save time on common tasks and data entry as they quickly onboard new customers and speed up the sales cycle.

Personalize Engagement

Build and maintain important client relationships for bankers, advisors, and insurers with a complete view of your customers, their financial accounts, assets, and households. Start by combining important data from legacy and third-party systems for a single view of each customer that changes with their financial circumstances and relationship to your institution. Then use prebuilt calculated insights with Data 360 and create targeted segments to deliver the personalized financial services that customers expect. Plus, automation can reduce administrative work to free up time to give smarter, more personalized advice. Together, these tools help relationship managers understand and predict clients’ needs, building their trust and growing revenue.

Scale Service

With a unified view of your customer, service reps can quickly find information to help customers, reduce errors, and deliver service consistently across any channel and on any device. Prebuilt Agentforce AI skills make it easier for admins and developers to set up automations that save time for reps and delight customers. Even better, with self-service experiences, customers can easily complete tasks like updating their account details, requesting financial statements, and reporting lost cards. Together, these features boost your service teams so they can tackle case volume and spend more time resolving more complex cases.

Integrate and Analyze Data

If you’re an IT professional, you can integrate core banking and other backend systems to improve overall productivity and satisfaction while protecting customer data. Tools like Data Consumption Framework, Data 360, Integration Procedures, and MuleSoft connectors integrate data from any cloud or legacy systems to deliver personalized, connected, and relevant customer experiences. This way, bankers, loan officers, advisors, service reps, middle- and back-office personnel, and other team members can engage with their customers on any channel.

If you’re a business leader, use core analytics on your integrated data to gain insights and quantify business objectives. With purpose-built data models, AI and analytics give you answers to business questions so you can make the most of your time and resources. For example, retail banking branch managers use the Branch Manager Dashboard to evaluate their branch and bankers’ performance. Embedded Einstein AI can analyze this data, too, for insights on a team’s strengths and areas where coaching could help.

Explore Financial Services Cloud’s Tools and Features

Financial Services Cloud extends Salesforce Sales Cloud and Service Cloud to meet the specific requirements of financial services institutions like yours. Get to know your customers better while giving them top-notch experiences and store data in purpose-built data models. Plus, all your users get a consistent, modern experience to complete their day-to-day work.

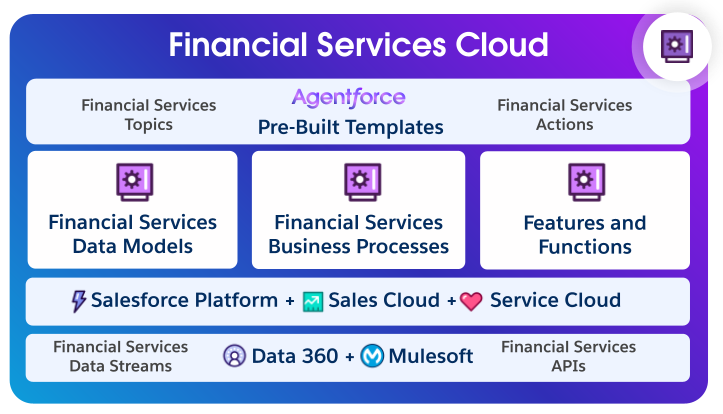

Here’s the high-level solution architecture, all built on the Salesforce Platform, Sales Cloud, and Service Cloud.

The solution components give you several benefits.

-

Integrated, unified, and harmonized data: At the base of your work in Financial Services Cloud is your data. Connect and harmonize data from systems across your business with Data 360, MuleSoft, prebuilt integrations, and APIs for a complete view of your clients.

-

Sector-specific data models: All the data flows into purpose-built data models that capture the complexity of financial accounts and client relationships. Whether you’re in retail banking, wealth management, insurance, or another business line, financial services data models extend core Sales and Service Cloud functionality. For example, the Know Your Customer (KYC) data model tracks specific customer information for security and compliance processes.

-

Sector-specific business processes: The data models work with the business processes and templates provided to streamline your institution’s work. Financial Services Cloud business processes include solutions for relationship management, personalized finance, integrated onboarding, and more.

-

A comprehensive toolset: Financial Services Cloud features and tools help your users fulfill customer expectations. For instance, Action Plans automate repeatable tasks and assign task owners and deadlines. Financial Goals and Plans help you address the needs that are most important to your customers’ financial wellbeing.

-

Work automation with Agentforce Templates, Topics, and Actions: All the data, processes, and features work with AI tools so your team can work more efficiently. Agentforce for Financial Services automates common, time-consuming tasks so teams spend less effort on manual processes and more time deepening the client relationships that promote growth.

Now, dive a little deeper into Financial Services Cloud’s AI capabilities.

Agentforce for Financial Services

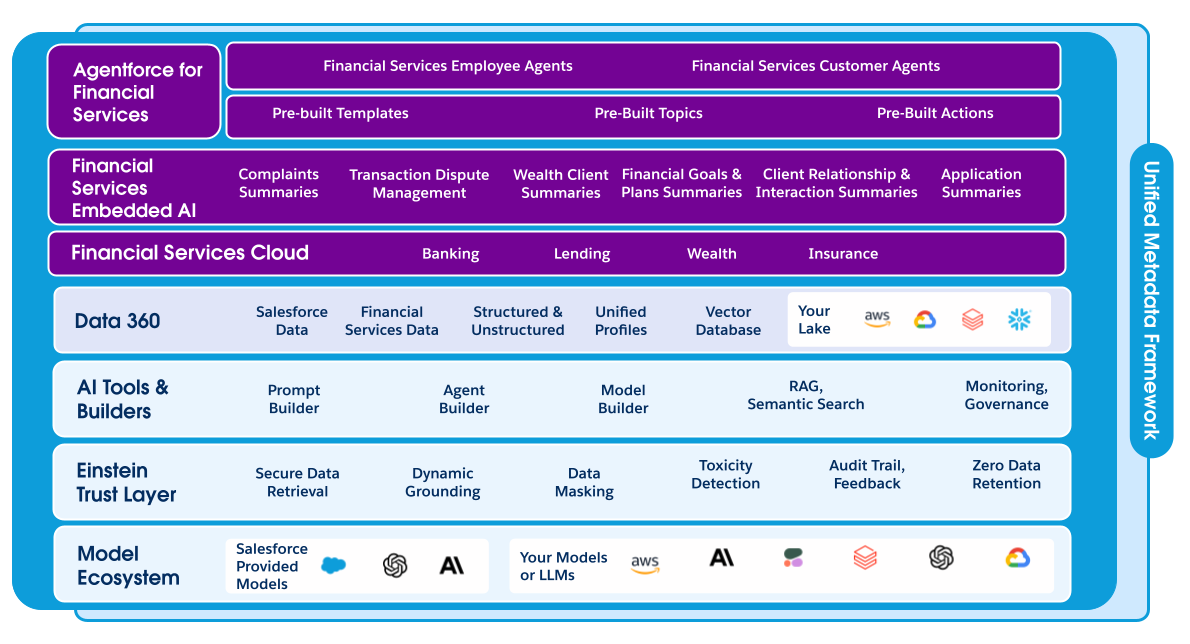

Financial Services Cloud is built on Salesforce's unified metadata framework. Use Data 360 and Agentforce tools to automate important tasks like getting ready for an investment review, replacing a lost credit card, or showing loan options to potential borrowers.

The diagram shows how the pieces fit together.

With all of your data available in Financial Services Cloud, you can customize prebuilt Agentforce skills to quickly add the power of AI to your institution. AI agents work side by side with bankers, service reps, and wealth managers to reduce administrative burdens that distract from more valuable tasks. Increase personal engagement, maintain regulatory compliance, and build the trust that makes customers loyal. In short, Agentforce for Financial Services gives financial professionals more space to focus on what matters most: their clients.

For details, complete Agentforce for Financial Services Cloud in Trailhead.

Partner Resources and AppExchange

Financial Services Cloud gives you many great features, and it’s also a starting point for adding your own capabilities. To this end, the Salesforce business partner ecosystem—our network of credentialed partners, apps, and developers—has expert solutions for financial institutions that build on Financial Services Cloud.

The partner ecosystem offers solutions across products, industries, and regions to support your business and technology requirements. Rely on the expert partners throughout your Salesforce journey for their deep Salesforce know-how and industry best practices.

AppExchange is the marketplace for all things Salesforce, such as apps, flows, and more. Find electronic forms and tools for financial planning, onboarding, customer profiling, identity verification, compliance, and more.

Now that you know the basics of how Financial Services Cloud can help your financial institution, your users, and your customers, you can dive deeper. In the next unit, explore how the features cater to an array of financial services sectors.