Automate Repetitive Business Processes with Salesforce Flow

Learning Objectives

- Describe the rationale for process automation in the insurance industry.

- List the flows available for insurance.

- Describe an insurance flow use case.

Automate the Customer Experience

What customers like Rachel want is a seamless and personalized customer experience when contacting Cumulus. But given the churn in the industry, how is this possible? One word: automation.

- Integrate various systems.

- Configure process logic.

- Design and build an end-user experience.

- Make the experience available from anywhere: desktop or mobile devices, internal apps, or external portals.

Meet Salesforce Flow for Insurance

The Lightning Flow for Financial Services Cloud package includes flows that are specific to retail banking and insurance. The flows help your service reps handle customer service requests better and more efficiently. The flows are installed as standard flow templates.

Salesforce Flow provides declarative process automation for every Salesforce app, experience, and portal, including the Insurance Agent Console. Flows give customer service reps like Zaw a productivity boost with preassembled templates to help him handle customer service requests faster. The flows provide step-by-step guidance for common service requests, including change of address, change of nominee, and change of beneficiary, without the need to navigate to different systems or screens.

- Add Beneficiary to Policy

- Add Driver to Auto Policy

- Cancel Policy

- Initiate First Notice of Loss (FNOL), which is the initial report made by a policyholder to an insurance provider following damage to, loss, or theft of an insured asset.

- Update Lienholder

- Update Policy Beneficiary Details

- Update Premium Payment Date and Frequency

- Update Premium Payment Method

In the next section, you see how easy it is to use flows.

Test Drive an Insurance Flow

Rachel has a service request for Zaw: She wants to add her niece as a driver to her auto policy.

- From Rachel Adams’s Person Account record page, select the Add Driver to Auto Policy Quick Action from the top-right corner.

- Select Car Policy and click Next.

- Fill out the driver and license details.

- First name: Madeline

- Last Name: Reddy

- Email Address: mreddy@mail.com

- Phone: 415-901-7040

- Driver’s License Number: D2345897

- License Issue Date: Aug 15, 2019

- License Expiration Date: Aug 14, 2029

- Upload a copy of the new driver’s license and click Next.

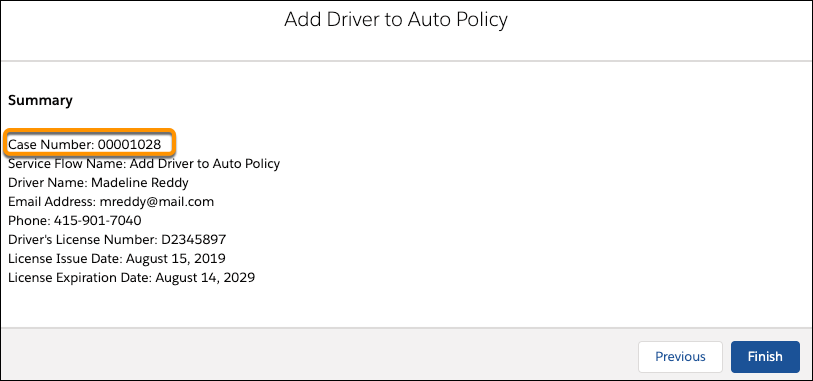

- Review the summary of the new driver’s info and click Finish. A new case has automatically been created. He provides this number to Rachel for future tracking purposes.

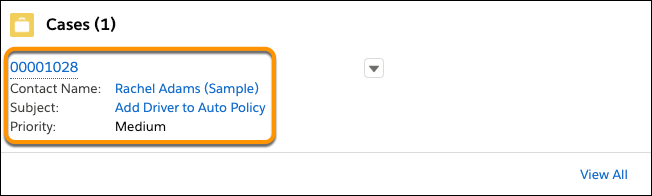

Let’s check out what happened to that case that just got created. Zaw can find it under the Related tab in Rachel Adams’s Person Account record page. Zaw scrolls down to the Cases section, and there it is.

He can click through the case number for details. If Rachel calls the next time for a status update, Zaw or any other service rep can easily find this info.

The info collected by this insurance flow is stored in an identity document, in this case a driver’s license. Zaw can access this document directly. Here’s what he does.

- From the App Launcher (

), find and select Identity Documents.

), find and select Identity Documents. - Select Identity Documents under All Items.

- Select the required document number. Zaw clicks through D2345897, Madeline’s driver’s license number that he’d provided as input for the flow earlier in this unit.

Wrapping Up

In this module, you learned how policy data previously lived in multiple disparate and antiquated systems, making it difficult for Cumulus staff to truly understand and empathize with their client’s needs.

With the new insurance innovation from Salesforce for Financial Services Cloud, Cumulus can now provide a unified experience to help policyholders and their families protect what they care about. Insurance Agent Console unlocks a complete view of the key performance indicators (KPIs) of agents and service reps like Zeynep and Zaw, helping them supercharge their productivity, grow their books of business, and deliver exceptional service.

The console app also unveils a unified, 360-degree view of policyholders’ policy info, coverages, claims, and even life events. This is possible because the console app provides a single frontend for multiple backend systems like policy admin, claims, and billing systems.