Define the Scope of Power Attributes

Learning Objectives

After completing this unit, you’ll be able to:

- List classes for power attributes.

- Determine the appropriate Attribute Scope to support given claims requirements.

- Create benefit types to support sub-limits.

Define the Class

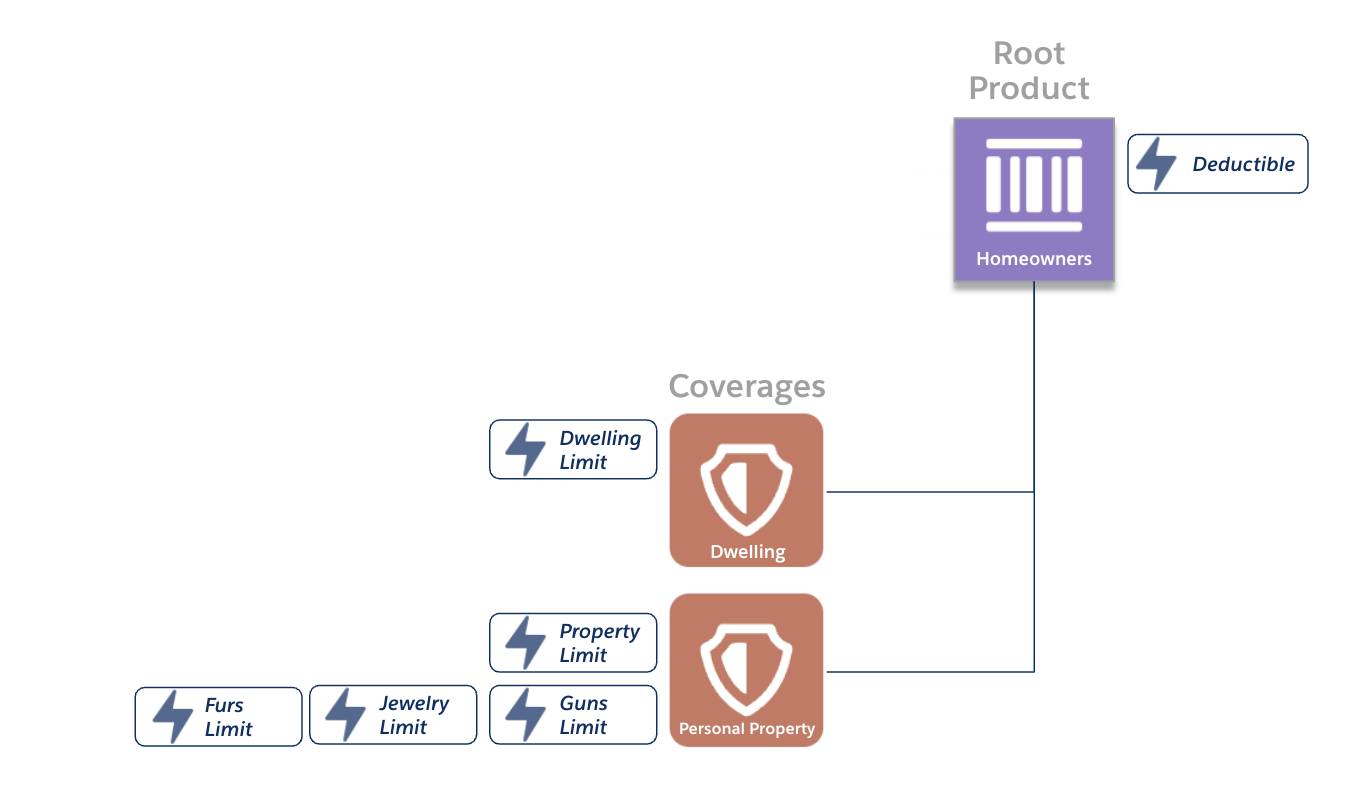

For the homeowners product, Justus must configure the six power attributes relevant to claims processing.

- Deductible, which is attached to the root product.

- Dwelling Limit, which is attached to Dwelling coverage.

- Personal Property Limit, Furs Limit, Jewelry Limit, and Guns Limit, which are attached to Personal Property coverage

As a first step, Justus defines the class for each power attribute. This is a relatively straightforward task based on the type of attribute.

Knowledge Check

The following flashcards cover classes: Out-of-pocket maximum, Coinsurance, Limit, Deductible, and Copay. Use these interactive flashcards to brush up on these classes.

Read the description on each card, then click or tap the card to reveal the class. Click the right-facing arrow to move to the next card, and the left-facing arrow to return to the previous card.

Define the Attribute Scope

Let’s focus on determining the scope and benefit types for power attributes. Selecting the correct scope requires a bit of thought as you need to think through the business context. Start with the deductible, as it’s the most straightforward.

Deductible - Claim vs. Policy Scope

For the homeowners example, the deductible at the policy level must reset every claim. Every time the policyholder files a claim, they must meet this deductible amount before receiving any payment. The paid deductible should not carry into any subsequent claim. Thus, the appropriate scope is Claim.

Let’s walk through each step for such a scenario.

-

Homeowners Policy Purchased (1): In January, the policyholder, Sophia, purchases a Homeowners policy. It has a deductible of $5,000 with Claim scope.

-

Claim I Opened (2): In June, Sophia files a claim for $225,000.

-

Deductible Met (3): Before receiving any payment, she pays her deductible of $5,000. After meeting the deductible, she receives $220,000 for the claim.

-

Claim I Closed (4): The claim closes, and the deductible resets to $5,000.

-

Claim II Opened (5): In October, unlucky Sophia files a new claim for $180,000.

-

Deductible Met (6): Once again, she must meet the $5,000 deductible before receiving a $175,000 payment on this claim.

-

Claim II Closed (7): The claim closes, and the deductible resets to $5,000. If Sophia files any more claims during the policy term, she will once again need to pay the deductible.

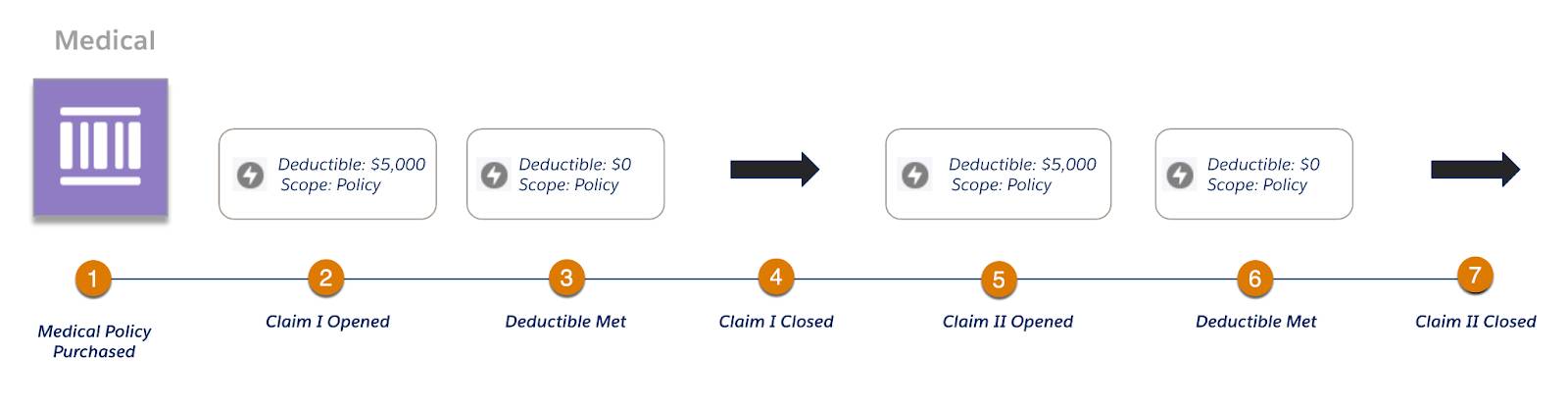

Now, imagine a medical product (medical policy), in which the deductible payment made on the first claim must carry over into the second. Here, set the attribute to Policy scope. Let’s walk through each step for such a scenario.

-

Medical Policy Purchased (1): In January, the policyholder, Sophia, purchases a Medical policy. It has a deductible of $5,000 with Policy scope.

-

Claim I Opened (2): In June, Sophia files a claim for $225,000.

-

Deductible Met (3): Before receiving any payment, she pays her deductible of $5,000. After meeting the deductible, she receives $220,000 for the claim.

-

Claim I Closed (4): The claim closes, and the deductible doesn’t reset. It is still zero.

-

Claim II Opened (5): In October, Sophia files a new claim for $180,000.

-

Deductible Met (6): This time, she doesn’t need to pay any deductible and receives the full $180,000 payment on this claim.

-

Claim II Closed (7): The claim closes, and the deductible again doesn’t reset. If Sophia files any more claims during the policy term, she won’t need to pay the deductible.

Claim scope is widespread for Property and Casualty (P&C) lines of business (LOBs), where claim frequency is low. In more high-frequency claim LOBs, such as Health, Pet, and Dental, the deductible is typically annual, with each payment towards the deductible carried over to the following claim. In such scenarios, set the scope to Policy.

Limits - Claim Coverage vs. Policy Coverage Scope

Now, consider the limits. In the homeowners example, each limit attaches to a specific coverage and must reset every time the policyholder files a claim. Thus, we need to set the scope to Claim Coverage.

Let’s walk through an example and see how the limit and deductible interact.

-

Homeowners Policy Purchased (1): In January, the policyholder, Sophia, purchases a homeowners policy. The limit for the Dwelling coverage is $250,000 with a Claim Coverage scope. The deductible is $5,000 with Claim scope.

-

Claim I Opened (2): In June, Sophia files a claim on the Dwelling coverage for $225,000.

-

Deductible Met, Limit Adjusted (3): Before receiving any payment, she pays her deductible of $5,000. After meeting the deductible, she receives $220,000 for the claim. Her limit on the Dwelling coverage is now $30,000.

-

Claim I Closed (4): The claim closes, and both the deductible of $5,000 and the limit of $250,000 get reset.

-

Claim II Opened (5): In October, Sophia files a new claim for $180,000 on the dwelling coverage.

-

Deductible Met, Limit Adjusted (6): She pays the $5,000 deductible and receives $175,000. The remaining limit is $75,000.

-

Claim II Closed (7): The claim closes, and both terms reset. If Sophia files any more claims during the policy term, she will have a full limit on the Dwelling coverage of $250,000.

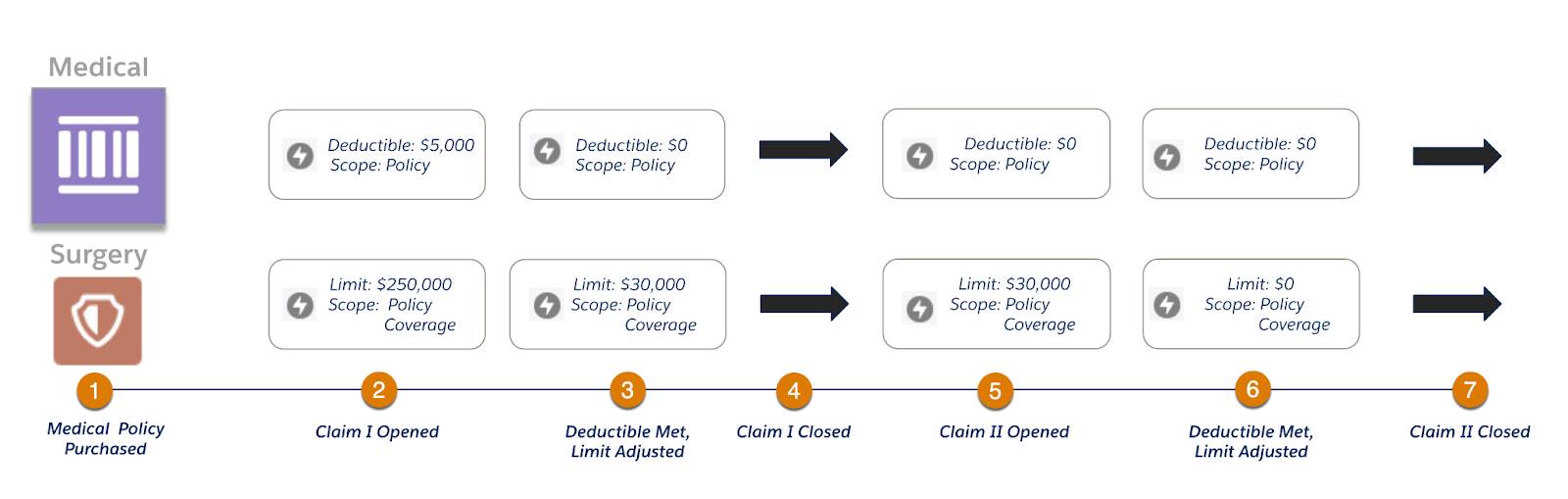

Once again, compare this to the medical policy example. Here, you set the limit for the surgery coverage to a Policy Coverage scope. Let’s go through the steps for such a scope.

-

Medical Policy Purchased (1): Sophia, purchases a medical policy. The limit for the surgery coverage is $250,000 with a Policy Coverage scope. The deductible is $5,000 with Policy scope.

-

Claim I Opened (2): Sophia files a claim on the surgery coverage for $225,000.

-

Deductible Met, Limit Adjusted (3): Before receiving any payment, she pays her deductible of $5,000. After meeting the deductible, she receives $220,000 for the claim. Her limit on the surgery coverage is now $30,000.

-

Claim I Closed (4): The claim closes, and the deductible and limit don’t reset. The deductible is $0 and the limit is $30,000.

-

Claim II Opened (5): Sophia files a new claim for $180,000 on the surgery coverage.

-

Deductible Met, Limit Adjusted (6): She pays $0 on the deductible but receives only $30,000 as the limit has been reached. She must pay the remaining $150,000 out-of-pocket. Ouch.

-

Claim II Closed (7): The claim closes but the two terms values carry over. If Sophia files any more claims during the policy term, she will have a limit of zero for surgery coverage.

Create Benefit Types

You may be wondering: what about all those personal property limits? Why are there four limits on a single coverage? How do we handle these?

First, consider scope.

The Personal Property coverage contains one personal property limit that applies to the entire coverage. Just like the dwelling limit, it should reset after each claim. So, it requires a Claim Coverage scope. In addition, three sub-limits define the limit for three specific types of personal property—furs, guns, and jewelry. Once again, each of these limits should reset after each claim. So, they all must have a Claim Coverage scope.

However, it’s a little more complicated than that. You want the claims system to apply any Personal Property loss payment details to the overall Personal Property limit. But, you want to apply loss payment details to the sub-limits only when the payment detail is specifically issued to pay for guns, furs, or jewelry.

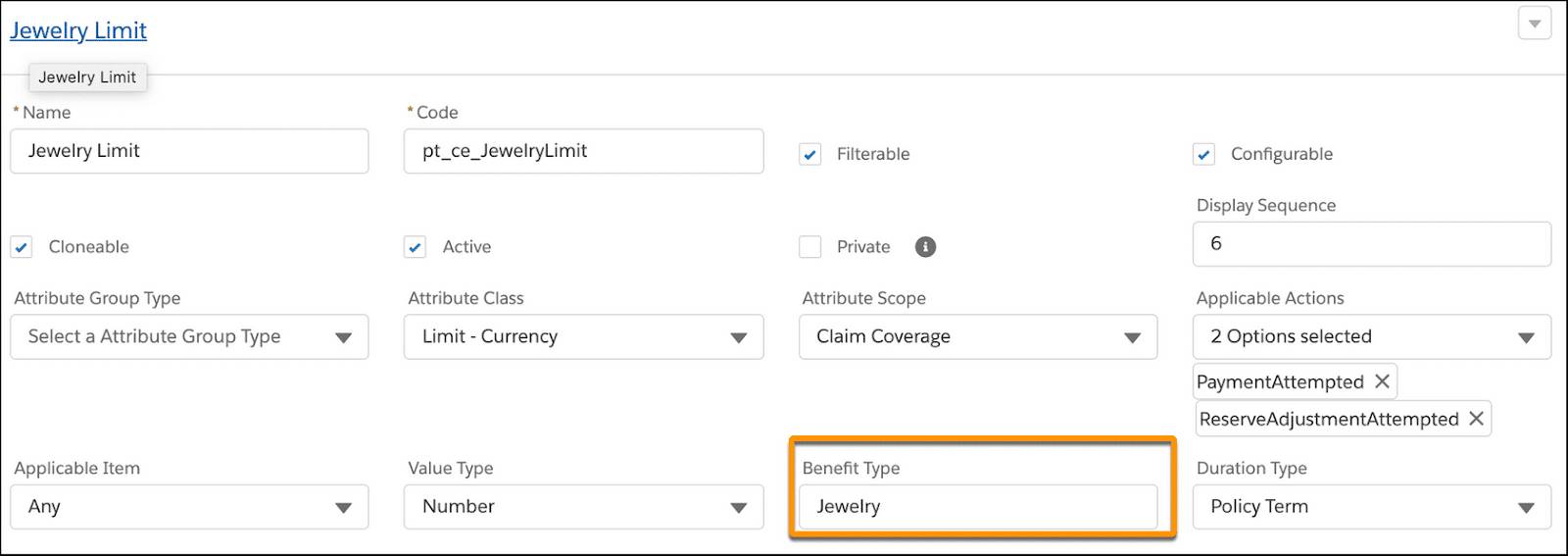

To support this requirement, create a distinct Benefit Type for each sub-limit. Benefit Type is another field in the power attribute section of the attributes designer.

Justus adds the Benefit Type of Jewelry to the Jewelry Limit.

When claims adjusters create loss payment details for the personal property claim, they can designate the benefit type.

- When a benefit type is designated, the loss payment detail applies to both the attribute associated with that benefit type and the overall coverage limit.

- When no benefit type is designated, the loss payment detail applies only to the overall coverage limit.

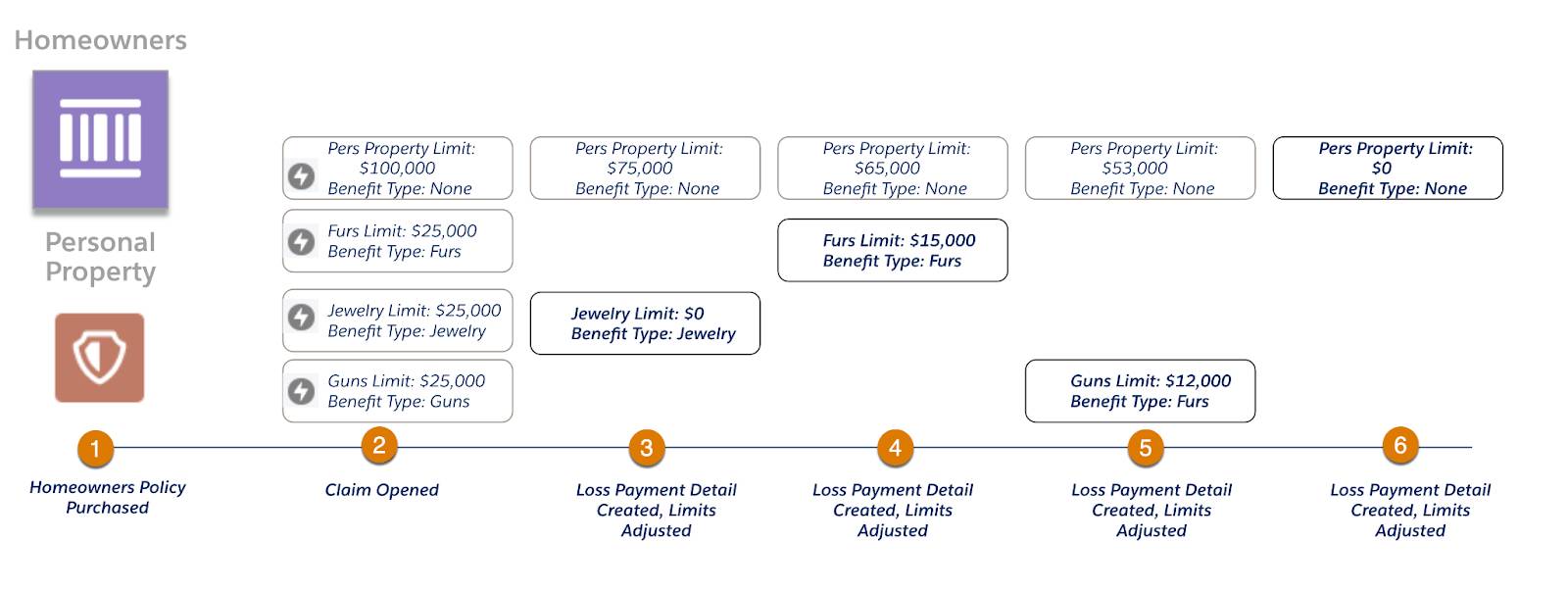

Follow along with the following example.

-

Homeowners Policy Purchased (1): Sophia purchases a policy with a $100,000 Personal Property limit and a $25,000 limit for each sub-limit.

-

Claim Opened (2): Following a burglary at the insured property, Sophia files a claim for $115,000 worth of eligible personal property. Of this stolen property, $35,000 is jewelry, $10,000 is furs, and $12,500 is guns. The remaining $58,000 represents miscellaneous items unrelated to these classes. The claims adjuster creates four distinct loss payment details for the single Personal Property claim coverage and pays them in order. The claims system automatically determines the appropriate payout for this constellation of loss items.

-

A $25,000 payment for the $35,000 jewelry loss (3): The limit for this benefit type is $25,000, so the Claims system restricts any payments over that limit from being made. Sophia’s claimed amount adjusts to $25,000 to remain within that sub-limit. After payment, the remaining Jewelry limit changes to $0, and the remaining personal property limit adjusts to $75,000.

-

A $10,000 payment for the furs loss (4): The limit for this benefit type is $25,000, so the policyholder is eligible for full payment. After payment, the remaining fur limit adjusts to $15,000, and the remaining personal property limit changes to $65,000.

-

A $12,000 payment for the guns loss (5): This limit is also $25,000, so the policyholder is eligible for full payment. After payment, the remaining Guns limit adjusts to $13,000, and the remaining personal property limit changes to $53,000.

-

A $53,000 payment for the $58,000 miscellaneous losses (6): Since the claimed amount is more than the remaining, the payment detail adjusts to $53,000 before the system allows the payment to be issued. After the payment, the remaining personal property limit is now zero.

And that covers the essentials of power attributes in the context of the broader claims process. In the next unit, explore how the claim model plays its role.