Understand Transaction Dispute Management

Learning Objectives

After completing this unit, you’ll be able to:

- Explain the types of transaction disputes.

- Describe the transaction dispute lifecycle.

- Describe the benefits of Transaction Dispute Management.

The Significance of Dispute Resolution

The success of a financial institution depends on how it addresses customer issues, complaints, and discrepancies in financial documents or transactions. With the growth in digital transactions, there’s been a significant rise in the volume of disputes across financial services.

Disputes cost financial institutions a lot of money. Without a clear strategy to manage disputes, you risk losing money and time. Fortunately, Transaction Dispute Management for Financial Services Cloud streamlines the dispute resolution process and makes your strategy actionable.

In this module, you will learn the basics of disputes and Transaction Dispute Management. Read on to find out how the app helps financial institutions reduce the impact of disputes on the cash flow and improve customer relationships.

Understand Disputes

A transaction dispute is a consumer complaint related to the customer’s credit or debit card. Here are some common disputes.

Fraud

Any fraudulent activity during a financial transaction to gain unauthorized access to funds, goods, or services. Fraud occurs when someone steals a customer’s card information and misuses it, impersonates a customer, or forges checks and documents.

Consumer Dispute

Any disagreement or problem regarding a purchase or a payment. Consumer disputes take place in instances such as online purchases, credit card purchases or refunds, and bank transactions.

Unauthorized Error

Any dispute that’s initiated when there’s no authorization or when the authorization code isn’t valid. Disputes also arise when there’s overbilling or multiple billing.

Fees

Any charge to the customer’s account by the financial institution. For example, late payment fee and insufficient funds fee. If customers feel that they’ve been charged unfairly, they can dispute such fees.

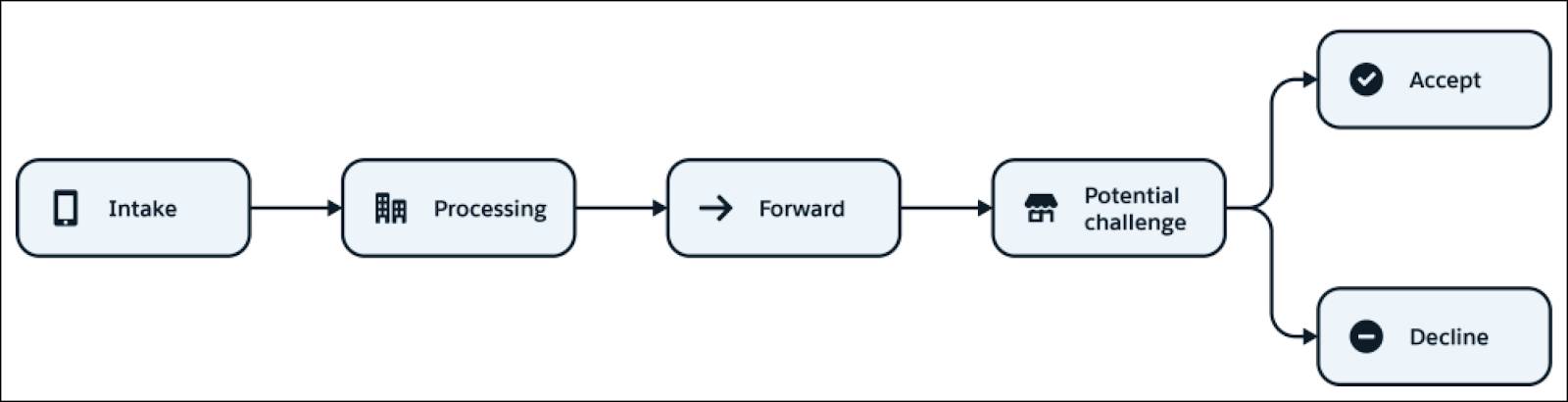

Transaction Dispute Lifecycle

Let’s check out the stages that a transaction dispute goes through.

-

Intake: The cardholder files a transaction dispute with their bank.

-

Processing: The bank sends the dispute to the merchant card processor.

-

Forward: The merchant card processor forwards it to the merchant.

-

Potential challenge: The merchant reviews the dispute and decides whether to accept or reject the disputed amount.

-

Accept/Decline: The merchant pays the disputed amount if they accept it. If they decline it, they prepare supporting documentation and submit it to the merchant card processor.

Gather Accurate Data and Communicate Better

So how does Transaction Dispute Management help you across these stages?

With a provided dispute intake form, you can collect accurate data from customers regarding their disputed financial transactions. Either your service reps working from a Salesforce account record or your customers working from a self-service portal can launch the dispute intake process. They can then select many transactions to dispute, select an appropriate dispute reason, and collect additional details related to the dispute through an assessment questionnaire.

You can customize the intake form to meet your business needs and integrate it with your core banking systems. With AI-powered prebuilt email templates, compose and send emails to customers to acknowledge their dispute requests and update them about the closure of a disputed transaction.

But that’s not all.

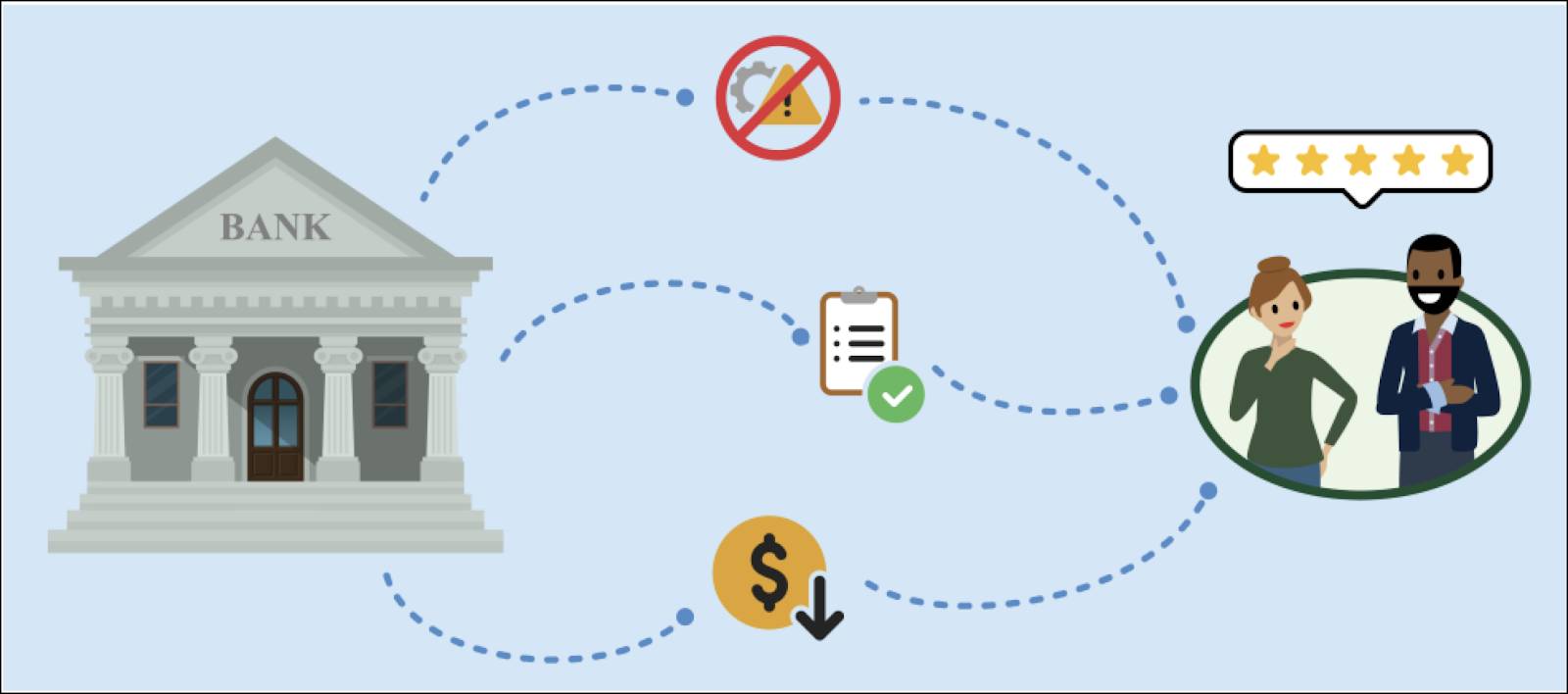

Explore the Benefits

With a streamlined dispute resolution process, Transaction Dispute Management helps dispute teams in financial institutions overcome challenges related to complex processes, systems, and regulations. You can eliminate the inefficiencies that arise from switching between systems, ensure regulatory compliance, reduce operational costs, and enhance customer and employee experience.

Here are some more benefits offered by the Transaction Dispute Management app.

Deflection First

Transaction Dispute Management follows a deflection-first approach. With the included transaction enrichment and business rules, many disputes are resolved during the intake process itself. This is a win-win for both the customer and the issuing bank. The customer gets immediate closure and the bank saves the dispute team’s time.

No Swivel Chair

Dispute management software dedicated only to transaction dispute resolution creates data silos. Because Transaction Dispute Management is an end-to-end solution, users don’t reenter data in multiple systems. The app integrates seamlessly with your network systems, so dispute agents manage chargebacks in a single system. This process eliminates human errors and increases efficiency.

Automated Chargeback Lifecycle Tracking

A chargeback is managed on a card network system and goes through many updates. With Transaction Dispute Management, dispute team members can see any activity on the chargeback. This is done through automatic updates on Salesforce records related to the chargeback.

Better Compliance

Banks must adhere to several regulations related to transaction disputes. Transaction Dispute Management’s dispute workflow automation through a robust enterprise case management platform helps banks comply with regulatory timelines. Moreover, the app integrates with Salesforce Prompt Builder and enables you to draft personalized customer communications.

Quick Configuration

Admins use Discovery Framework, Omnistudio, and Service Process Studio to set up the Transaction Dispute Management processes to give your service reps and customers a guided process for capturing disputes. This improves time-to-value by implementing processes quickly and efficiently, often using low or no code

Wrap Up

In short, Transaction Dispute Management helps you resolve disputes faster, work more efficiently, and improve customer service. Contact your Salesforce admin and connect with your teams to find out how you can make the app work for your organization.