Meet Service Process Studio

Learning Objectives

After completing this unit, you’ll be able to:

- Describe the importance of services in the banking industry.

- Explain the issues that banks and financial institutions face with service processes.

- Describe the importance of Service Process Studio.

The Importance of Services in Banking

Services have a huge impact in the banking industry. Customers expect their service interactions to be easy and consistent across all communication channels, including email, mobile phone, and apps. Customer experience governs the products a customer buys, determines the level of customer retention, and ultimately decides a bank's success.

Recent research provides several insights.

- More than 75% of people choose their bank based on positive customer experience.

- 90% of all interactions with a bank are service-oriented.

- 55% of customers leave their bank due to poor customer service.

- Only 16% of customers say that they’re satisfied with their bank’s digital experience.

The figures show clearly that great customer service is critical for customer retention in banks, and this goes for other financial institutions too. Still, most banks fail to deliver a pleasant experience due to the many challenges they face in serving their customers.

Your institution can go far by delivering a great customer experience to gain customer loyalty. Fortunately, with today’s tech-savvy generations, financial institutions can use technology to consolidate and streamline processes, saving time and money, and most importantly, delighting customers.

But how can financial institutions use technology to improve customer service? Before answering that, let’s look at some common customer challenges.

Current Issues with Service Processes

A service process can relate to any banking operation, including customer data updates, overdraft protection, or accounting reconciliations. Implementing and running effective service processes are key factors in customer satisfaction. However, building service processes and integrating them with other banking and external systems can be time-consuming, and complex.

That’s the case at Cumulus Bank, a large financial services provider. As Cumulus Bank expands its business and operations, it sees the number of service requests and associated service processes grow exponentially. The entire team at Cumulus has identified gaps between service delivery and customer expectations. So what’s causing these gaps?

- More than a thousand service processes and lack of automation

- Meeting customer and employee expectations in an increasingly competitive landscape

- Simple straight-through processing (STP) and complex back and middle office collaboration requests

- Challenges with core banking and other banking systems integrations

- Slow service delivery and long wait times

- Falling short when resolving customer problems

To retain customers and maintain a competitive edge, Cumulus wants a robust framework, including capabilities to:

- Design customer service processes quickly and efficiently.

- Build service processes and automate their fulfillment.

- Create service process definitions to configure and organize multiple actions or tasks required.

That task falls to Matt O’Brien, the trusty Salesforce admin at Cumulus.

In this badge, you’ll follow Matt as he uses Service Process Studio for Financial Services Cloud (FSC) to help Cumulus work more efficiently.

Meet Service Process Studio

Service Process Studio is a comprehensive framework that helps service reps provide enhanced customer service experiences through real-time integration with core banking functions and transactional data. Use Service Process Studio to design customer service processes quickly and efficiently. Service reps can launch the processes to carry out all types of activities, including customer address updates, checkbook orders, request for statement copies, and more.

Service Process Studio Concepts

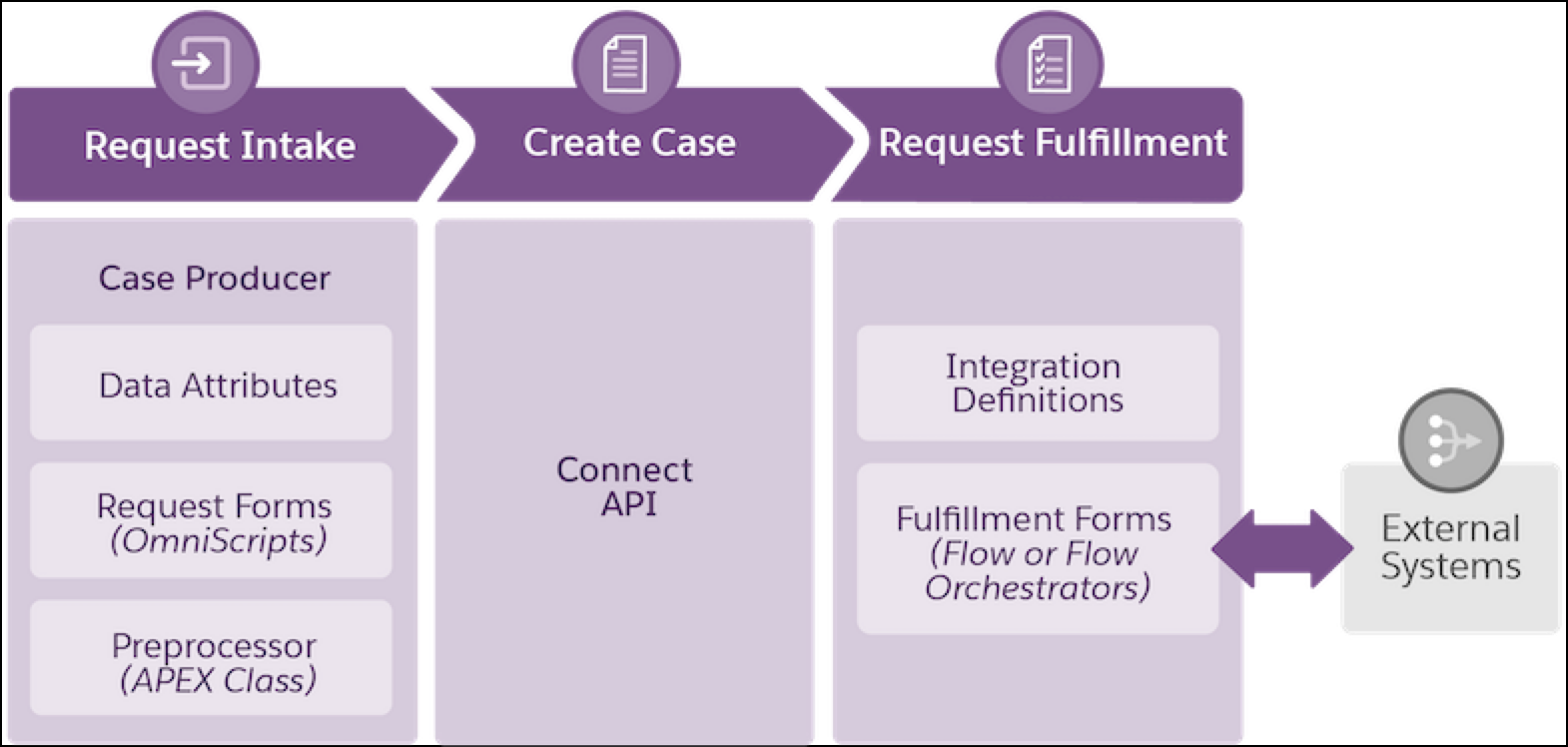

Service Process Studio takes you through a set of steps starting with providing the basic details through to associating a fulfillment flow. This diagram shows the service process workflow and how each building block supports workflow design.

The main steps in creating a service process definition are:

-

Request Intake: Design a streamlined request intake process using data attributes, Omniscripts, and preprocessors.

-

Create Case: Create an Apex class and invoke the API, which includes passing all the attributes from the request intake form as input to the case creation.

-

Request Fulfillment: Build a fulfillment flow or a flow orchestration to automate the fulfillment of a service process request.

High-Level Structure of Service Process Studio

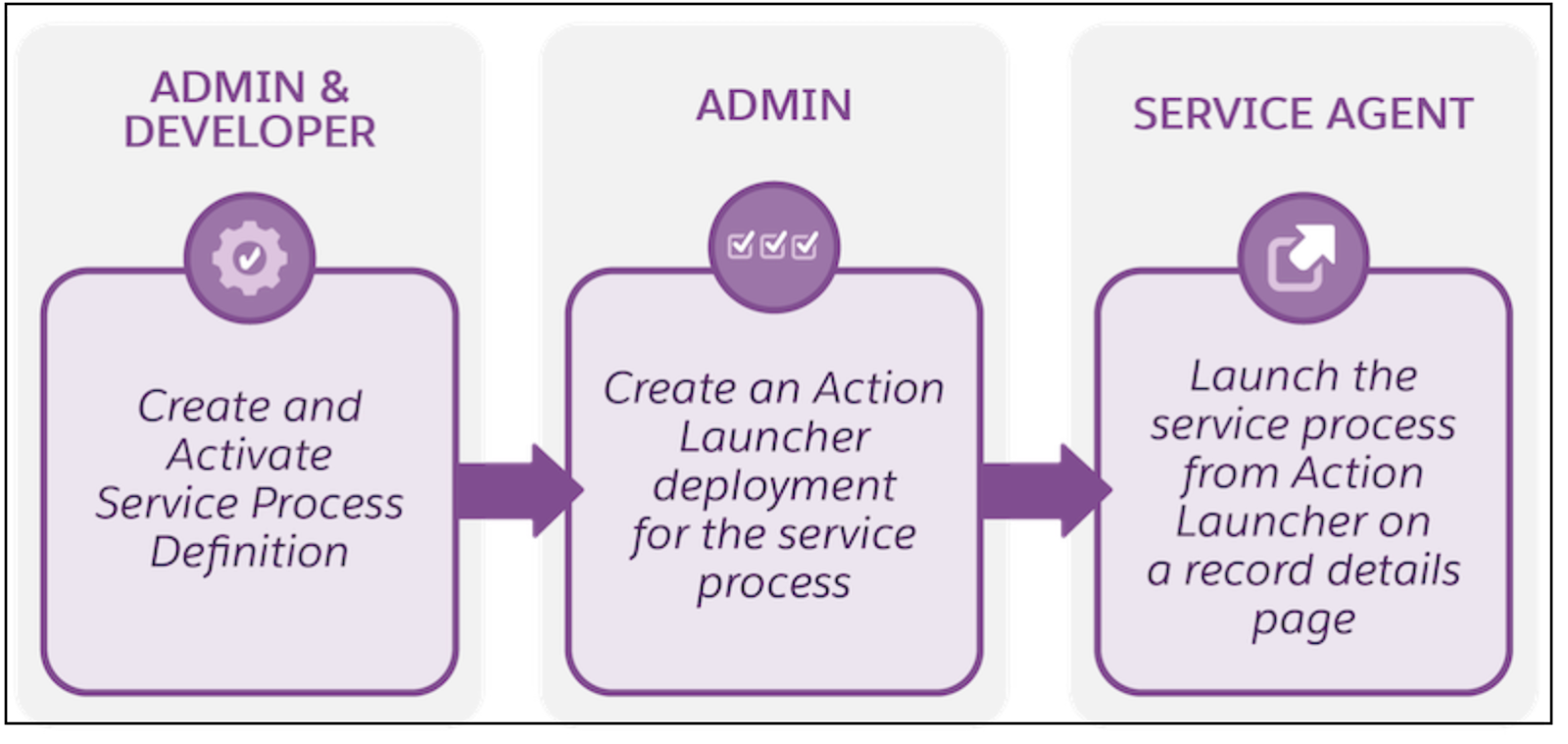

This flow diagram shows the tasks performed by the key roles who use Service Process Studio.

The admin or developer creates and activates the service process definition. Once the definition is active, the admin associates the service process to an Action Launcher deployment. In a customer-service scenario, the service rep launches the service process definition from Action Launcher on a record details page. The process guides or supports the rep in carrying out their day-to-day jobs to be done.

About This Module

In this module, we assume you're a Financial Services Cloud admin with the proper permissions to use Service Process Studio. If you’re not an admin for Financial Services Cloud, that’s OK. Read along to learn how your administrator would take the steps in a production org. Don't try to follow these steps in your Trailhead Playground. Financial Services Cloud and Service Process Studio aren’t available in the Trailhead Playground.

Also, while this module focuses on retail banking, Service Process Studio works equally well with other FSC subverticals, including insurance, wealth management, and commercial banking.

Up Next

Matt gets started setting up the solution right away. Follow along as he prepares the org in the next unit so he can start using Service Process Studio.

Resources

- Salesforce Help: Service Process Studio

- Salesforce Help: Standard Retail Banking Service Processes for Financial Services Cloud