Give Finance a Helping Hand

Learning Objectives

After completing this unit, you’ll be able to:

- Identify key Invoice features.

- Explain how Salesforce Billing simplifies the technological approach to generating invoices accurately and quickly.

Your Customers’ Success Equals Your Success

You may have heard a similar tag line from us, maybe right after our award-winning Forward-Looking Statement slide in all of our presentations. (In all seriousness, there is no award for this slide, but if there was one, we like to believe that we would win it.) What our history in the market has told us is that if you deliver on an experience that just works, odds are you’ve just converted a customer into an advocate.

And this goes both ways–if your Finance team gets the right tools that make life easier, more often than not they adopt it and trust the process you put in place, even in the face of change. That is one of the goals of Salesforce Billing when we talk about eliminating the Sales-to-Finance gap.

Invoice Execution

Let’s take a look at the generation of invoices and see how this concept applies. With Salesforce Billing, there are a lot of things at your fingertips that enable you to bill customers appropriately, at the right time. Here are some of our favorites.

|

One-Time Invoicing |

The ability to manually post invoices. |

|

Recurring Invoices |

The ability to automate invoices that meet a specific criteria. Ideal for common, transactional interactions. |

|

Variable Invoicing/Dynamic Invoice Plan |

For invoicing needs that don’t follow standard billing frequencies, such as billing to milestones or project acceptance. |

If you want to learn more about how these and other invoice features work, check out our Help and Training documentation. That said, the key factors here are flexibility and control. If there ever was an existential struggle within the finance realm, this would be it.

We provide a platform that enables Finance to work with Sales and Operations on the right process for order creation and invoice generation. And you’re still in the driver’s seat when it comes to locking in revenue.

Streamlined Order-to-Invoice Conversion

Speaking of platforms, let’s demonstrate what this looks like from a technological perspective. Here are some scenarios to really show how Salesforce Billing differentiates from other technologies in the market.

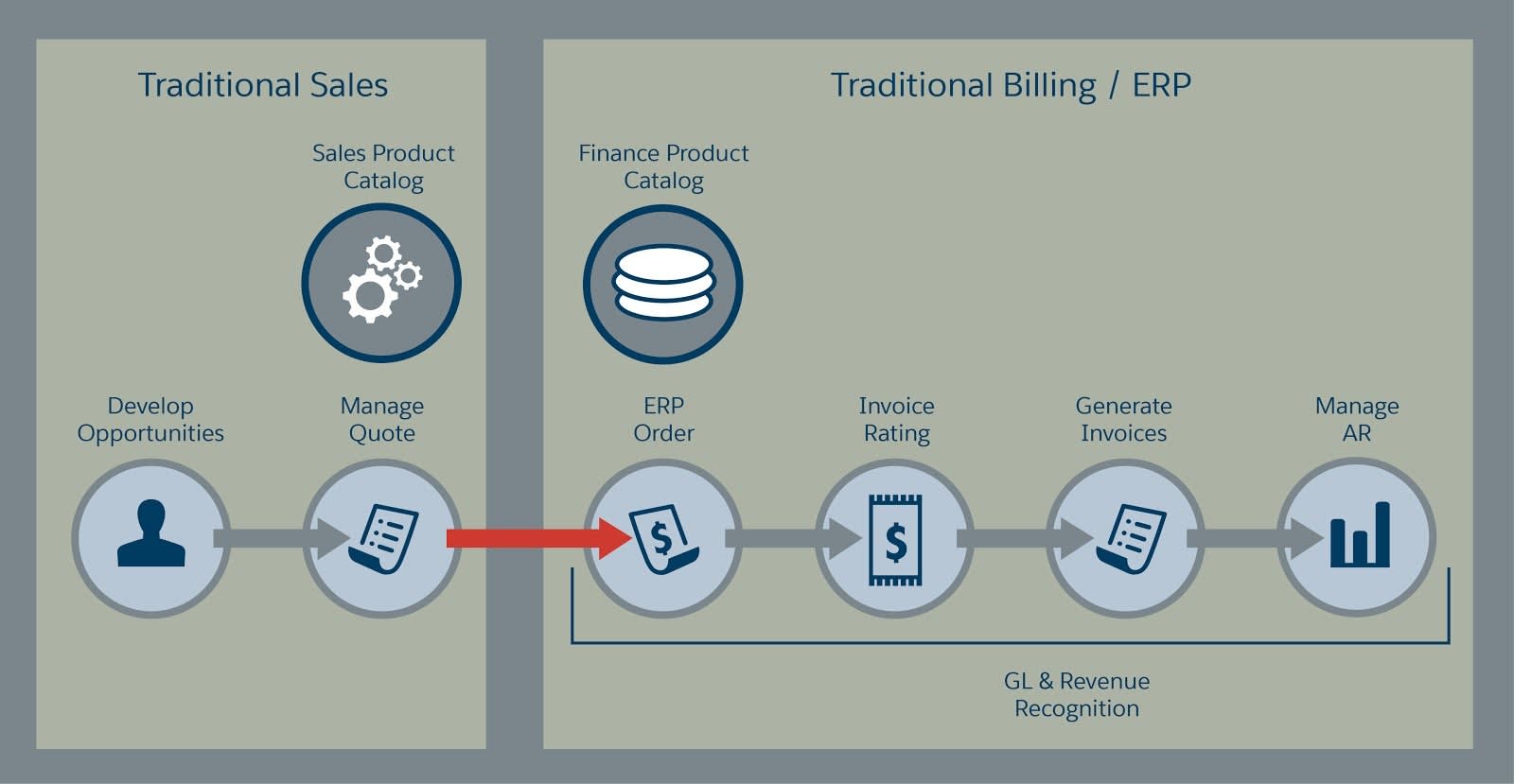

In a traditional revenue lifecycle, you have Sales on one side and Finance on the other both in their siloed systems. All of the customer interaction and potential financial data moves through the sales motion and then all of a sudden, it hits a wall. You have the very real risk of inaccuracy and confused processes as you try to pass off information, reprocess data, recalculate proration and price, and so on.

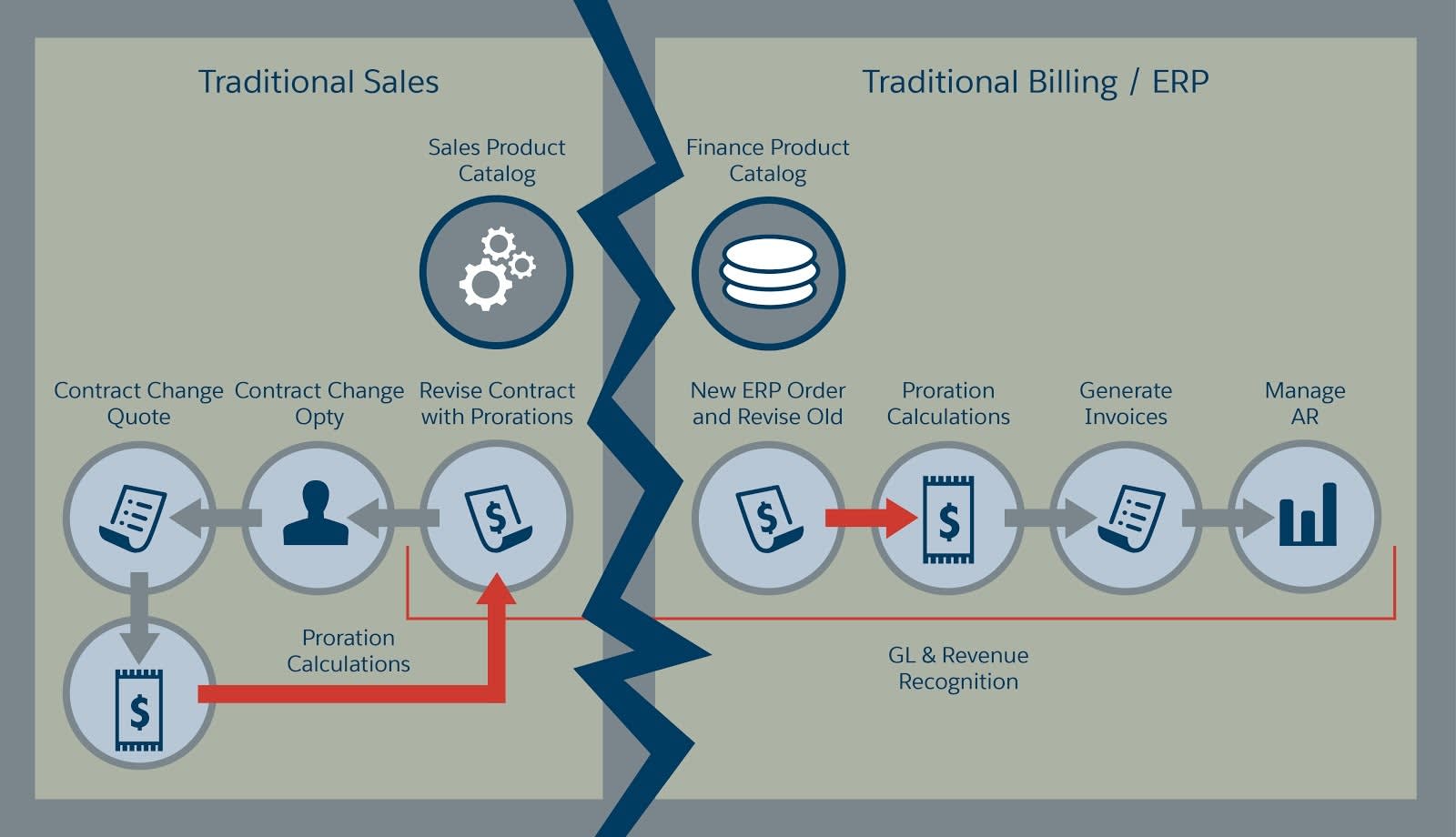

What happens when you try to introduce change through recurring business? Maybe you want to dabble in services. Maybe you want to fully transform how you go to market. The process breaks down.

Now think about adding a third-party billing system—even more complexity, more silos, more risk; the exact opposite of where we’re trying to go.

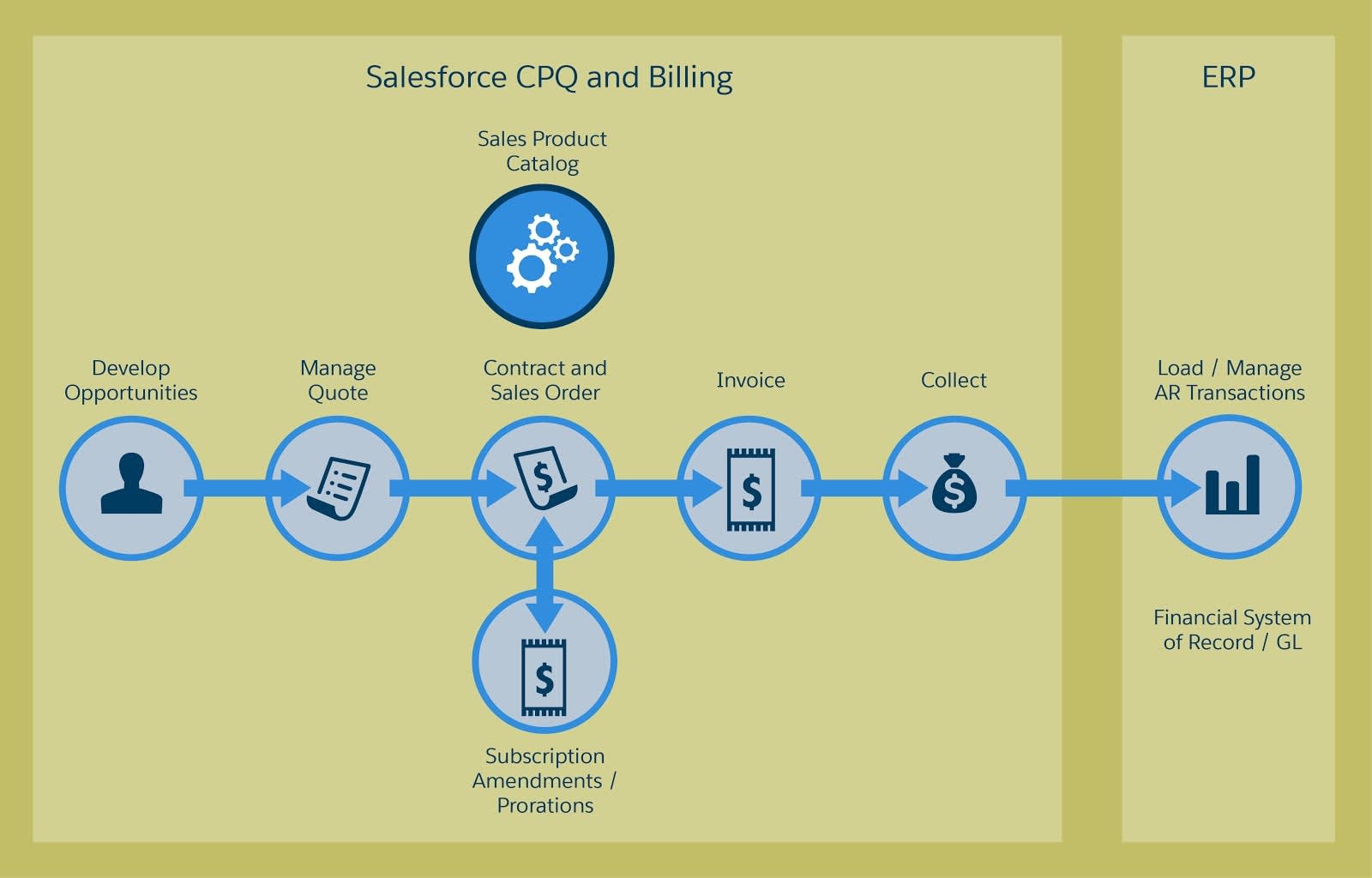

These are just sample scenarios. But in conversations with our customers, we’ve seen many examples that strike true to what we’ve demonstrated here. And these have been the core challenges we aim to solve with our billing solution. With Salesforce CPQ and Billing, the end to end customer engagement can be managed in Salesforce whereas the internal financial system of record is managed in the ERP. After all, the C in CRM stands for customer and the E in ERP stands for enterprise.

When leveraging our platform, there’s one point of pricing doing the calculations, one continuous process for transaction, and then a seamless hand-off to Accounts Receivable and Reporting. Right away, a lot of the chaos of recalculation and duplication disappears, data flows quicker between points in the revenue lifecycle, and you’re able to get down to execution.

But Wait, There’s More

This is by no means the endgame for Salesforce Billing. But by now, hopefully you have the sense that when we talk about transforming your relationships both internally and externally, transforming business processes and technology, and giving you the platform to do so, we’re not cooking the books at all!