Get to Know Your Revenue Model

Learning Objectives

After completing this unit, you’ll be able to:

- Define common deal terms.

- Describe the difference between subscription and on-premises revenue models.

- Explain why it’s important to close deals early.

The Art and Science of Pricing

Pricing a deal is not only an art and a science, it’s a team sport. A winning deal works for you, works for your customer, and makes sense for your company. This module shows you how to lay the groundwork for building great deals.

After you complete this module, you’ll know:

- How to approach pricing.

- About common tools and research.

- How to choose a pricing strategy.

- How to write a proposal.

Think of deal building as setting off on an epic adventure. You and your customer are partners in the quest to build a winning deal and have a gear bag filled with goodies like resources, tools, and support teams to make it happen.

Know Your Deal Terms

But first: terms. To know them is to love them. No, seriously!

You’re going to see these terms a lot when you price deals.

| Term |

What It Means |

Example |

|---|---|---|

|

Annual order value (AOV) |

Annual value of the contract |

The quote amount, divided by the number of years, equals the AOV. |

|

Total contract value (TCV) |

Total amount a contract is worth |

If the AOV is $500,000 with a 2-year term, then the TCV of this deal is $1,000,000. |

|

Annual contract value (ACV) |

How much the value of a contract has gone up or down compared to last year |

If a customer’s current AOV is $500,000 and they’re purchasing an additional $200,000 of products, then the ACV equals $200,000 and the new AOV equals $700,000. |

|

Revenue |

Money your company earns and can recognize in its financial statements |

Your company reports revenue to Wall Street in your quarterly and annual reports. |

|

Deferred Revenue |

Cash up front on a subscription contract based on invoice generated. This turns into revenue as you deliver the services. |

The customer paid the whole $500,000 invoice, but that’s deferred revenue until you start delivering services. |

Know Your Revenue Model

When pricing deals, you also need to understand your company’s revenue model. Let’s compare two popular revenue models in the software industry–subscription and on-premises–to see how each impacts the bottom line. Even if the terms “subscription” and “on-premises” are new to you, at a high level the difference between them is pretty simple.

Subscription: When the customer subscribes to software as a service, revenue is recognized as services are delivered. That is, revenue is recognized when licenses are activated, which may not be the day the contract was signed.

On-premises: When the customer buys software outright, revenue is recognized up front for the licenses and equipment necessary to run software on site.

But wait. “Revenue model,” you say, “what’s that?” Glad you asked. Basically, it’s how your company accounts for the money it earns. And that’s why understanding your revenue model is really important.

As an example, take a look at a 1-year $120,000 contract structured using subscription and on-premises models.

Example A: On-premises revenue model

- Contract is worth $120,000 over 12 months. So the annual contract value (ACV) is $120,000.

- Contract is paid in full on day one.

- All $120,000 of revenue is recognized on day one.

- Zero revenue is recognized during the rest of the contract because it was all recognized on day one.

Example B: Subscription revenue model

- Contract is worth $120,000 over 12 months. So the ACV is $120,000.

- Contract is paid in full on day one.

- All $120,000 of the contract is considered deferred revenue until services are delivered.

- $10,000 of revenue is recognized monthly once the contract starts, until the contract ends.

In Example B, the money changes internally from deferred revenue to revenue, as services are delivered. Revenue is spread out over the full term of the contract, even though the customer is still paying in full up front.

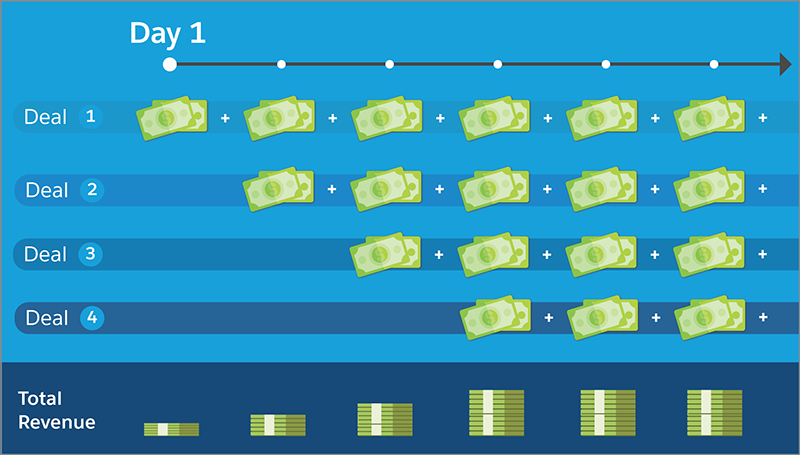

The subscription model spreads revenue out over the length of the contract. One really cool aspect of the subscription revenue model takes shape when you book multiple deals in the same year. The aggregate daily revenue increases as each new deal comes online.

And total revenue is maintained day-to-day instead of peaking up front and zeroing out after that. That’s the subscription revenue model at work. (You might notice that we are fans.)

To sum up, here are some advantages of the subscription revenue model.

- You get to spread revenue evenly over the entire length of each contract.

- You get long-term revenue streams, making growth steady and predictable.

- All $120,000 of the contract is considered deferred revenue until services are delivered.

- You have the ability to plan long-term; unlike companies with an on-premises revenue model.

Within the subscription model, there’s another important factor that affects the bottom line: when you close deals. Let’s take a look.

Close Early, Close Often

Closing deals late in a quarter increases the risk of not meeting revenue expectations. Close early, and revenue starts flowing early in the quarter, which gets you on track to meet those expectations.

In the subscription revenue model, revenue can be recognized per day of delivered service, and not as lump sums on day one of a contract. Close early, and you can recognize more revenue throughout the rest of the quarter and year.

Here’s a quick example: Let’s say you close a deal with a new customer, Company XYZ, worth $1,200,000 over the next 12 months (that’s the ACV). What happens if you close early in the quarter versus closing late?

- Close on the 1st day of the 1st month of the quarter.

- Recognize a full 3 months of revenue in that quarter.

- That’s $100,000 × 3 months = $300,000. BOOM!

Versus

- Don’t close until the 1st day of the 3rd month of the quarter.

- Recognize only one month of the contract before the end of the quarter.

- That’s only $100,000 for the quarter, instead of the full $300,000 that closing early would have recognized.

And the impact of revenue on the bottom line is pretty simple.

Why Early Matters to You

With every deal you close, you’re that much closer to hitting your numbers. When you close early, your manager is happy, you’re happy, and you have time to focus on crushing more deals–all of which brings you that much closer to relaxing on a beach!

Now you have the lay of the land when it comes to revenue models, and you know why it’s important to your company–and to your personal success. You’re starting to speak the language of pricing and deals like a local. In the next unit you explore the tools you’ll use on the quest to price winning deals.