Empower Personal Bankers to Be Their Best

Learning Objectives

After completing this unit, you’ll be able to:

- Explain how bankers can use Salesforce to intelligently prioritize their customer interactions.

- Describe how Salesforce helps bankers engage and encourage prospects at key moments.

- Outline how Salesforce drives seamless, customer-centric collaboration among bankers and their business partners.

Prioritize Customer Interactions

Meet Dan. He’s a personal banker at Cumulus Bank who specializes in mortgages.

Dan starts each day in Salesforce using dynamic dashboards to review selling activity, customer account usage, and CSAT and NPS metrics. These dashboards help him understand how he’s performing and where opportunities exist for Cumulus Bank to address customers’ mortgage needs. One Salesforce feature that Dan especially appreciates is Einstein, because it does the heavy lifting for him and intelligently scores and prioritizes his queue of mortgage leads.

Shortly after Rachel funds her checking account, Dan logs in to Salesforce and sees an alert that he has a new, high-priority lead: Rachel Adams rates as a 92 on likelihood to need a mortgage—well above the average score of 71.

Dan is curious and clicks in Rachel’s lead record to understand why her score is so high. He discovers that Rachel downloaded the Cumulus mobile app, browsed the mortgage page on the Cumulus website, and even completed a mortgage calculator after clicking a retargeted advertisement. With Einstein, Rachel's data is compared with a massive pool of data about all of the bank’s past leads to determine that Rachel is highly likely to need a mortgage.

Engage Customers at the Right Moment

Based on these Einstein insights, Dan decides to give Rachel a call to find out more about her needs. After all, Dan knows that she’s interested in a mortgage based on her browsing behavior. That doesn’t mean he understands enough about her particular circumstances to make a specific offer.

Dan asks Rachel about her initial experience with Cumulus and whether she is looking for a new home. Rachel says she is happy with her Cumulus bank account. She explains that, given the New York rental market, she is in fact looking to buy her own home.

Based on this information, and because he knows that Rachel already downloaded the Cumulus mobile app, Dan suggests that she use the app to secure preapproval for a mortgage.

After Dan’s call, Salesforce automatically logs the activity. Now Dan has a record of the interaction, and he can reference that information as he moves forward with Rachel’s mortgage process. This ensures that any of Dan’s dynamic dashboards are accurate and can help him keep track of this opportunity.

Dan and Rachel exchange a few emails, and she says she plans to apply for preapproval shortly.

Einstein Activity Capture automatically logs each of these activities. As a result, Einstein Opportunity Insights can alert Dan when it’s been more than a week since Rachel interacted with him or with the Cumulus app. Based on previous mortgage leads, Einstein predicts that a lack of activity for more than a week means Rachel is likely to abandon the process.

Dan decides to give Rachel a call, because her record in Salesforce shows that she responds more often to phone calls than emails. Dan reaches Rachel, and she explains that she hasn’t had time to find a Realtor in her area.

Collaborate Seamlessly with Business Partners

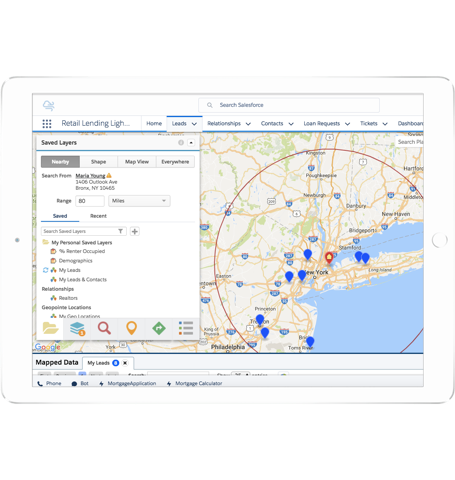

Cumulus keeps a list of Realtor partners in Salesforce, and Dan can quickly filter them based on customer reviews and their proximity to Rachel. Dan recommends a highly-rated Realtor, Amy, and asks if he can provide her with Rachel’s contact information. Rachel agrees, so Dan logs in to the Cumulus Mortgage online community, where the bank collaborates with Realtor partners.

Dan creates a referral for Amy by sharing information from Rachel’s record in Salesforce. That provides Amy with context about Rachel’s situation and triggers a request that she reach out and help Rachel look for a home.

Amy connects with Rachel and shares information about a few upcoming open houses. When Rachel registers for these open houses, the activity syncs to the Cumulus Mortgage online community, and Dan knows that Rachel’s housing search is underway.

Rachel visits a home in Brooklyn that she absolutely loves. Immediately afterward, she applies for a mortgage using the Cumulus app. She gets approval in minutes and proceeds with confidence to placing an offer on the home. Thanks to Salesforce, Rachel and Cumulus established a rewarding relationship that will last a lifetime.