Get Started with Quoting

Learning Objectives

After completing this unit, you’ll be able to:

- Describe some challenges the insurance industry is facing with quoting.

- Explain how the Quote, Rate, and Apply solution helps solve the challenges.

- List some benefits of using Quote, Rate, and Apply for insurance.

- Identify major components of Quote, Rate, and Apply.

- Explain how Quote, Rate, and Apply fits in with Financial Services Cloud and Health Cloud.

Before You Start

Before you start this module, consider completing the following content.

Challenges in Quoting

Remember Anna Murphy? She’s a professional in her 40s living in New York.

Anna is a long-standing customer of Cumulus Insurance, a large, well-diversified provider of insurance services nationwide. Cumulus provides health insurance to Anna through her employer, Cloud Kicks. She recently learned that Cumulus also offers property and casualty insurance (P&C), including auto insurance policies for individual purchase. It just so happens, Anna’s looking for coverage for her trusty sedan.

Anna visits the Cumulus website to shop for a policy and apply online. When she sees the policy she wants, she starts the application process. The website prompts her to download several PDF files and fill out a long, text-heavy application. As she previews the application form, she sees that it asks for the same information repeatedly. What’s more, she finds out she has to wait several days to get her quote and probably has to work with an agent over the phone. At this point, Anna gives up. Who has time for all these manual tasks and phone calls?

At Cumulus, profits are down and employee dissatisfaction is high. The old-fashioned quoting system turns new customers away. Cumulus employees are frustrated with the inefficient business processes and feel defeated when they can’t help their customers.

You might remember Justus Pardo? He’s a highly skilled solution architect and an expert on the Digital Insurance Platform.

Justus, whose reputation precedes him, has led several insurance companies through successful digital transformation projects. So it makes good sense that Cumulus have hired him as a consultant to help transform their complicated and inefficient quoting process.

Justus knows how frustrating the quoting process is for customers like Anna. Unfortunately, she’s not the only one let down by Cumulus. Internal staff, including sales reps, customer service reps, and admins are pulling their hair out due to their disconnected tools and legacy systems.

The teams wrestle with several challenges.

- Disconnected lead platforms let valuable leads slip through the cracks.

- A legacy rating engine and multitude of spreadsheets, along with manual underwriting, make quoting inefficient.

- Offline payment and policy issuance eat up valuable time that sales teams could spend winning deals and building customer relationships.

- Siloed customer data in several legacy systems further hampers the quoting process.

Thankfully, as a consultant extraordinaire, Justus knows how to help. He’s seen the quoting solution in action and knows it works like magic. Let’s explore Quote, Rate, and Apply to see how it turns the quoting process at Cumulus into a delightful experience for insurance shoppers and Cumulus staff.

The Quote, Rate, and Apply Solution

Quote, Rate, and Apply enables carriers to rapidly deploy digital quote-to-bind processes and dynamic digital experiences for external users, including customers and brokers, and for internal users, like underwriters and sales agents. Unlike traditional policy-focused core systems, digital quoting with Quote, Rate, and Apply is tightly integrated with market-leading Salesforce capabilities. The solution delivers automated quoting experiences as part of a cohesive customer-centric experience.

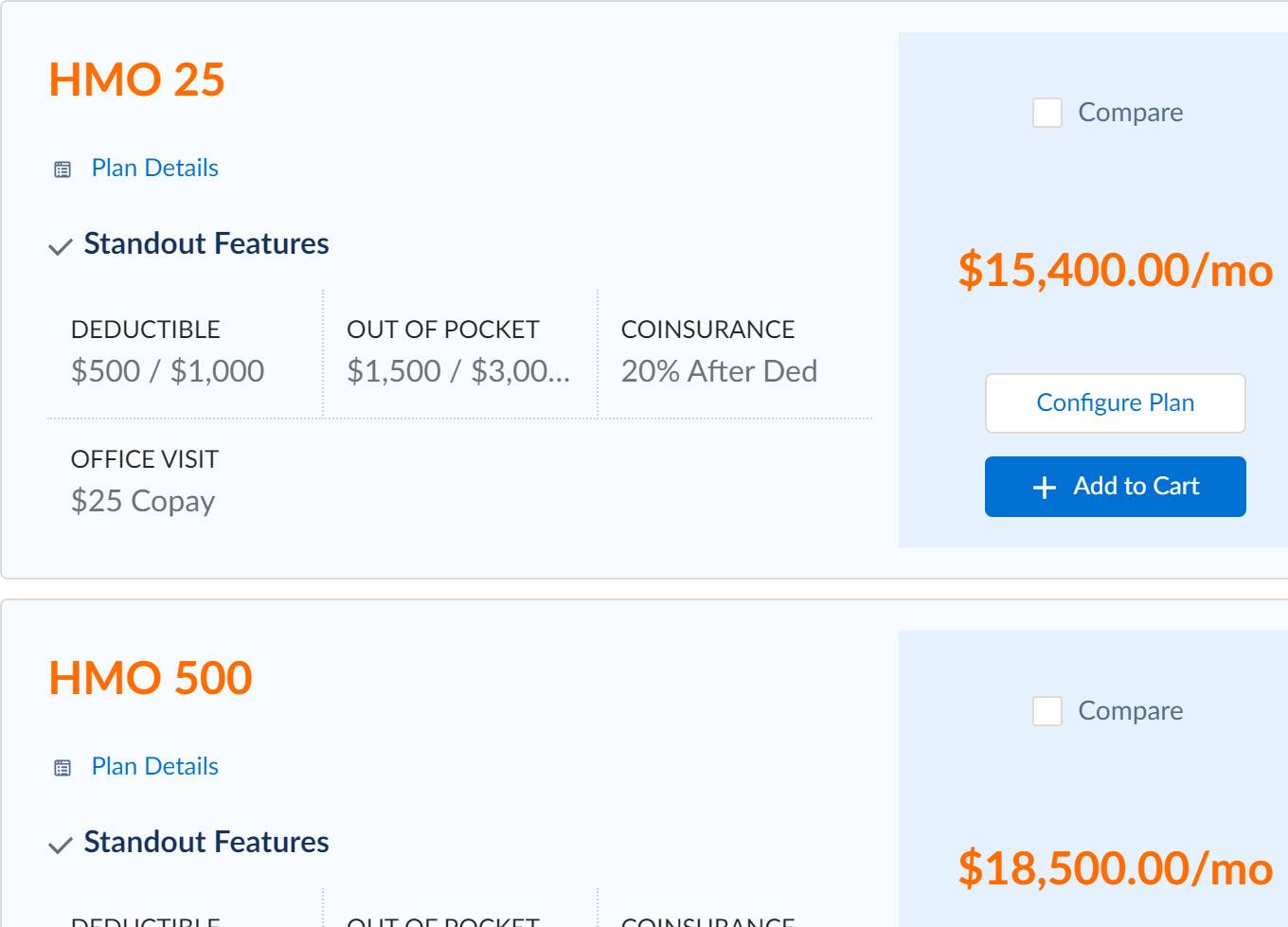

This screen capture shows a generated quote for a customer like Cloud Kicks, Anna’s employer, which is shopping for group health insurance for its employees.

Cloud Kicks can choose from a few types of group health insurance. It can then configure options for items like deductible, out-of-pocket expenses, and coinsurance, and add the product to cart.

Quote, Rate, and Apply has three main components that address key aspects of quoting.

- Product modeling

- Rating

- Quoting process

Product modeling and rating underpin the quoting process, but all three work together to form the end quoting solution. Let’s take a closer look.

Product Modeling

Product modeling is the process of designing and creating a visual representation of a product that an insurance company sells, like individual car insurance, a small group health plan, life insurance, a Medicare plan… you get the idea. In Anna’s case, the product she’s in the market for is an individual car insurance policy.

Product modeling is both an art and a science. When you design a product model, you need to consider lots of details, especially those that affect the price and options the user chooses during the quoting process. It’s important to get the product model right because the Digital Insurance Platform services use the model as a blueprint to create quotes and policies, and a whole lot more.

Rating

Rating is insurance-speak for setting a price. A rating is a risk-based calculation of a premium based on a set of input characteristics. It determines the cost a customer needs to pay for the insurance carrier to take on the risk of ensuring a customer. For Anna’s car insurance, the input characteristics are the type of car she wants to insure, her driving record, how many miles she drives annually, and her car’s safety features.

Quoting Process

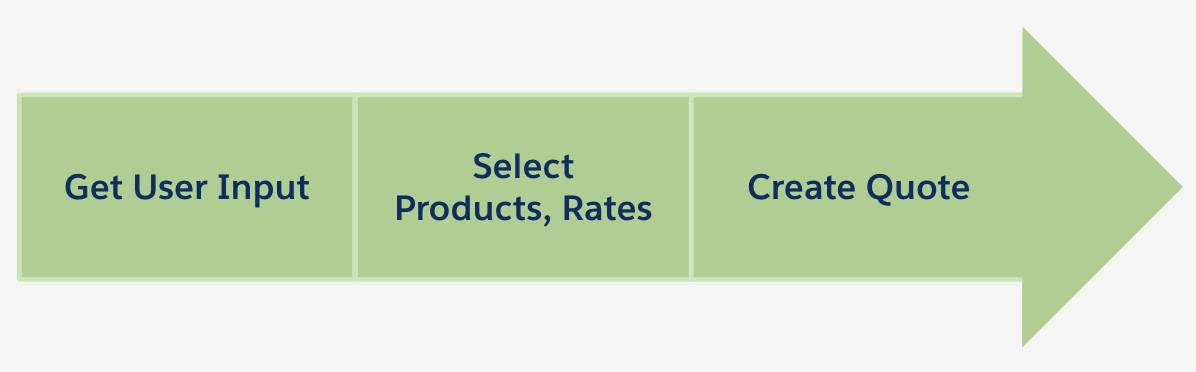

The purpose of the quoting process is to take customer details, identify best-fit insurance plans, and provide a price for the customer’s chosen plan. Here are the high-level steps in a standard quoting process:

Let’s look at each step in more detail.

-

Get user input: Customers provide information that the insurance company needs to determine which products are suitable to them and at what price. For example, customers provide their name, age, vehicle details, and driving history.

-

Select products, rates: The company determines products that the customer is eligible for along with the plan rates. The customer chooses the plan they like.

-

Create quote: Based on the customer details and chosen product, the insurance company calculates a price, which forms the basis of the quote.

Quote, Rate, and Apply streamlines the entire quoting process. Customers can shop for plans and create quotes online. Industry professionals, like sales reps, can configure quotes directly from a Salesforce record page using the out-of-the-box quoting Lightning web components or using an OmniScript. OmniScripts include business logic to guide users through information gathering, product selection, configuration, and ultimately quote creation. Pretty neat, right?

Solving Industry Challenges

Quote, Rate, and Apply addresses many challenges that insurance companies face when it comes to quoting. After implementation, businesses see impressive results like:

- Significant reduction in quote-to-application time

- Decreased quote-to-bind time

- Reduction in underwriting admin time

This table goes into more detail about how Quote, Rate, and Apply solves industry challenges.

Industry challenge |

How does Quote, Rate, and Apply solve the challenge? |

|---|---|

Single system of engagement |

Instead of using scattered and disconnected lead platforms, agents have a single system of engagement for insurance quoting. All customer information is in one place, and they can complete all their business processes and transactions without accessing another tool. |

Simple experiences with minimal typing |

Gone are the days of long, text-heavy applications. Quote, Rate, and Apply offers guided workflows that are easy to complete and don’t make customers repeat their details. |

Instant approval or referral to underwriting |

Instead of a lengthy approval process with legacy rating engine and manual underwriting process, Quote, Rate, and Apply speeds up the quote-to-bind process by offering instant rule-based approvals or underwriting referrals. |

Digital purchase and policy issue |

You can get almost anything online these days, and customers expect the same from insurance. With Quote, Rate, and Apply, customers can not only get the quote online, but they can also purchase the policy right away and have the policy issued digitally. |

Omnichannel access |

Customers want to get a quote online anytime and on a device of their choice. With OmniScripts that give customers a guided path for completing a business process, customers can conveniently do just that. |

The Bigger Picture

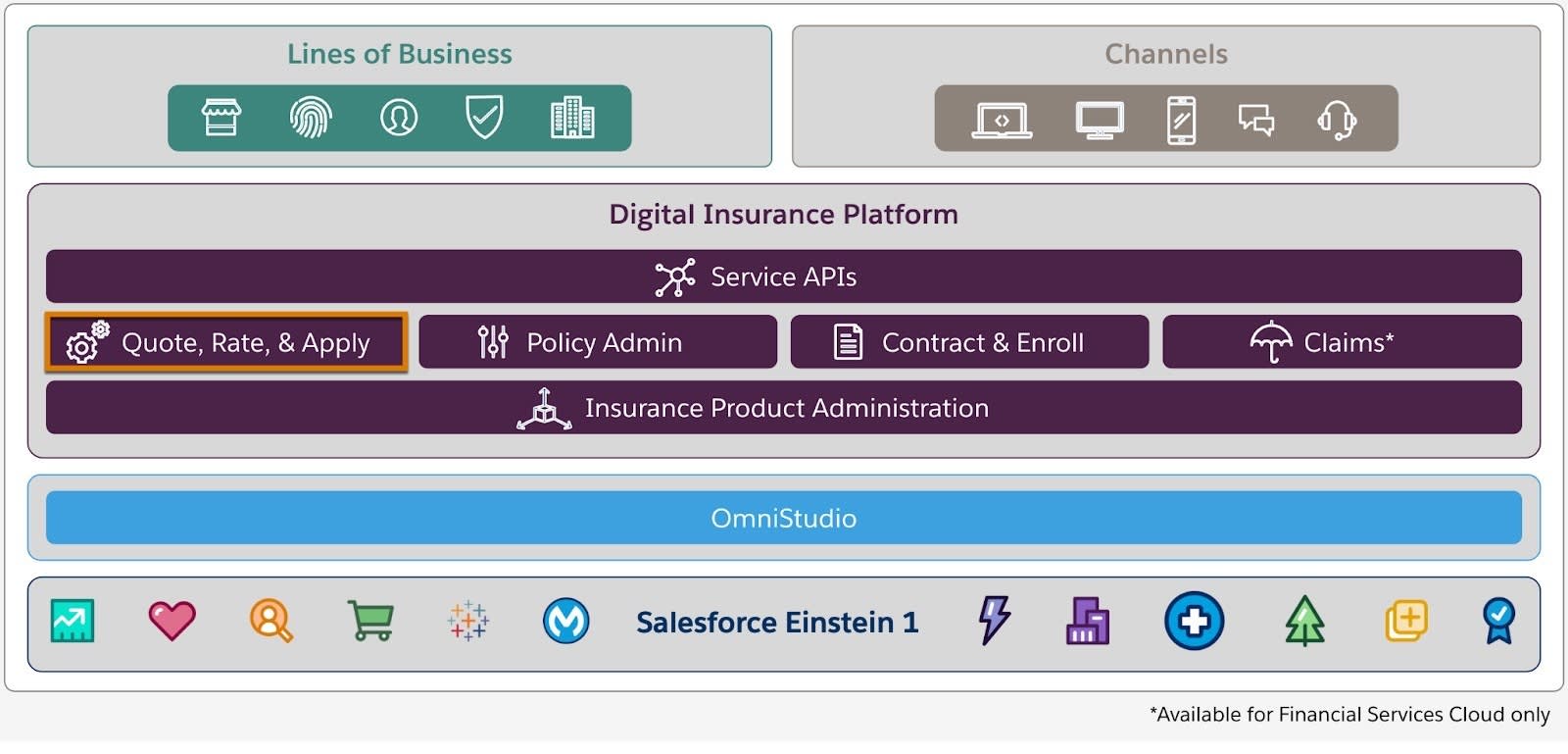

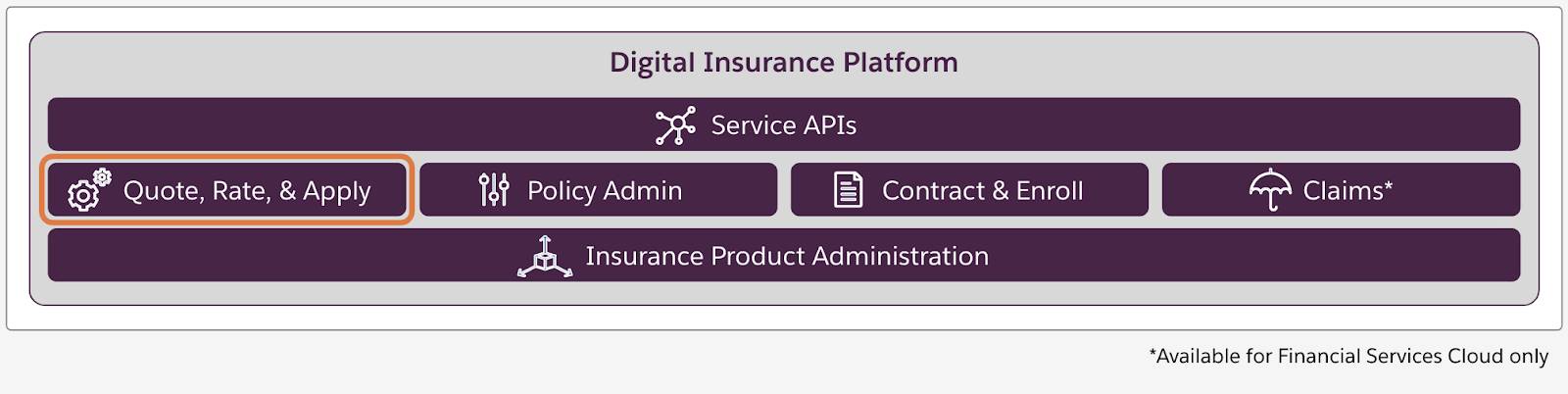

Quote, Rate, and Apply runs on top of Salesforce and uses all the Clouds and apps you know and love. Here’s the Digital Insurance Platform solution map, which shows how the pieces fit together.

The overall solution gives you several quoting capabilities.

-

Support for lines of business: Depending on your desired lines of business, the Digital Insurance Platform provides tailored processes and services to support auto insurance, property insurance, life and annuity, specialty lines, and more.

-

Delivery across multiple channels: Members want to use their laptop to get a quote? No problem. Use their mobile phone to track the status of the quote? Done. You want to set up a custom portal site for policyholders? Of course. They still want the option to call a contact center with questions? Sure, that too.

-

OmniStudio: OmniStudio provides tools such as OmniScripts for building and customizing self-guided experiences. Create top-notch experiences to walk users through the process of obtaining a quote and other key tasks they need to complete.

-

Salesforce: The full Salesforce gives you so many possibilities, helping you create a single view of your customer across market-leading applications in Sales, Service, Marketing, and Commerce.

Inside the Digital Insurance Platform

Now let’s focus on the role of Quote, Rate, and Apply alongside the other modules and services in the Digital Insurance Platform.

Quote, Rate, and Apply integrates seamlessly with the other parts of the Digital Insurance Platform, including:

-

Service APIs: The Service APIs eliminate the need for custom programming with a range of out-of-the-box services that carry out key insurance functions.

-

Policy Admin: The Policy Administration module manages the entire policy lifecycle, including quoting, issuance, endorsement, billing, renewals, and commissions.

-

Contract and Enroll: The Contract and Enroll module creates contracts with employers and enrolls participants in group benefit plans.

-

Claims: The Claims module enables rapid and transparent claims processing across the entire claims lifecycle.

-

Insurance Product Administration: The Insurance Product Administration module drives agile insurance product development, policy rating, and more.

Now you should have a clear idea of the main advantages of the Digital Insurance Platform for quoting. Next, let's get more insight into the key jobs to be done for quoting and who does them.

Resources

- Trailhead: Omniscripts in Omnistudio for Managed Packages

- Trailhead: OmniStudio Architecture

- Trailhead: Financial Services Cloud Basics

- Trailhead: Health Cloud for Payers