Calculate Quotes with Rating

Learning Objectives

After completing this unit, you’ll be able to:

- Describe the role of rating in insurance quoting.

- Explain the process of implementing rating.

- Describe how to plan and prepare rating information.

- Describe what decision matrices are and how rating uses them.

- List types of rating procedures.

About Rating

Quote, Rate, and Apply facilitates key aspects of quoting, including product modeling, rating, and quoting. A rating is a risk-based calculation of a premium based on a set of input characteristics. It determines the cost a customer needs to pay for the carrier to take on the risk of insuring the customer.

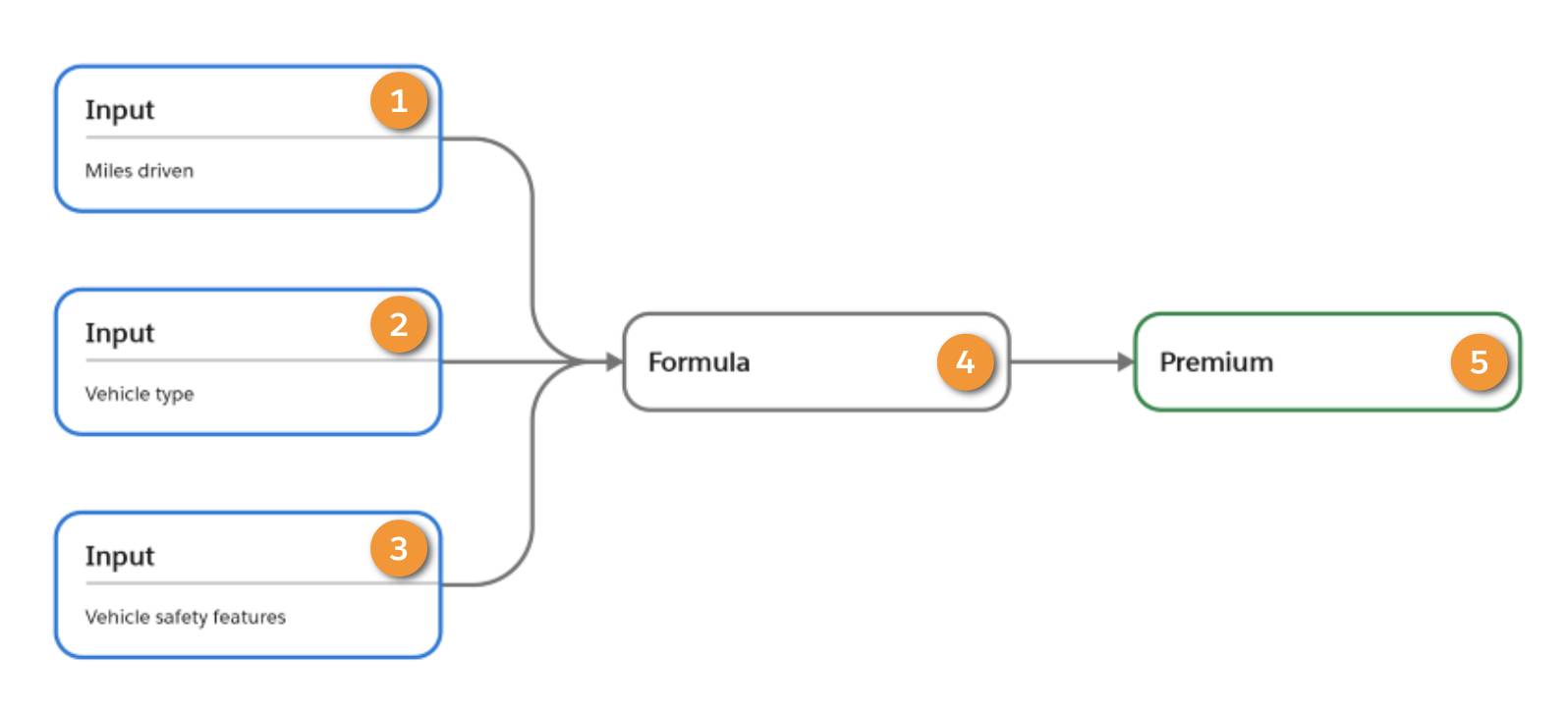

When establishing rates for policies, insurance companies determine the factors that influence pricing and the impact of those factors. Here’s what a calculation looks like.

The factors that influence pricing are captured as inputs. Customers like Anna Murphy, who are looking for car insurance quotes, need to provide information to the carrier, such as miles driven annually (1), the type of vehicle to insure (2), and safety features in the car (3). The insurance company plugs the inputs into a formula (4) along with other variables, and the output of the formula is the premium (5) the customer pays.

The Digital Insurance Platform uses rating procedures to perform these calculations. A rating procedure is a combination of an expression set and a decision matrix linked to a root product.

- A decision matrix is a table of information, such as base rates and coverage factors.

- An expression set is a calculation engine that chugs away to do all the math using an algorithm that you define. The expression set uses the data in the decision matrix to calculate and return a final price as output.

Process for Implementing Rating

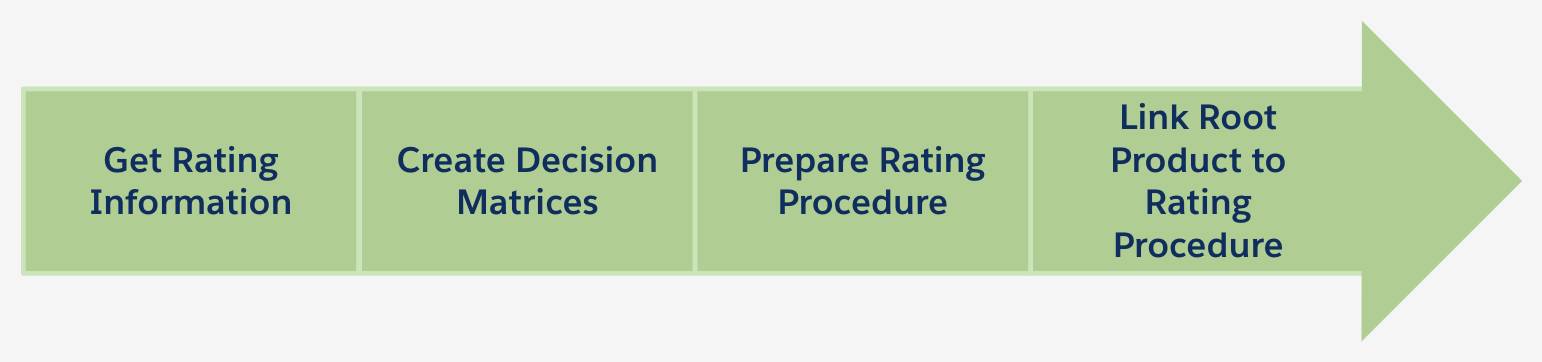

When you’re ready to implement rating, you need to configure the rating information in Salesforce. This diagram shows the high-level rating process flow.

The process involves these key steps.

- Get rating information.

- Create decision matrices.

- Prepare the rating procedure.

- Link the root product to the rating procedure.

Let’s look at the steps in more detail.

Rating Information

To implement a rating, you first need to determine the rate for your insurance products. You need details about the rating algorithm, whatever its form, to prepare the algorithm for Salesforce.

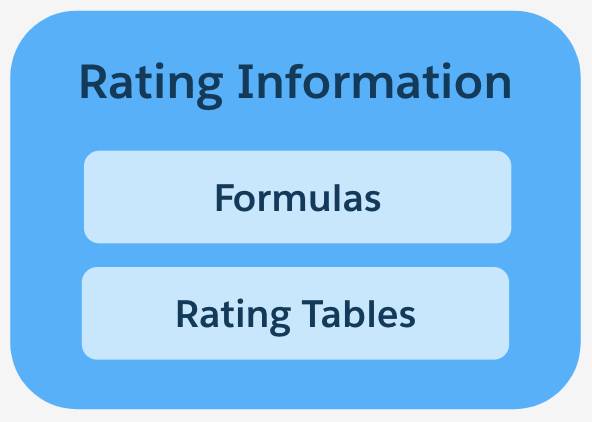

While there’s no uniform standard for external rating information, two common components are required: formulas and rating tables.

Formula

A formula is a mathematical expression with constants and variables. Here’s an example of a simple, generic rating formula. The final premium is the result of a series of calculations.

The calculation starts with a base rate. The base rate, or basic rate, is the cost of coverage before any adjustments. Multiply the base rate by the coverage factor. The coverage factor is the amount of liability that the insurance policy covers, and you usually define it by its limits and deductibles. When Anna shops for her car insurance, she chooses a combination of limits and deductibles for various coverages. This creates her unique coverage factor. When you multiply base rate by coverage factor, you get the base premium.

Not every customer pays the same premium for the same coverage. The amount they pay depends on how risky they are in the eyes of the insurance company. For example, Anna is a responsible driver, doesn’t have a long history of car accidents, and has several safety features on her car. It’s not very risky for Cumulus to insure Anna, because she’s not likely to get into a car accident. Because she’s not risky to insure, her insurance premium is lower than the premium of someone with many accidents.

How does an insurance company calculate the premium for each customer? They multiply the base premium by any number of rating factors to produce the adjusted premium. A rating risk factor is a percentage adjustment to the base premium based on the defined risk level of a rating input. Typically, risk factors involve characteristics of the insured party or item. The riskier a characteristic is, the higher the rating factor, and the higher the adjusted premium.

Although more complex rating often involves far more calculations, this example illustrates the purpose of most rating formulas.

Rating Table

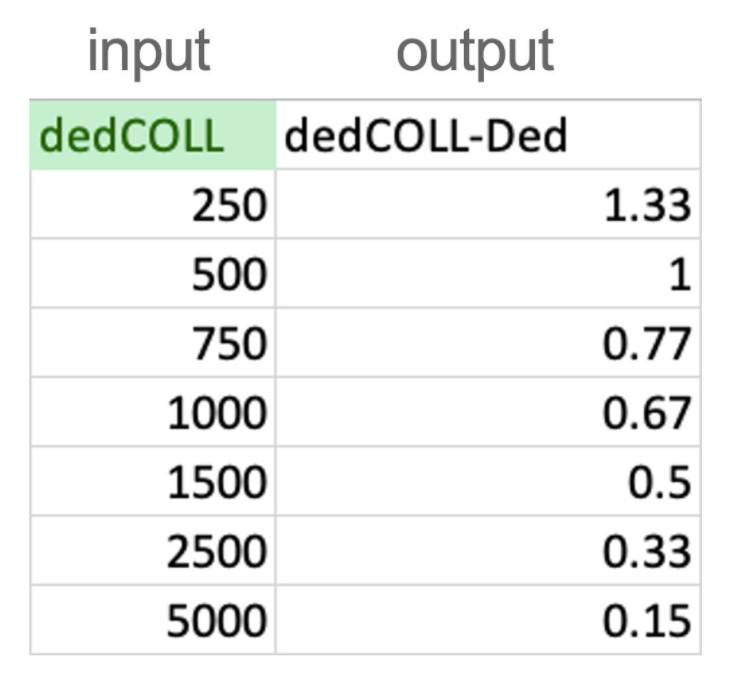

You’ve defined all your formulas, which use several inputs to create a final, adjusted premium. These inputs come from rating tables. A rating table contains data organized into columns and rows. Each table contains one or more input columns and one or more output columns.

Use rating tables to look up data, such as factors that impact premiums. Generally, the input columns contain some coverage or risk factor, and the output columns contain corresponding rates. The outputs from a rating table serve as inputs to a calculation.

Here’s an example of a rating table that Cumulus uses for auto insurance.

The input is the deductible amount for collision coverage, and the output is the deductible factor. As the deductible amount increases, the deductible factor decreases. The deductible factor is input to a formula that calculates the premium a customer pays.

Decision Matrix

A decision matrix is a rating table that you configure in Salesforce. Once you prepare your rating information, which is your formulas and rating tables, the next step is to import the rating tables into Salesforce.

You import the rating tables into decision matrices. Once the many rows of rating data are organized neatly into a decision matrix, rating procedures can use the matrices to calculate premiums.

Let's move on.

Rating Procedure

You’ve gathered rating information and imported the rating tables into decision matrices. Now it’s time to build a rating procedure. A rating procedure is either an expression set or an Integration Procedure that returns one or more premiums based on inputs. Let’s look at these two options.

Expression Set

An expression set is a type of rating procedure with a series of elements.

These elements are constants and variables, lookup steps to access decision matrices, and... drumroll... formulas that you gathered as part of rating information in the very beginning. An expression set may include aggregation steps that allow it to aggregate multiple input sets.

Integration Procedure

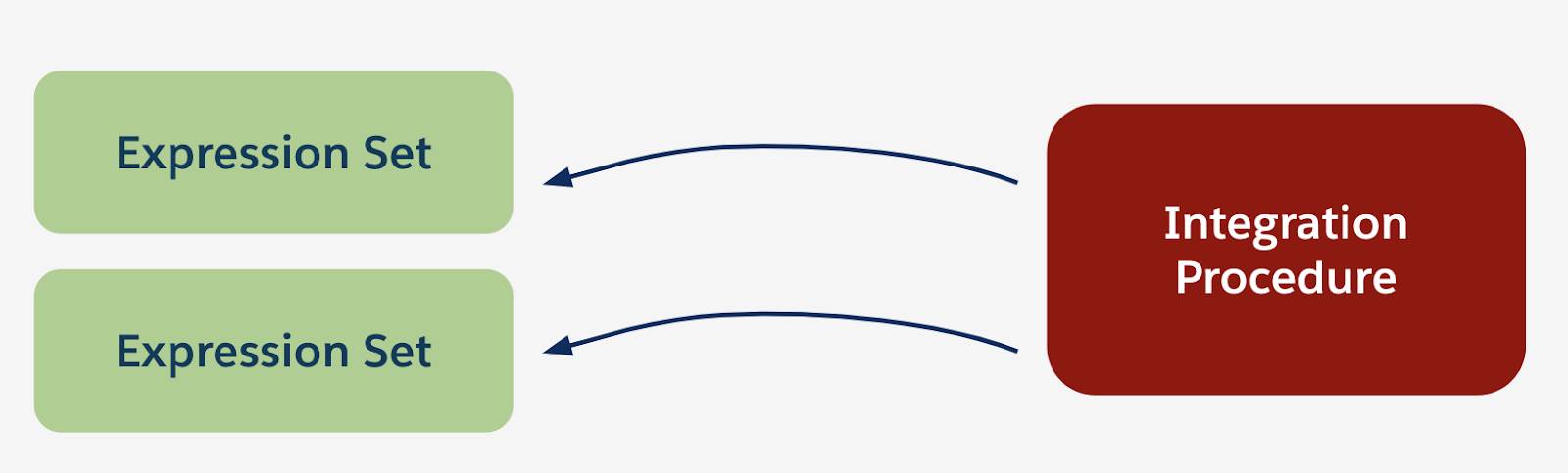

An Integration Procedure is another powerful, flexible tool that supports more complex rating scenarios. Use Integration Procedures to knit together multiple expression sets.

You may want to use an Integration Procedure for a few reasons. For example, you might need to call a rating system in an external system. The most common situation is when you need to use an aggregation output of one expression set as an input in another calculation.

Here is an example: Imagine you have multiple characteristics, like age, gender, and tobacco use. You want to rate these characteristics separately, and then average or sum them together in an aggregation step to get a single rating number. This is a good time to use an Integration Procedure.

Rating Procedure and Root Product

After successfully creating and enabling a rating procedure, it’s time to associate the procedure to any root products that need to use it.

If you use only one expression set for a rating, link it directly to the root products. If you use multiple expression sets, combine them with an Integration Procedure. Then link the Integration Procedure to the root product.

Resources

Trailhead: Integration Procedures in Omnistudio for Managed Packages