Say Hello to Insurance Claims

Learning Objectives

After completing this unit, you’ll be able to:

- Identify the parts of an insurance claim.

- Explain the relationship between claim, claim item, claim participant, and product spec objects.

- Describe the claim coverage object and its relationship to insurance policy coverage.

- Describe the claims financial objects for payments and reserves.

- Explain the relationship between insurance policy term objects.

Bump, Dent, Scratch

Remember Anna? She was recently in a car accident, and her Audi needs to be towed. Esperanza was biking to work when she saw the accident happen.

Anna calls up Cumulus Insurance and is directed to Zaw, Cumulus’s go-getter customer service agent. Zaw is happy to help Anna raise a claim.

The Claims Management data model allows you to manage claims by tracking data for policies, claims, and claim coverages. Let’s work through the data model as Anna enters all relevant details of the incident.

Claims Management with the Insurance Data Model

As Zaw initiates the new claim request, the platform works behind the scenes to create a number of claim-specific objects. When Zaw begins a claim request, the platform creates a Claim record. This object stores claim-attribute data such as the claim number, report date, claim type, and status.

Next, Anna logs in to her Cumulus account to enter the remaining details about her involved car, the sedan (Claim Item), and the claim participants. She adds herself, the involved driver and claimant, and Nigel and Esperanza, witnesses to the claim.

You may remember Phil Segad, a claims adjustor at Cumulus, who you meet in the Claims Foundations module. Phil jumps back into his claims adjuster console. He notices that Anna has collision coverage included in her policy and links it to the claim by creating a claim coverage record for that policy coverage.

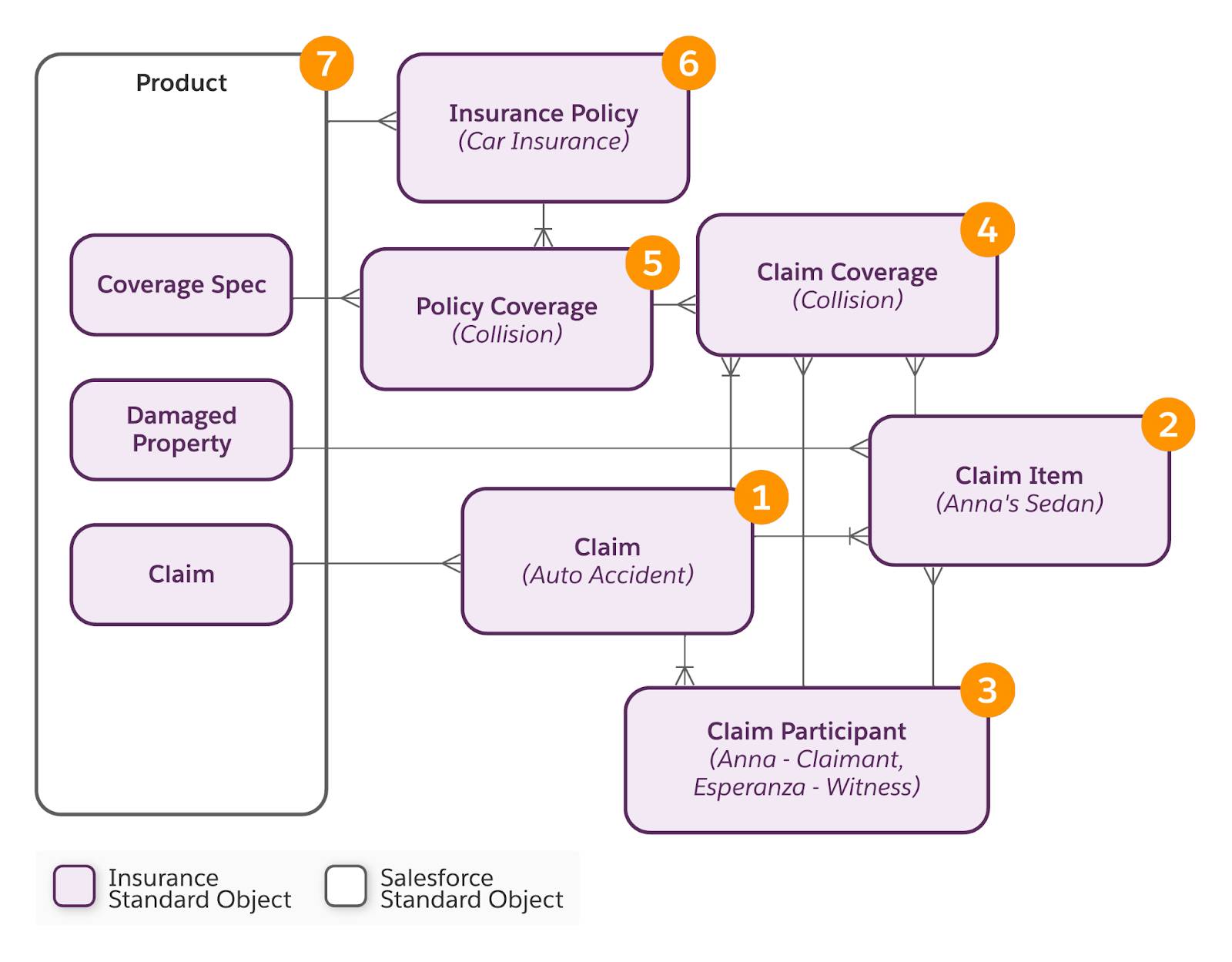

Here’s a simplified diagram of Anna's insurance policy and its relationship to the claim.

This table describes the initial claim objects and their relationship to the key insurance policy objects, policy coverage, and insured item specs.

Object |

Description |

|---|---|

Claim |

Filing a claim creates a Claim object (1) using the claim product spec records as its definition. The claim uses the policy to identify available coverages and insured items. The Claim object stores all of the information about this claim and its related objects. The Claim Coverage, Claim Item, and Claim Participant objects have user-key relationships with the Claim. |

Claim Item |

Anna’s involved sedan is a Claim Item object (2). This object stores information about the car and its damage. The Claim Item definition comes from the damaged property product spec records. If Anna is injured in an accident, her injuries are represented by a claim item record and defined by an injured person product record. |

Claim Participant |

Anna, Nigel, and Esperanza each have a Claim Participant record (3), each with a different role specified. Claim participants link back to Account, Contact, and Insurance Policy Participant for the common definition of the person. This definition includes details like their name, address, and phone number. |

Claim Coverage |

You can open multiple Claim Coverages on a single claim. When Phil opens Claim Coverage for Collision, the Claim Coverage links back to the Insurance Policy Coverage. The Insurance Policy Coverage contains the policy terms, such as limits and deductibles, which the Claim Coverage enforces on the Claim. Anna’s accident only opens Collision Claim Coverage (4) because there were no bodily injury or property damage reports, only damage to her sedan. |

Policy Coverage |

Anna’s car insurance policy includes Comprehensive, Collision, Bodily Injury, and Property Damage coverages. Policy Coverage records (5) store this information. Policy Coverages use product coverage specs as their definition. |

Insurance Policy |

Think of the Insurance Policy (6) as the root object in the insurance data model. Everything else flows from here, including the claims- management objects. This root object is a specific configuration of the product model and is based on policyholder characteristics. For this example, we focus on Anna’s car insurance policy. |

Product |

The Product object (7) is a product model. In our case, it’s the blueprint of the Cumulus Insurance product. The Product object is made up of specification or spec records. This object has many subtypes. Each serves as a blueprint for objects in Anna’s data model.

|

Claim Coverage and the Claims Adjuster

Claim Coverage objects represent the specific claim coverages open on the claim. Typically, this is the stage when the Claims Adjuster begins to actively work with the claim. Phil opens coverages, adjusts reserve amounts, and adds expense and loss items to Anna’s claim model based on the information Zaw collected. Once Phil defines the appropriate reserve detail and adjustment on the claim coverage, and follows the required approval processes, the claim is ready for payment.

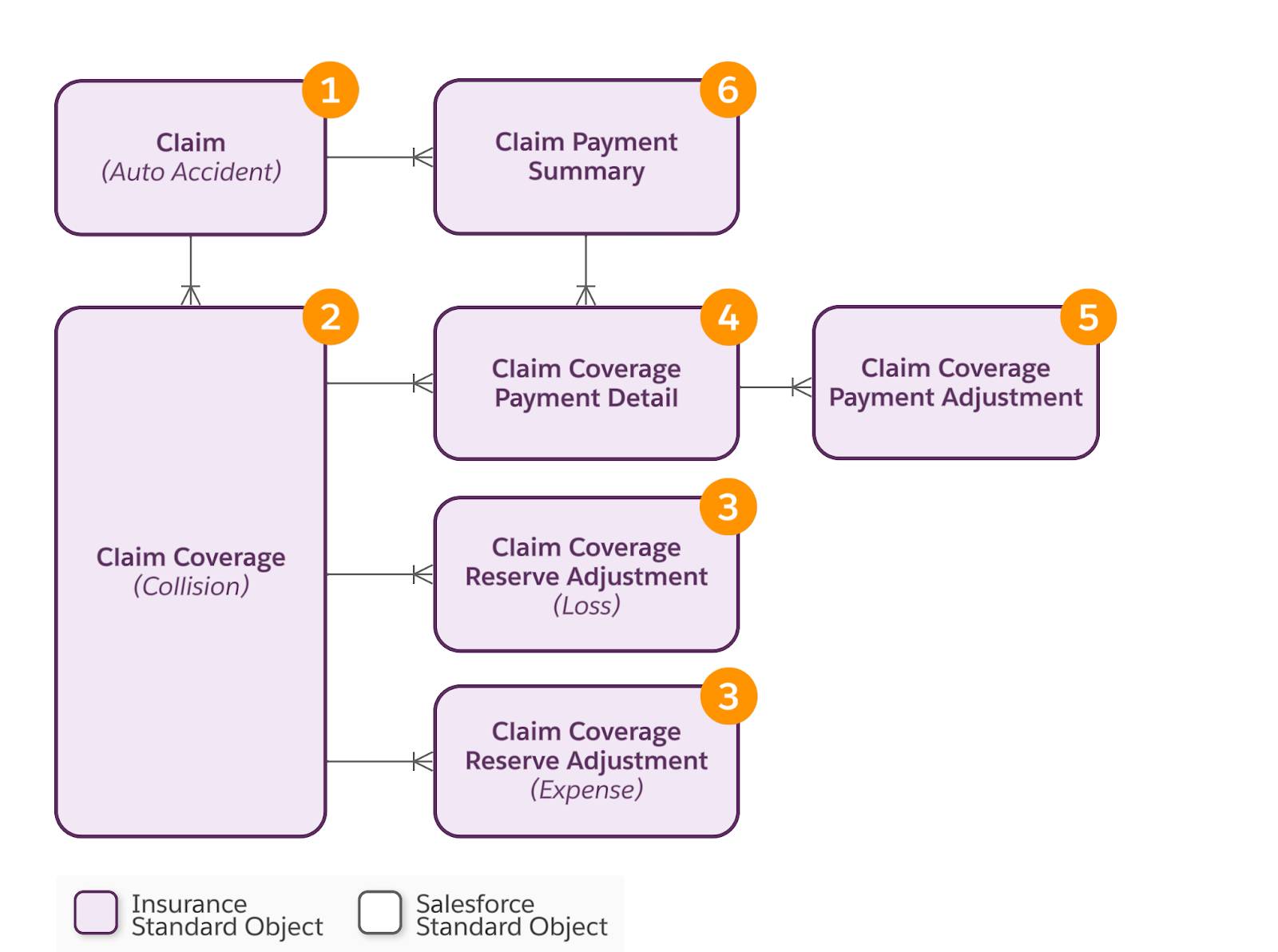

Here are the important notes about the claim coverage objects and their relationships.

Object |

Description |

|---|---|

Claim |

The Claim object (1) stores all the information about this claim and its related objects, including claim payment summaries. |

Claim Coverage |

Anna’s accident opens Collision Claim Coverage (2). The Claim Coverage object represents the financial obligations for the insurance carrier. Claim Coverage Payment Details and Claim Coverage Reserve Adjustments are created as part of the claim coverage lineage. |

Claim Coverage Reserve Adjustment |

Automatic creation of Claim Coverage Reserve Adjustments records (3) occurs when Phil sets or makes adjustments to the reserve, loss, or expense amounts for the collision claim coverage. |

Coverage Payment Detail |

When Phil creates a loss or expense item on a specific Claim Coverage, this creates a Claim Coverage Payment Detail record (4). This record contains the claimed and adjusted amount. lt also contains a status attribute. In Claim Coverage Payment Detail, you can add approval processes to define who has the authority to actually make a payment. |

Claim Coverage Payment Adjustment |

The Claim Coverage Payment Adjustment records (5) store any adjustments made to a claim coverage payment detail. In this case, a deductible needs to be paid before Anna receives payment on her collision coverage. |

Claim Payment Summary |

When a specific loss or expense item is paid, this creates a Claim Payment Summary record (6). Multiple Claim Coverage Payment Details can link to a single Claim Payment Summary. The Claim Payment Summary contains information, such as the total payment amount, payee, payment date, and identifier. The Claim Payment Summary links back to the claim itself. |

Insurance Policy Term Objects

Finally, as Cumulus Insurance makes payments to Anna’s claim, the policy record updates to reflect the coverage payments using policy term objects. Insurance Policy Terms are the terms and conditions that customers agree to when they buy an insurance policy. The terms typically apply to policy characteristics, like limits and deductibles. Upholding these terms and conditions is one of the primary functions of insurance claims management.

As payments are made against claim coverages, Policy Term objects reflect the utilization of the policy terms. In Anna's scenario, as Cumulus Insurance makes payments against Anna's collision coverage, a deductible is applied to the payment. The policy term tracking reflects when she meets the deductible.

Here are the important notes about the policy term objects and their relationships.

Object |

Description |

|---|---|

Insurance Policy Term |

Either the issuance of the policy or the initiation of a claim creates the Insurance Policy Term (1). It contains specific details about each policy attribute, such as its Class, Scope, and Initial Amount, which are critical for managing claims. Anna’s Collision Deductible has a scope of Claim Coverage (2) and a class of Deductible. |

Insurance Policy Term Tracking |

Financial activity for a particular claim coverage detail (3) creates Insurance Policy Term Tracking records (4). These records contain information about how much remains for this particular policy term after the claim financial activity. This keeps the policy up to date and correctly enforces terms on future claim payments. For Anna, the Deductible Insurance Policy Term Tracking record shows that her deductible was fully applied for that claim coverage, so if another payment is made, the deductible isn’t applied a second time. |

Whew! You’ve come a long way. Now you have a basic picture of the core objects and relationships involved in the claims management data model. Of course, this model can be much more complex, depending on the scenario. The policyholder could have multiple Insurance Policy Assets or insured parties on their policy, multiple coverages open on a single claim, or additional claim participants requiring payment.

This flexible data model fully supports these more complex claim scenarios. In the end, Anna is just happy her insurance paid out her claim without any complications, thanks to their effective data management. Hooray for Cumulus!

Resources

- Salesforce Developers: Claim Object

- Salesforce Developers: ClaimCase Object

- Salesforce Developers: ClaimItem Object

- Salesforce Developers: ClaimParticipant Object

- Trailhead: Claims Foundations module