Meet Claims Management

Learning Objectives

After completing this unit, you’ll be able to:

- Describe the lifecycle of a claim.

- Identify some challenges the insurance industry is facing with claims.

- Explain how Claims Management helps solve the business challenges.

- List some benefits of using Claims Management in your business.

- Explain how Claims Management fits in with the Digital Insurance Platform.

Before You Start

Before you start this module, consider completing this recommended content.

The Claims Lifecycle

New to insurance? Let’s review what a claim is and describe the key stages of the claim lifecycle.

An insurance claim is a request for payment made by a policyholder to their policy provider to cover a loss. While the concept is simple, a lot goes into an insurance claim. From filing the claim to making adjustments, approvals, and payments, many pieces need to come together seamlessly.

While different lines of business can have different claim processes, the lifecycle of most claims has six stages.

This table introduces each stage.

Stage |

Description |

|---|---|

First notice of loss (FNOL) |

Report details about the loss, theft, or damage of an insured item or injury to an insured party. |

Segmentation and assignment |

Determine the claim characteristics; segment the claim based on the characteristics; and assign the claim to the appropriate handling resource. |

Workload management |

Break the claim into different tasks and then prioritize, monitor, and resolve them. |

Investigation and documentation |

Investigate the claim and determine the amount of loss or damages covered by the policy. |

Financials and adjudication |

Pay or deny claims after comparing the specifics of the claim to the benefit or coverage requirements of the policy. |

Closure |

Settle the claim. Insurers generally track the time to closure on a claim carefully as a key performance metric. |

Ultimately, a claims-management system manages all aspects of a claim and provides workflows and other tools that store all claim details in a centralized system. Some claims-management systems work as standalone solutions, while others integrate completely into a broader suite of insurance solutions.

Let’s look at some major challenges associated with claims-management systems. Then, we explore how the Salesforce Claims Management module gives insurance companies powerful solutions for the entire claims lifecycle.

Challenges in Claims Management

You may remember Anna Murphy, a professional in her 40s who works as a data scientist at Cloud Kicks.

Anna is a long-standing customer of Cumulus Insurance, a large, well-diversified provider of insurance services nationwide. Anna currently has auto, homeowners, and health-insurance policies with Cumulus. So far, Anna's impressed with the digital customer services of Cumulus. She quickly and easily shopped for her auto and homeowners policies through the Cumulus website, completing application and enrollment online. Plus, whenever she wants to view or update her policy details, she can self-serve using her digital customer portal.

Recently, Anna got into an accident that caused some damage to her insured car. Expecting the claims process to go smoothly, she’s disappointed to find the Cumulus claim-submission process time-consuming and frustrating.

From the outset, it’s no picnic.

Anna visits the Cumulus website to submit her claim. She tries to complete the online form three times before it successfully submits. After each failed submission, she calls the contact center for help. Each time, a different customer service rep asks her the same questions about her policy and the accident, so Anna has to keep repeating herself.

Once the claim is finally submitted, she needs to provide more information online and over the phone to the claims adjuster.

The adjudication process seems to last forever, and even after the eventual settlement, she has to wait another 6 weeks to receive reimbursement by check in the mail.

As if the accident wasn’t bad enough, its aftermath is all the more unpleasant thanks to this seemingly endless claims process.

The claims adjuster, Phil Sagad, is also frustrated by the old-fashioned system.

Phil knows he could be much more efficient in investigating and adjudicating claims, if only the claims system integrated with the policy administration system. Every day, he does so many repetitive tasks that he knows should be automated.

Eventually, Phil reaches out to Justus Pardo, an expert consultant hired by Cumulus, and articulates the current problems with the legacy claims system. After feeling Phil’s pain, Justus identifies the following challenges at each stage of the claims process.

Stage |

Challenges |

|---|---|

First notice of loss (FNOL) |

Overreliance on outdated, manual modes of collecting claims information. The customer service platform is disconnected from the claims platform. This disconnection makes it time-consuming to access and update customer data because Cumulus staff need to update the information in two places. |

Segmentation and assignment |

Manual processes lead to slow and suboptimal assignment outcomes. The claims manager, in charge of overseeing the whole claims department, spends too much time managing assignments. Claims adjusters, responsible for evaluating claims, spend too much energy on rote tasks better handled by automated processes or clerical resources. |

Workload management |

Claims adjusters and supervisors rely on ad-hoc, disconnected processes to manage their workload. There’s no integrated channel to gain a full picture of a claimant’s history and data, no integrated dashboard to view key metrics across different segments, and no automated process to identify and resolve the appropriate tasks for a specific claim. |

Investigation and documentation |

The claims department must manually research the claim and coordinate between different parties. Investigation requiring field service is entirely disconnected from the customer-resource-management system and requires a ton of extra work to integrate with the claim. |

Financials and adjudication |

Claims adjusters must review policy terms and requirements to calculate the appropriate reserves and adjustments, another manual and complex job prone to human error. |

Closure |

Resolving and paying the claim is a cumbersome and slow process as claims adjusters must manually update various policy, account, and billing records. |

Faced with all these glaring issues, Justus decides to act and implement a full claims-management solution with the Digital Insurance Platform.

The Claims Management Solution

With Claims Management for Insurance, companies can design modern, efficient, satisfying experiences for all parties involved in the claims process.

-

Modern and OmniChannel: Unlike legacy claims systems, Claims Management provides a fully digital guided omnichannel experience across web, mobile, contact center, and chat. It’s all managed with little or no code.

-

Straight-Through Processing: Claims Management empowers insurers to reduce manual interventions by automating high-frequency processes at each stage of the claims lifecycle.

-

Integrated Data, Customer Centricity: At every step, Claims Management puts the customer front and center. With seamlessly integrated customer data, companies can create truly smart, efficient processes. The solution gives accurate real-time data and an intelligent foundation for engaging digitally with customers.

Claims Management for Insurance helps insurers like Cumulus improve their key performance indicators and see results like:

- Faster claims settlement cycle time

- Higher claims processed per claims employee

- Lower cost per claim

- Lower claim error rate

Now that you have a better idea of the challenges facing insurers and how Claims Management for Insurance can solve them, let’s see how the Claims Management module fits into Salesforce and the Digital Insurance Platform.

The Bigger Picture

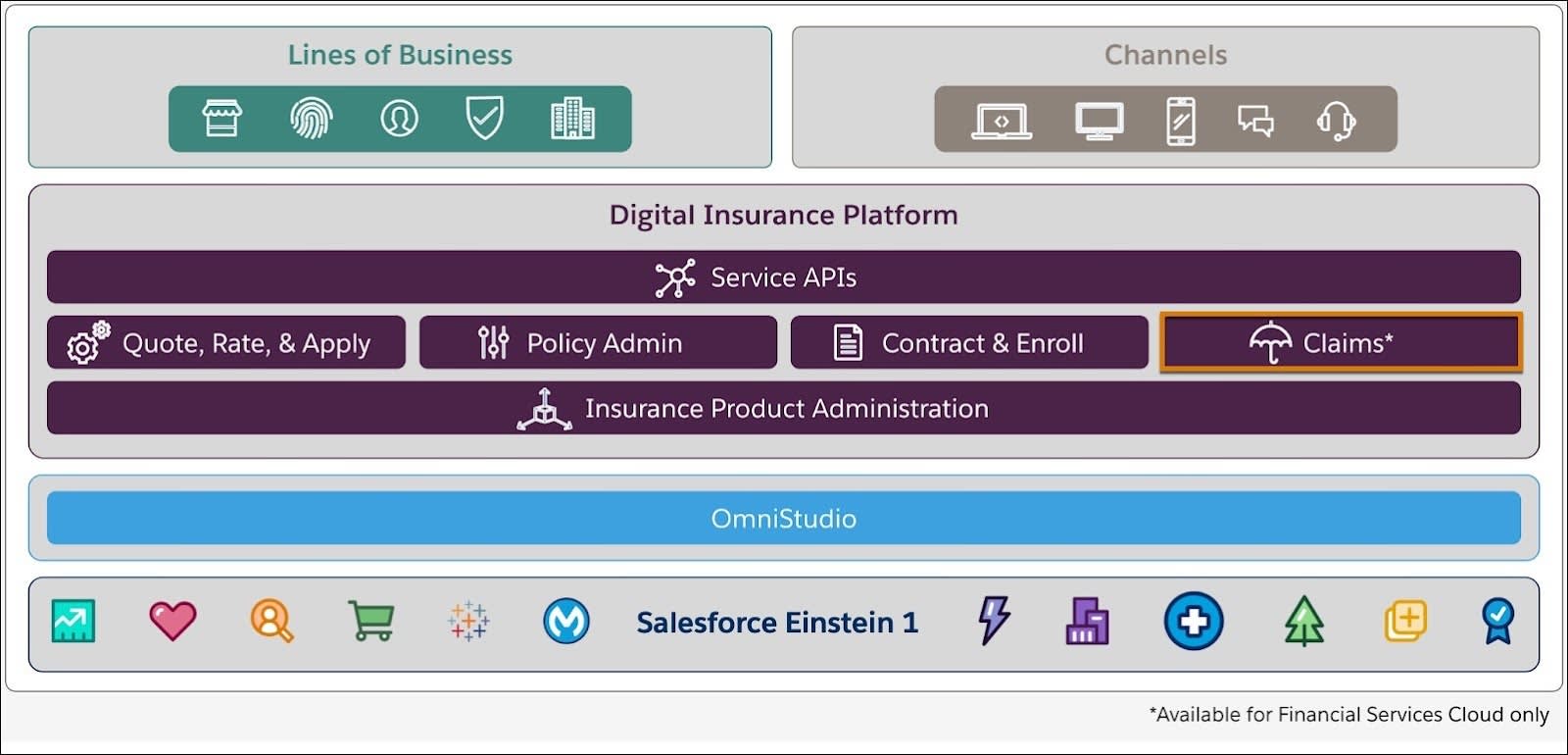

Claims Management runs on top of Salesforce and uses all the Clouds and apps you know and love. Here’s the Digital Insurance Platform solution map, which shows how the pieces fit together.

The overall solution gives you several claims-management capabilities:

-

Support for lines of business: Depending on your desired lines of business, the Digital Insurance Platform provides tailored processes and services to support auto insurance, property insurance, life and annuity, specialty lines, and more.

-

Delivery across multiple channels: Members want to use their laptop to file the claim? No problem. Use their mobile phone to track the status of the claim? Done. You want to set up a custom portal site for policyholders? Of course. They still want the option to call a contact center with questions? Sure, that too.

-

Omnistudio: Omnistudio provides tools such as Omniscripts for building and customizing self-guided experiences. Create top-notch experiences to walk users through the first notice of loss and other key tasks they need to complete.

-

Salesforce: The full Salesforce gives you so many possibilities, helping you create a single view of your customer across market-leading applications in Sales, Service, Marketing, and Commerce.

Inside the Digital Insurance Platform

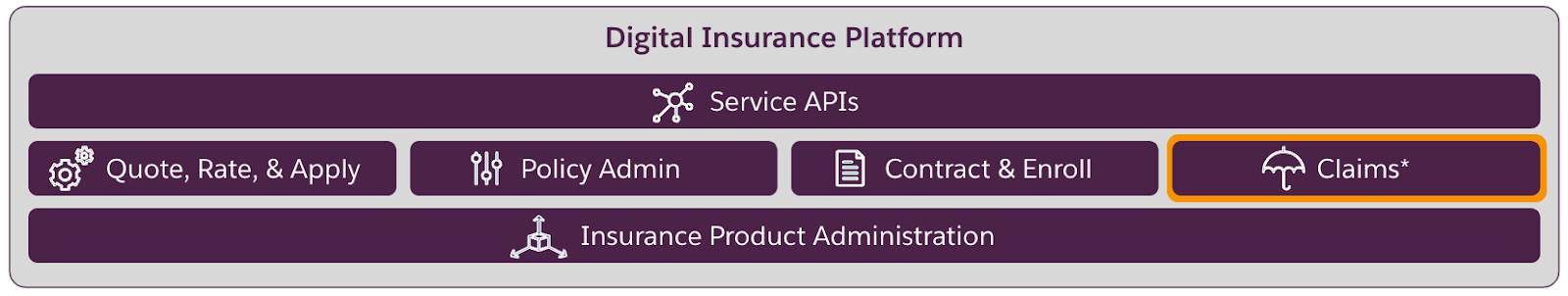

Now let’s focus on the role of Claims Management alongside the other modules and services in the Digital Insurance Platform.

Claims Management integrates seamlessly with the other parts of the Digital Insurance Platform, including:

-

Service APIs: The Service APIs eliminate the need for custom programming with a range of out-of-the-box services that carry out key insurance functions.

-

Quote, Rate, & Apply: The Quote, Rate, & Apply module enables digital quoting for policyholders, brokers, and underwriters.

-

Policy Admin: The Policy Administration module manages the entire policy lifecycle, including quoting, issuance, endorsement, billing, renewals, and commissions.

-

Contract and Enroll: The Contract and Enroll module creates contracts with employers and enrolls participants in group benefit plans.

-

Insurance Product Administration: The Insurance Product Administration module drives agile insurance product development, policy rating, and more.

The Claims Management module delivers the key capabilities required by any claims-management solution, but the other Digital Insurance Platform components also play a role in claims management.

- The Service APIs handle common claims-management tasks, such as creating a claim, opening claim coverages, and storing loss and expense payment details.

- Insurance Product Administration gives you claim product specs that form the basis for specific claims.

- The Policy Administration component fully integrates with Claims Management, with all the information about a specific policy–the coverages, terms, insured items, and insured parties–helping to define the claim.

Now you should have a clear idea of the main advantages of the Digital Insurance Platform for claims management. Next, let's get more insight into the key jobs to be done for claims and who does them.

Resources

- Trailhead: Omniscripts in Omnistudio for Managed Packages

- Trailhead: Digital Insurance Platform Foundations

- Trailhead: Financial Services Cloud Basics

- Trailhead: Insurance Quoting Foundations