Get to Know Claims Management

Learning Objectives

After completing this unit, you’ll be able to:

- Identify the people who use claims-management systems in the workplace.

- List jobs to be done at each stage of the claims lifecycle.

- Explain typical business processes and tasks supported by Claims Management for Insurance.

Working with Claims Management

Cumulus is ready to take the next step in their digital transformation journey and implement Claims Management for Insurance. The whole claims team at Cumulus is excited to see what it can do.

Justus Pardo, the super consultant spearheading the project, begins by identifying the main users of the claims system and how they use it.

Let’s dive in.

Key Players

Many people play a role in claims management. Their exact titles and roles can vary depending on the organization and line of business. At Cumulus, Justus identifies the following key groups:

- Claimants

- Claims adjusters

- Claims supervisors

- Product administrators

Let’s take a look at each group.

Claimant

A claimant is the individual who experiences the loss and reports a claim. A first-party claimant is a policyholder who suffers a loss, while a third-party claimant is a non-policyholder who also suffers a loss. Both claimant types need some way to file a claim, and today’s first-party claimants expect a comprehensive and integrated claim experience that’s tied to their policy.

During the claims process, claimants want to:

- Provide all the required information about a claim through a simple, guided user experience using their preferred channel. They want an experience tailored to their specific situation without any extra steps.

- Track the claim’s progress and easily upload any additional required information.

- Submit an appeal request for a claim payment if they disagree with the original claim determination.

Claims Adjuster

A claims adjuster assesses, adjusts, and processes claims made by claimants. They require a deep but intuitive adjuster desktop they can use to easily see the full scope of their claims, prioritize them, and act quickly. Claims adjusters don’t want repetitive work to bog them down, so they appreciate tools that can automate their common tasks.

Typically, claims adjusters work for the insurance company, but sometimes third-party adjusters play a role. Larger organizations often classify claims adjusters by their skills and areas of expertise. These larger teams need an automated process for assigning claims and obtaining the required approvals.

Claims Supervisor

A claims supervisor reviews and approves adjustments to claims. They must have a holistic, operational view of their team so they can tactically review and manage them throughout the day. Claims supervisors constantly try to reduce the burden on their team by optimizing and standardizing processes. This includes determining assignment rules, action plans, and approval processes. Supervisors need a deep, flexible claims platform with dashboards and reports they can use to efficiently monitor, analyze, and support their team.

In addition to the end users, multiple users design, configure, and maintain the claims solution. Let’s quickly take a look at these important players.

Product Administrator

A product administrator is responsible for modeling claims, which involves designing the claim product specs, terms, calculations, and rules. Often, the person or team responsible for claims modeling is also in charge of product modeling for the policy.

In Claims Management for Insurance, the data models for the claim and policy are closely linked, making it easy to define both at the same time. Product admins often work closely with claim supervisors and other key decision-makers to design and optimize the model to fit the needs of the organization. They also work closely with the developer to implement the claims model in Salesforce.

Omnistudio Developer

An Omnistudio developer configures the actual models, ratings, and workflows in Salesforce. They need to know how to configure Omniscripts to customize the first notice of loss, use Flow Builder to automate business processes, and create integration procedures to support rules and other key claims objectives. Omnistudio developers work closely with claims modelers and supervisors to ensure their vision is fully realized in Salesforce.

How Claims Management Supports Users

Let’s now explore how claims management supports claims users at each stage of the claims lifecycle.

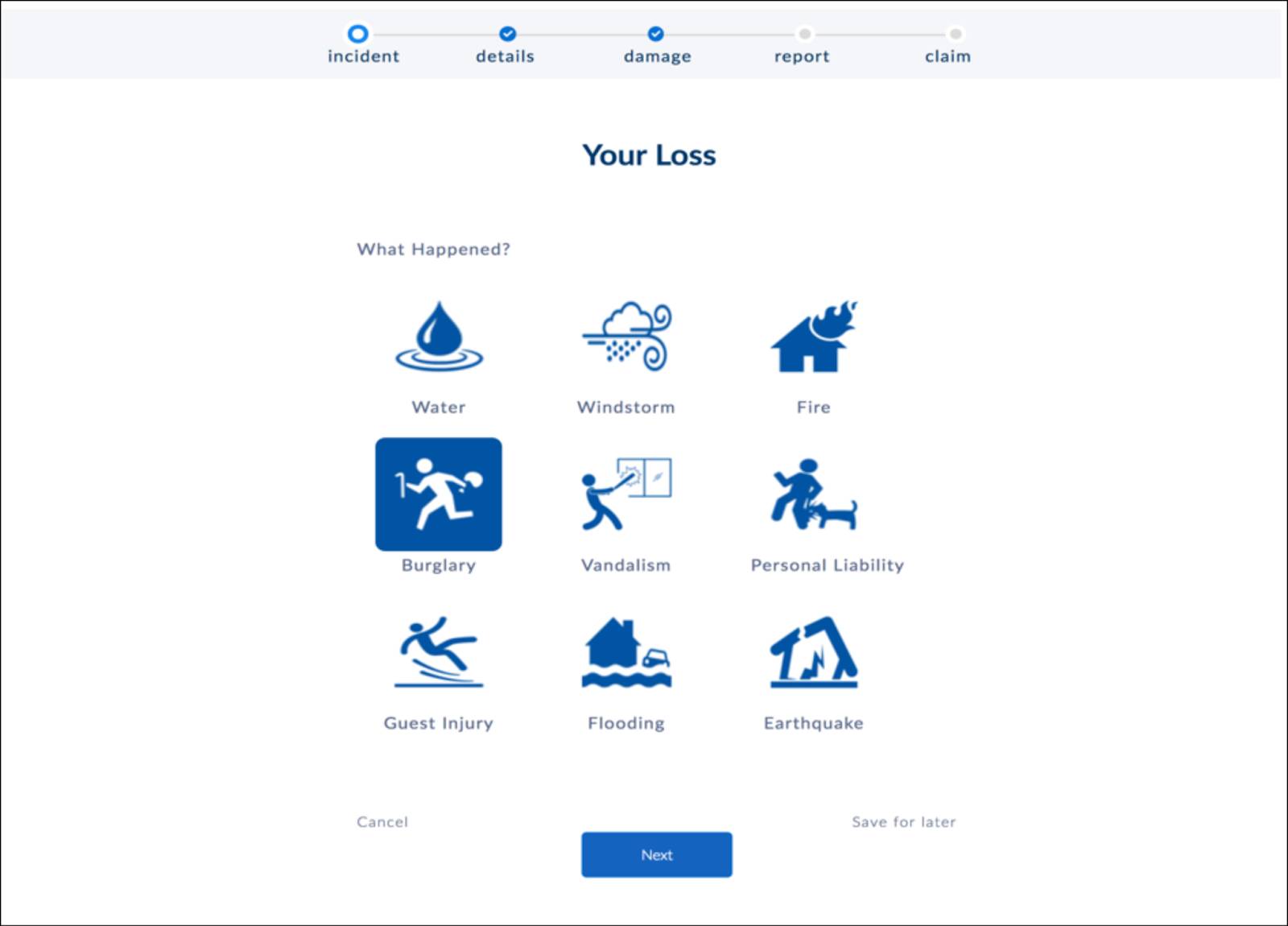

First Notice of Loss

To support the first notice of loss, Claims Management provides prebuilt, peril-based guided flows in the form of Omniscripts, which claimants use to quickly and easily create and update claims. They can even use their preferred channel, such as mobile or tablet device. Omnistudio developers can easily customize this flow to meet the insurer's exact needs.

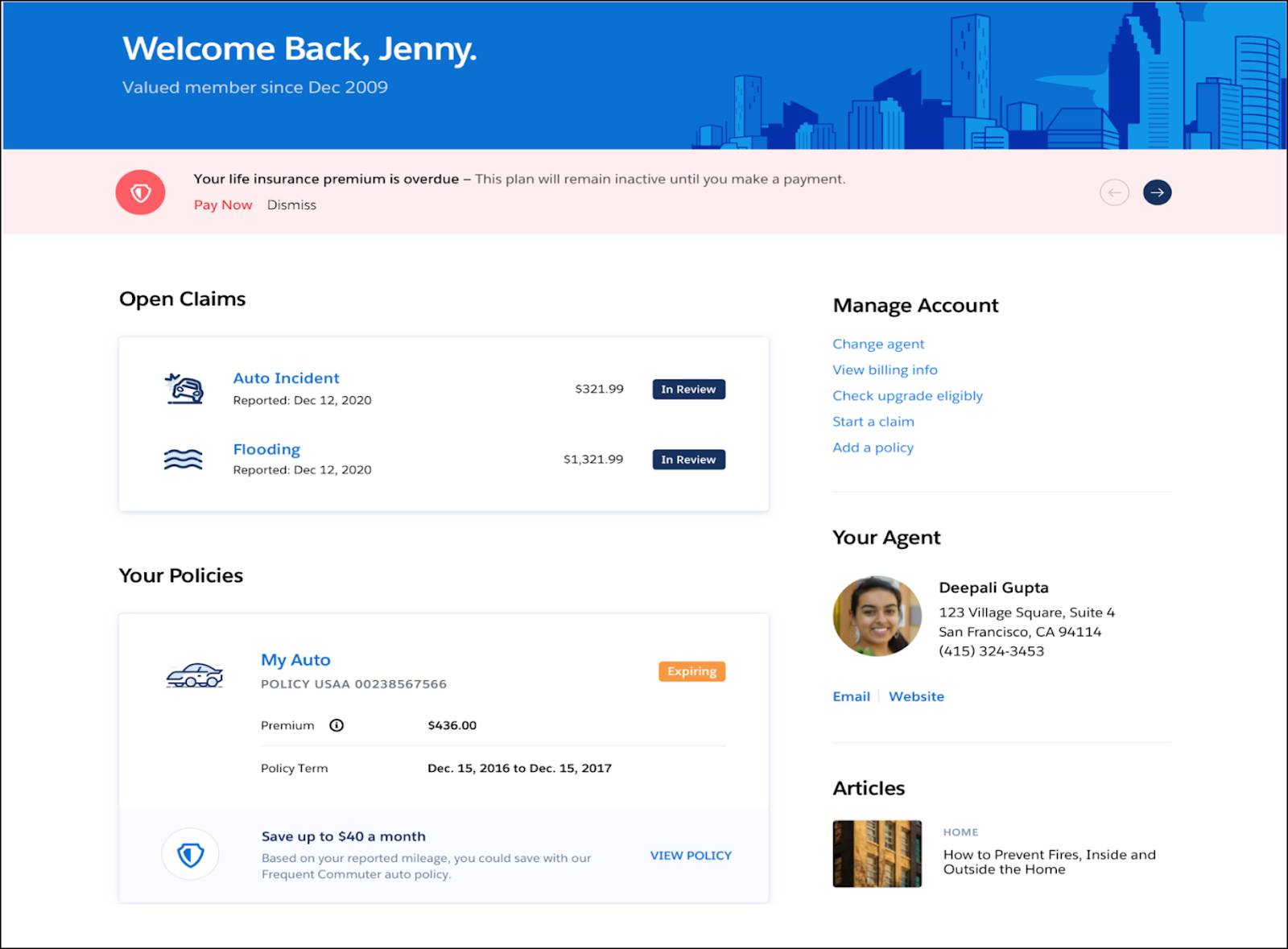

Additionally, the Digital Insurance Platform comes prepackaged with a portal that provides a comprehensive, integrated community experience for the policyholder. From the portal, they can instantly view a snapshot of all their open and closed claims. Policyholders can also start a claim and submit information and documentation.

Segmentation and Assignment

To support segmentation and assignment, Claims Management empowers product modelers to quickly create deep claim models, coverage models, and state models that are closely linked through a comprehensive claims-management data model. Within these models, the modeler defines characteristics and rules to automatically and intelligently segment and assign claims.

Using the sophisticated skills-based routing tools of Financial Service Cloud, claims supervisors ensure that each claim is assigned to the right resource based on the characteristics of the claim and its associated policy.

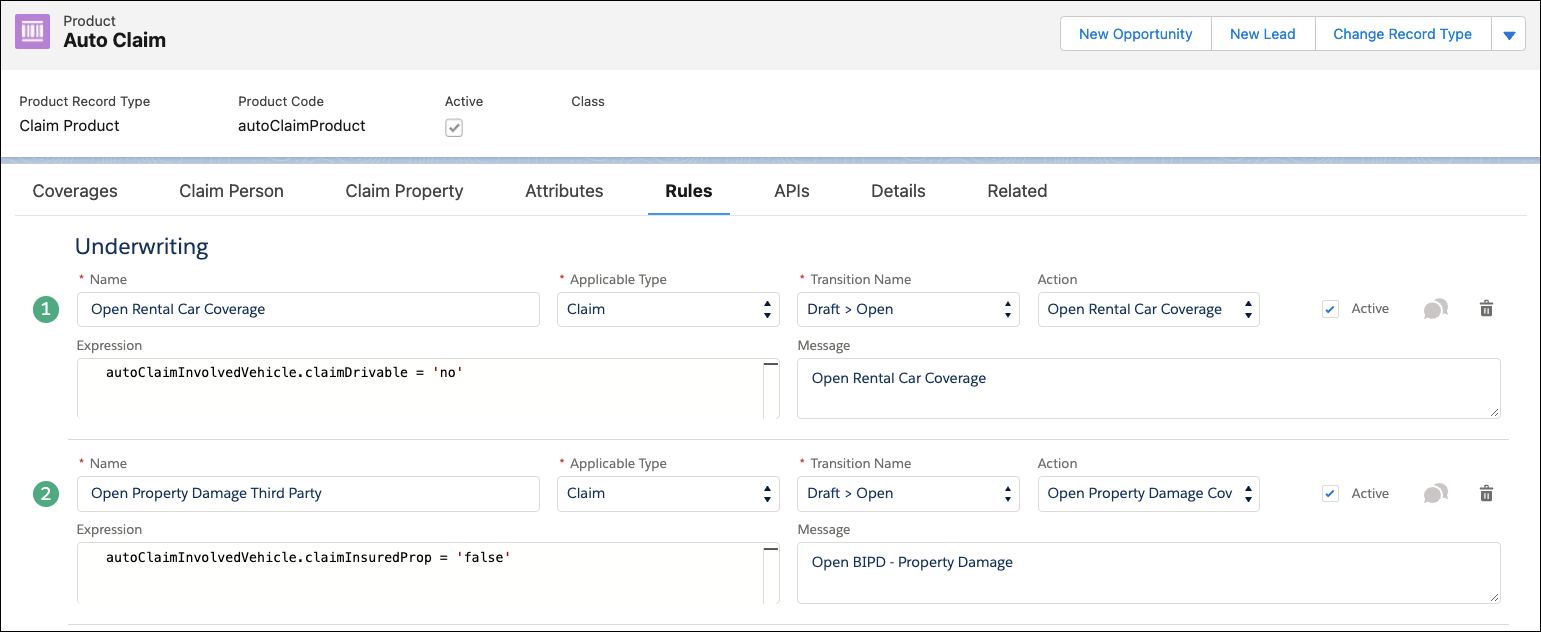

For simple claims that don’t need an adjuster, insurers can configure auto-adjudication rules to enable straight-through processing of the claim. Here’s a screen capture of two underwriting rules added to an auto claim product.

The screen shows the auto claim product with the Rules tab displayed. When added to claim products, underwriting rules define conditions for opening claim coverages. Claim coverages are the financial building blocks of a claim. All claim coverages open against a specific insurance policy coverage. To open a claim coverage, you need a corresponding coverage on the insured policy.

Workload Management

To support workload management, tasks and action plans allow claims teams to achieve operational consistency. Claims supervisors can design action plan templates for different claim types, ensuring there is a tailored plan in place for a variety of claim scenarios.

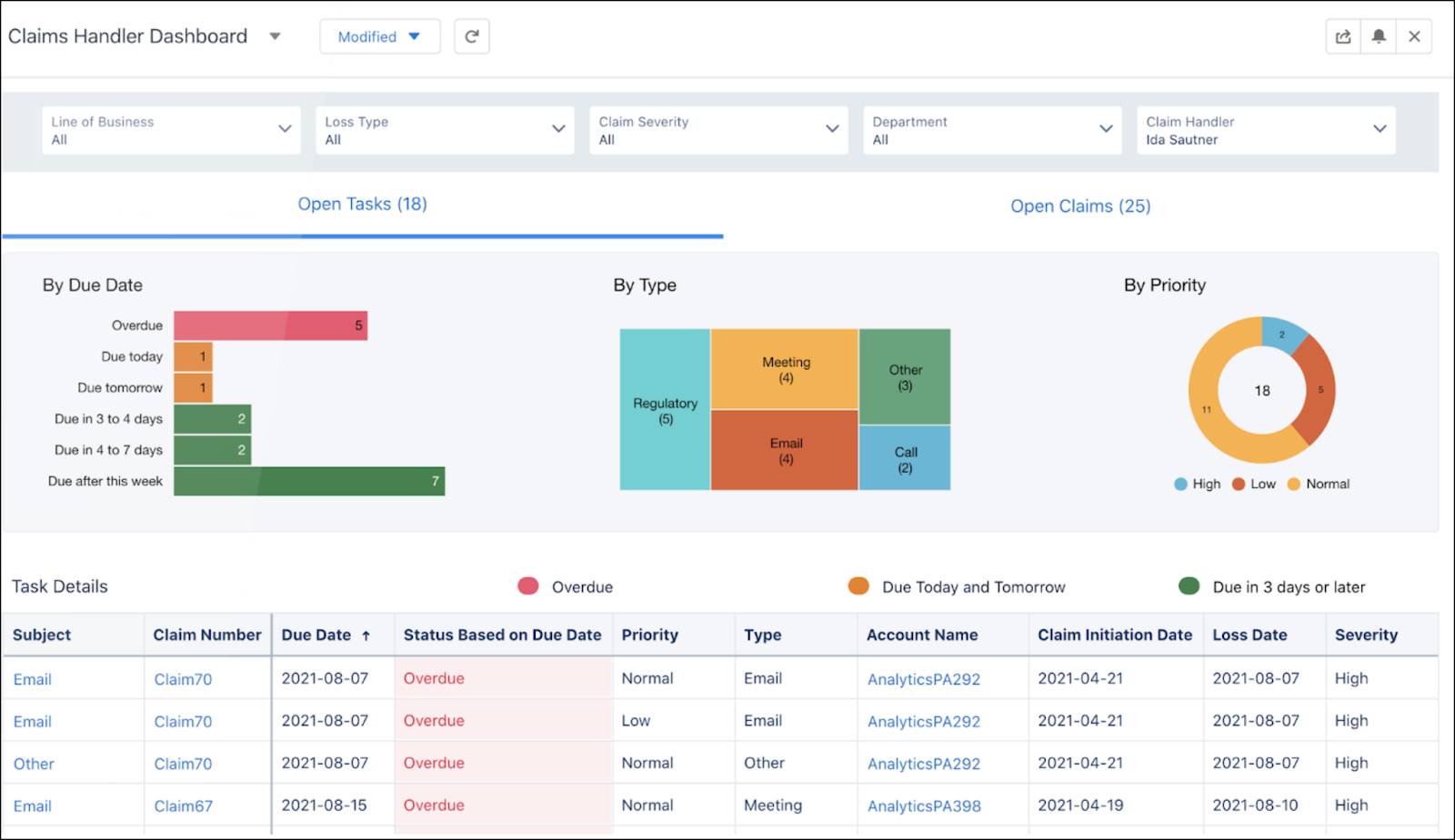

Additionally, claims adjusters and supervisors can use dynamic dashboards to maintain visibility into assigned claims and service level agreements with seamless navigation into claim records and files. Supervisor dashboards give team-level views and the option to drill down into individual adjuster dashboards. All this provides a single source of truth about current workload and status.

This example screen shows a claims handler dashboard.

The dashboard presents the adjuster with a quick view of all their claims segmented by due date, type, and priority, allowing the adjuster to easily prioritize and access their open claims.

Investigation and Documentation

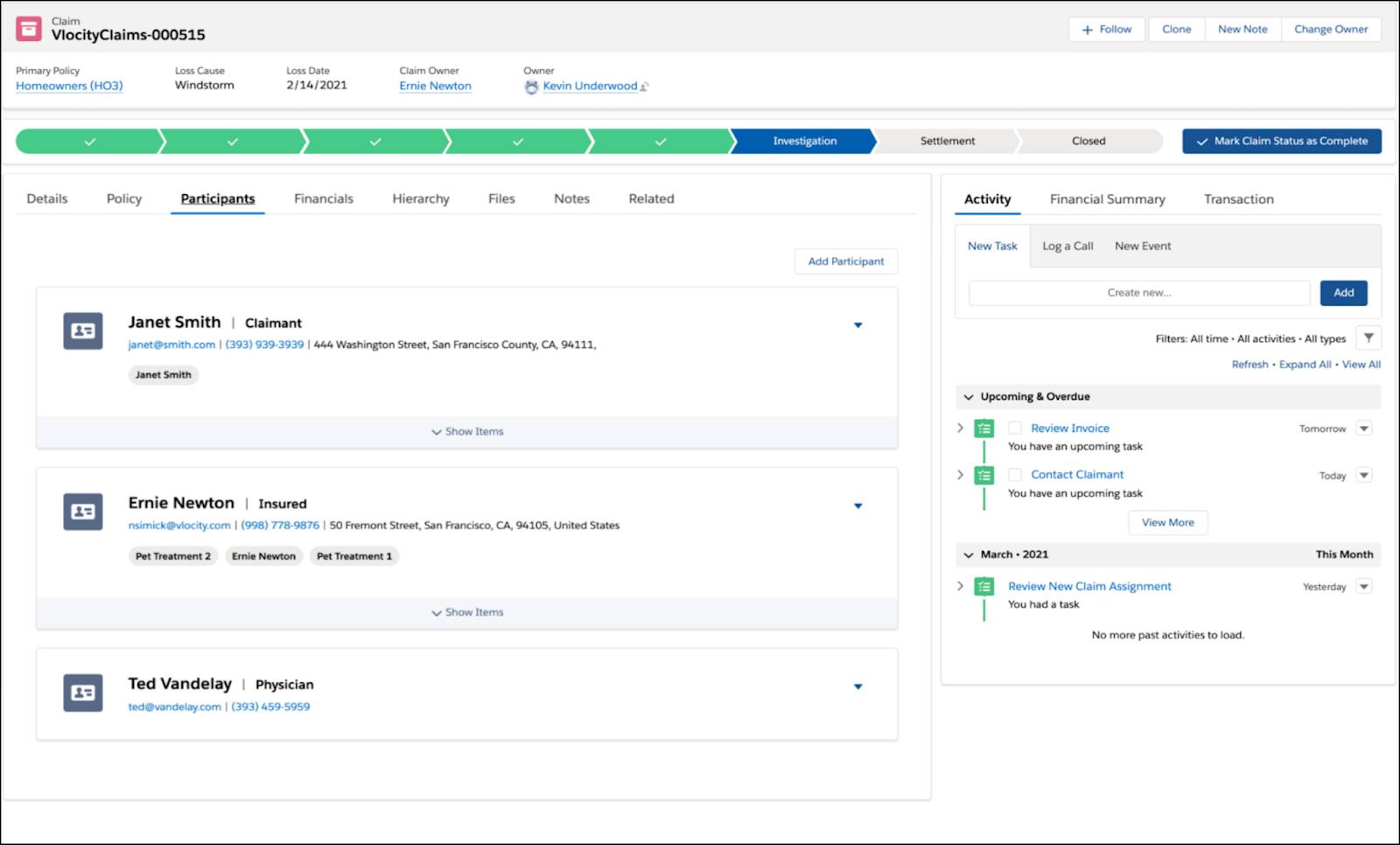

To support investigation and documentation, Claims Management gives adjusters a central location to manage all claim participants, contact information, and itemized loss information.

Supervisors and support reps can quickly get up to speed on a claim by visiting their claim history, which shows a detailed inventory of all claim events, including emails, approvals, and notes.

Using field service optimization tools, claims departments can easily manage onsite claims investigation and processing.

Financials and Adjudication

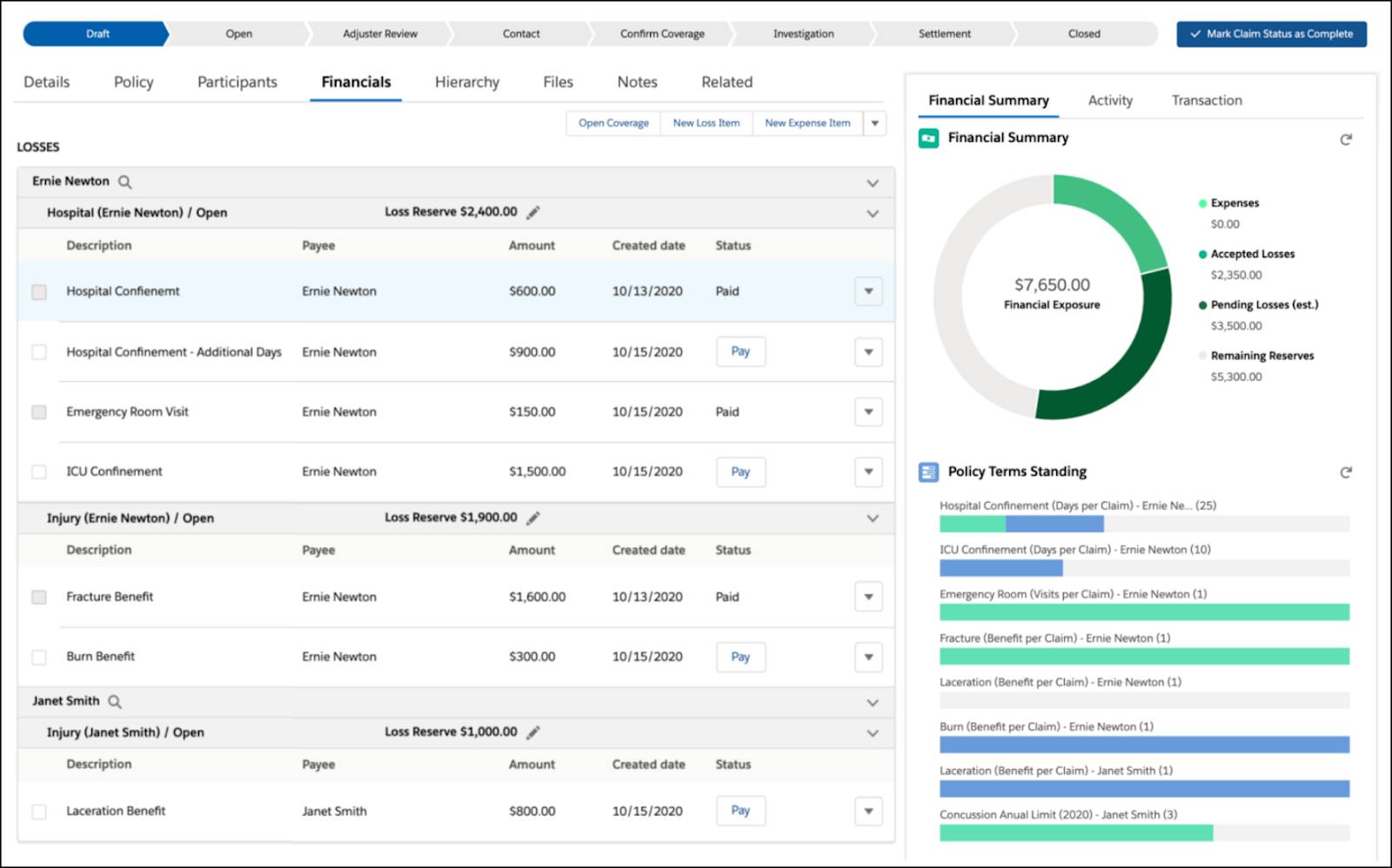

To support financials and adjudication, Claims Management gives teams a full suite of powerful tools called the Adjuster’s Workbench. Adjusters manage claim coverages and reserve adjustments using a single financials user interface.

They can issue loss and expense payments with a holistic view of financial activity on both the claim and policy records.

With policy term tracking, adjusters can quickly assess current standings of limit, deductible, copay, coinsurance, and out-of-pocket maximums.

Supervisors can configure authority and approvals to set loss and expense authority levels based on coverage specifications. And adjusters and supervisors can assess current spend and pending exposure for the claim using a top-down view of claim financials.

Closure

To support closure, Claims Management provides prebuilt processes for automatically closing claim coverages, zeroing reserves, and sending out claim summary documents and surveys to involved parties. Further, because the claims system integrates so completely with the policy system, the policy terms and other important details automatically update, and there’s no need to manually record anything related to the policy following closure.

As you can see, users of claims management need to complete a variety of tasks. And Claims Management for Insurance is there at every step with advanced tools and processes to help people do their jobs with ease and efficiency.