Get to Know Group Insurance Contracts and Enrollments

Learning Objectives

After completing this unit, you’ll be able to:

- Describe group insurance.

- Understand how contracts and enrollments relate to group insurance.

- Explain how Contract and Enroll solves industry challenges.

- List key benefits of Contract and Enroll.

Before You Start

Before you start this module, consider completing the following content.

Contracts and Enrollments Overview

Contracts and enrollments. They’re an exciting and critical part of group insurance. The good news is that the Digital Insurance Platform provides the solution for streamlining contract creation with employers and enrolling participants in plans. First, let's get on the same page about group insurance.

Group Insurance

Insurance carriers provide insurance to individuals and groups. For individual insurance, the carrier offers the insurance directly to the policyholder. For group insurance, the policyholder is a group member, such as an employee. Group members can enroll in the plans offered by their employer, for example, medical insurance and life insurance. The group, which is an employer or plan sponsor, negotiates with the insurance carrier to determine the best plans to offer members.

Key Players

Meet Anna Murphy, who works for Cloud Kicks. Anna is a Cloud Kicks group member and a policyholder with a medical insurance policy.

Enter Cumulus Insurance. Cumulus provides insurance, such as medical, dental, and life insurance plans, which employers make available to their employees.

Anna receives her Cumulus medical insurance plan through her employer, Cloud Kicks.

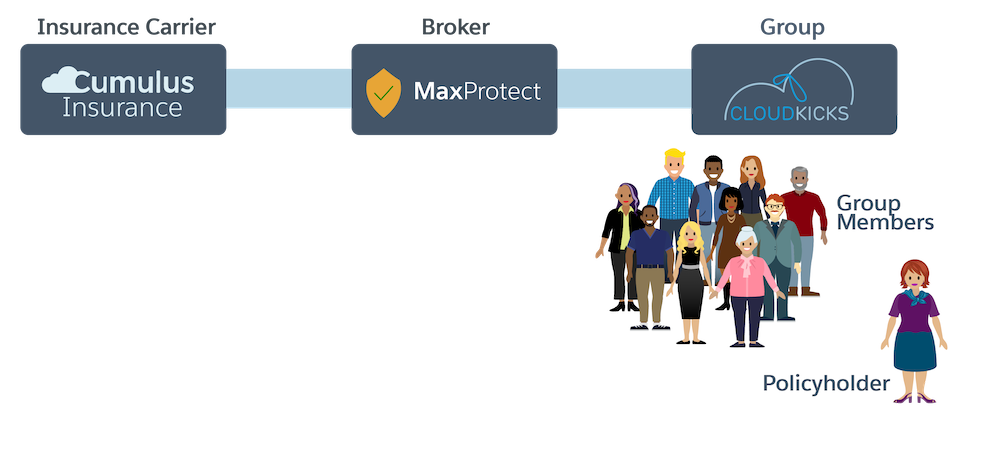

Look at how the carrier, broker, group, and group members are connected.

In the diagram, Cumulus is the insurance carrier. In this case, there’s a broker, MaxProtect, that represents the insurance carrier and sells policies to employers. Here, the employer is Cloud Kicks. MaxProtect and Cloud Kicks work together to negotiate the plans and pricing for employees. In the end, Cloud Kicks offers the plans to its employees, who are the group members. Those who receive coverage are policyholders, like Anna. Ta-da, now you know what group insurance is.

Contracts and Enrollments

Now, how do contracts and enrollments relate to group insurance? Getting back to Anna, before she can sign up for any plan through her employer, a contract needs to be in place between the insurance carrier and her employer. After that, she’s ready to roll, that is, enroll in a plan.

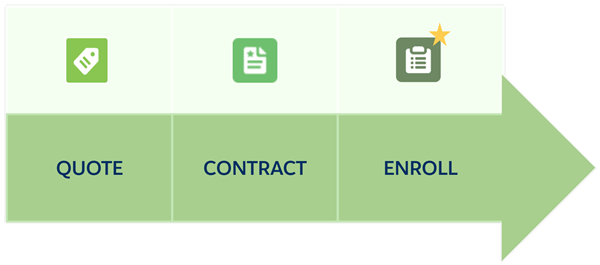

Group insurance involves the end-to-end processes of quoting, contracts, and enrollments. In this module, we focus on contracts and enrollments, which happen after a final quote and before any claims.

The quote that an employer or other plan sponsor agree on includes details of the products to offer to group members. Next, it's time for the insurance carrier to create a contract with the employer. Once the contract is in place, the enrollment phase begins, and employees can sign up for plans and get their policies.

Business Challenges

Meet Justus Pardo, the digital insurance consultant in charge of the digital transformation for Cumulus’s insurance solution.

Justus has some challenges to solve. He hears over and over from Cumulus group admins about how much time they spend creating contracts. After they do all the work of going back and forth with a group to build a final quote, and when it’s time to sign on the dotted line, all is good. However, there’s a gotcha. Now, the real hard work starts, because they must manually enter all those details again in another system to create the contract. Final census information, manual. Billing details, manual. All these manual tasks are time consuming and prone to errors.

Phew, the contract is done, so now onto enrollments, which is when group members become policyholders. Don’t get too comfortable though, because enrollments are another whopping kettle of fish. Not only is enrollment a slow and manual process, but, since COVID-19 has people working digitally from home, it’s more challenging than ever.

You may ask, “Why is enrollment so difficult?” In a nutshell, Cumulus is stuck in the past.

- Paper booklets and forms don’t work as well as they used to.

- Customers are demanding digital access.

- Great new voluntary benefits are available, but it’s challenging to market them to members.

- Legacy marketing and enrollment systems are disconnected.

Surely, there’s a better way.

The Need for Speed and Efficiency

Justus is excited to have discovered some impressive ways the Digital Insurance Platform can help Cumulus succeed in the modern digital world. The Digital Insurance Platform is a modular solution that digitally enables all core insurance operations and integrates with existing systems to drive business forward.

Contract and Enroll is a Digital Insurance Platform module that automates contracting to speed up the process and minimize errors. Add to this promoted enrollment to streamline the enrollment process. Plus, with omnichannel service, customers like Anna can work with their policy on their device of choice. Justus can’t wait to sink his teeth into the project and help bring relief to stressed-out Cumulus group admins, as well as policyholders like Anna further down the line.

Automated Contracting

After a group agrees to the final quote, it's time for the contract. The Digital Insurance Platform makes contracting easy. With the automated-contracting capabilities, you can generate the contract based on the agreed terms. Plus, the solution gives you:

- Customizable and reusable clauses

- An automated omnichannel workflow to capture required data

- Flags for issues with census uploads, so you can quickly resolve them

- Electronic contract signatures and digital payment processing

All this means increased speed of contract creation and fewer errors in contracts.

Promoted Enrollment

Through promoted enrollment, you let members know about the plans available and encourage them to enroll. Enrollment gives you a leg up with:

- Automated enrollment setup, which is based directly on the contract

- Voluntary benefits marketed with Salesforce Marketing Cloud Engagement

- A modern digital user experience for members to shop and enroll

As a bonus, this helps increase revenue and lower costs to the business.

Omnichannel Service

The advantages go beyond contracting and enrollment. Omnichannel service means that members can self-serve through their digital portal to find answers to questions, whether on a laptop or mobile phone. Employees looking to check their coverage, change dependents, and more, can do so anytime, from anywhere with an internet connection.

We’ve introduced you to key advantages that the Digital Insurance Platform provides for contracts and enrollments. Let's find out how the solution pieces fit together.