Dive into Financial Services Cloud Solutions

Learning Objectives

After completing this unit, you’ll be able to:

- Describe Financial Services Cloud solutions.

- Understand how Financial Services Cloud features align with the solutions.

Meet Financial Services Cloud Solutions

Financial Services Cloud solutions combine features to meet the key business needs of financial institutions. In this unit, explore these solutions and some of the tools working behind the scenes.

Build Trusted Relationships

When customers trust their financial institution, they’re more likely to recommend it to others, add products and services, and share more personal data. Discover some of the tools you can use to build trusted relationships.

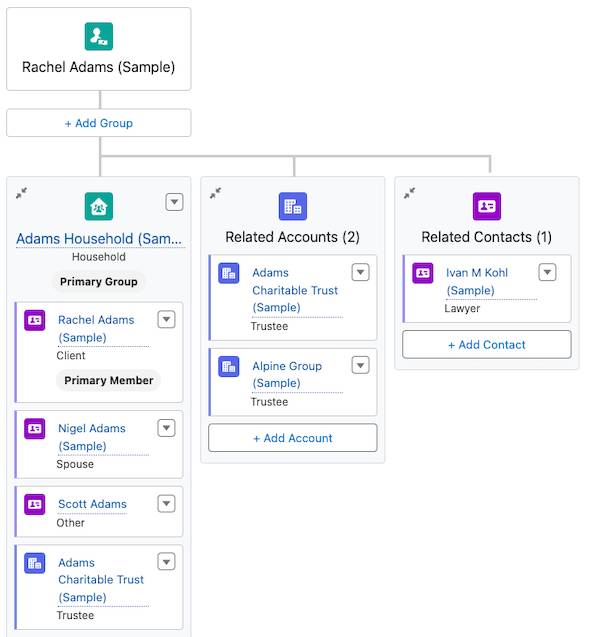

Groups, Households, and Actionable Relationship Center

The Groups (Householding) feature helps you track family members and professional connections.

Then, use Actionable Relationship Center (ARC) to explore these connections through an interactive component to really get to know your customers.

Financial Accounts

Financial Accounts paint a picture of your customer’s financial standing, while Financial Goals help you set and track customer’s targets. Industry-specific data models reduce the need for customization. To learn about Financial Services Cloud data models, read Data Model Overview in Salesforce Help.

Tear Sheet Generation and Interaction Summaries

Tear sheet generation helps your team prepare for meetings with formatted account summaries that compile the most important information about customer accounts. A commercial banker can create a tear sheet before a meeting to have all the customer’s business information to hand, preparing the banker for a more meaningful conversation.

Your team can capture notes about any meeting or interaction using interaction summaries, and then coordinate follow-up activities.

Onboard Customers to New Products

Make a great first impression by reducing the time to onboard new customers. Typically the most complex financial-services process, streamline onboarding activities to improve customer satisfaction with features to:

- Gather customer information.

- Screen for risk.

- Perform consent and electronic signature.

- Automate document generation.

- Store documents in compliance with standards.

Discovery Framework

Use Discovery Framework to create digital forms that collect and validate data without time-consuming manual data entry.

Combine the Discovery Framework data model with Omnistudio to manage every aspect of questionnaire-driven data collection in compliance with your policies.

Know Your Customer Data Model

By using the Know Your Customer (KYC) data model, perform identity verification, risk assessment, and screening checks of accounts, contacts, and leads with ease.

Document Checklist Items and Document Matrices

Use these tools to collect identity verification, paystubs, and other documents from clients. Set up rules that determine which documents you need based on region, services offered, and other criteria. Then use optical character recognition (OCR) to automate the approval of submitted documents.

Intelligent Document Automation and Disclosures and Consent

Consent is the permission granted by a customer to perform an action on their behalf. Use Intelligent Document Automation to manage consent and disclosure documents and generate authorization request forms. Track whether a person has seen, signed, or rejected an authorization request form, and how and when they gave their response.

A disclosure is information you’re required to give to a customer. Use the Disclosures and Consent feature to deliver annual privacy statements to customers.

Provide Best-in-Class Service

Customers expect timely, efficient, and personalized service from their financial institutions across all channels, including self-service, mobile, and chat. But multiple, complex systems and lengthy training for service agents make giving best-in-class service a challenge. Use Financial Services Cloud to improve service and:

- Integrate siloed data from your external systems with prebuilt connectors.

- Give agents a complete view of their customers.

- Lower costs with customer self-service and bots.

Service Process Studio

Service Process Studio extends the Case object so you can design business processes quickly and efficiently using Omniscript and flows. For example, automate key banking operations, like customer data updates, overdraft protection, and accounting reconciliation.

Financial Services Cloud includes several pre-built service processes, such as Fee Reversal, Address Change, Dispute Transaction, and File Complaint. Customers can launch these processes in self-service channels or service agents can initiate them. You can also build your own guided flows, for example, to add an authorized user to an account.

Timeline and Record Alerts

Help your agents stay customer-focused with Timeline, a comprehensive and chronological view of customer interactions that displays key events in one place.

Use Record Alerts to notify agents when action is required. Agents can quickly view critical details from core banking systems or Salesforce and decide when and how a customer needs their help. For example, use record alerts to notify an agent of a low balance, so the agent can advise the client to transfer funds and avoid overdrafts.

Financial Accounts

With an included page component, service agents can view a customer’s financial accounts, transactions, and record alerts in one place.

Additional page components compile views of financial account details and transactions. Financial Services Cloud can retrieve this data from core banking or other backend systems.

Personalize Financial Engagement

Improve customer loyalty and retention with personalized experiences powered by real-time financial data. Use Financial Services Cloud to:

- Use data to generate personalized insights for advisors.

- Create plans for customer goals.

- Anticipate customer needs and invest in their wellbeing.

Data Cloud for Financial Services Cloud

Calculated insights show a customer’s accounts with your institution, income and expenditure, net worth, and financial health. Use these insights to guide customers through day-to-day financial activities, like managing spending, paying off debt, and reviewing significant purchases.

Financial Plans and Goals

Help your clients reach their financial objectives using the Financial Goals and Financial Plans objects. For example, a customer can have a financial plan for retirement with a financial goal to cover post-retirement monthly expenses. Update the goal, link it to a financial account, and specify contributions to track their likelihood of reaching that goal.

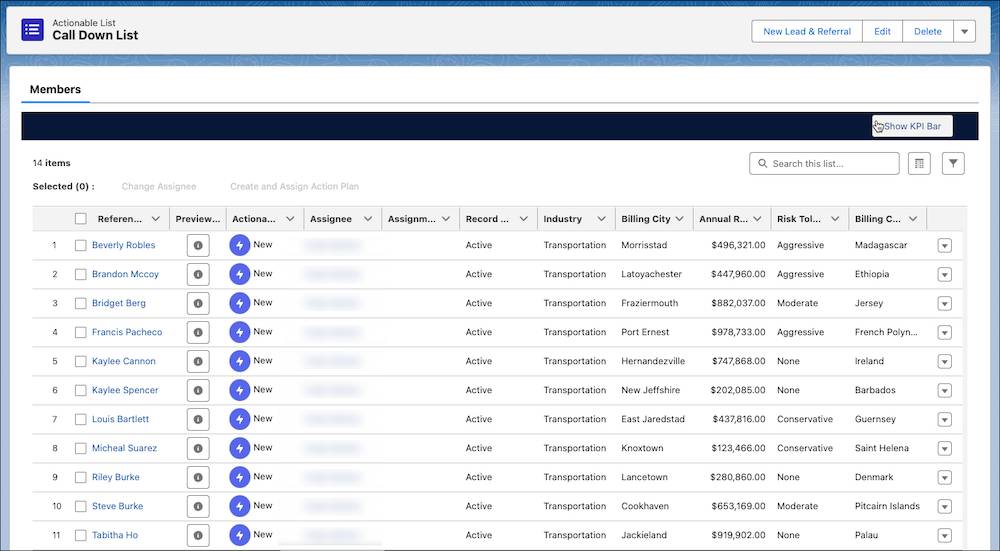

Actionable Segmentation

Use Actionable Segmentation to segment similar customer profiles, curate them, and design personalized outreach programs. You can then create actionable lists for various outreach initiatives. For example, a wealth manager can use an actionable list of high net worth individuals for a wealth plan outreach initiative.

Automate Time-Consuming Tasks

Automation helps you meet customer expectations and focus your employees on only high-value activities. Improve efficiency and reduce risk by reusing business processes across channels and automating data collection, document generation, and more.

Use automation to:

- Close books accurately.

- Automate manual reporting and data aggregation.

- Eliminate repetitive tasks for agents at the contact centers.

- Digitize onboarding and account origination processes.

With Salesforce Flow, you can start with prebuilt workflows and customize them to meet your business needs.

Pay Attention to Compliance

Financial Services Cloud uses Salesforce compliance features such as field tracking, date and timestamps, and the auditing of changes. For example, the Compliant Data Sharing feature helps Salesforce admins and compliance managers configure advanced data-sharing rules. Your team gets precise control and monitoring of data sharing, without the need for complex code, keeping you in compliance with regulations and company policies.

Integrate Siloed Data

Siloed data is a challenge for many financial institutions. Some customer data is held in core banking systems, other information is housed in external systems, and it can all feel disconnected. Financial Services Cloud helps you build bridges between these islands of data for a comprehensive view of your customers and business.

Use Data Consumption Framework to enable your agents to access complete and current data from external systems without leaving Salesforce. The framework extends Omniscript and Flexcard with integration capabilities and better real-time performance. Agents can also use the framework to initiate asynchronous flows that call APIs at scale to support more simultaneous users.

Use prebuilt MuleSoft connectors to integrate data from any cloud or legacy systems to deliver personalized, connected, and relevant customer experiences. These connectors adhere to common standards such as BIAN and ACCORD.

Put Financial Services Cloud to Work

In this module you learned the basics of Financial Services Cloud: How it works, which sectors it serves, and what solutions it offers. You now know how you can use Financial Services Cloud to scale service, streamline onboarding, and personalize engagement with integrated data and analysis tools.

With this knowledge, you’re ready to take a deeper dive into all Financial Services Cloud has to offer. To learn more about how Financial Services Cloud can help you respond to today’s customer and compliance demands, visit the links in Resources.