Get Started with the Customizable Actionable Relationship Center

Learning Objectives

After completing this unit, you’ll be able to:

- Define retail banking.

- Discuss challenges retail bankers face.

- Describe Actionable Relationship Center.

- Explain how the ARC helps retail bankers build relationships with their clients.

Before You Start

Salesforce currently offers two versions of Actionable Relationship Center (ARC), which are independent of each other. The older version is view-only, while the latest ARC solution is customizable. This module covers the latest, customizable version of ARC. For information on the view-only version, see Actionable Relationship Center in Financial Services Cloud.

Retail Banking and Relationships

In the banking industry, building strong relationships with clients is important for everyone’s success. Clients need to know that their bank is looking after their money, so trust is key. And bankers need access to the right client data to answer their questions and make informed financial recommendations.

Retail banking is a division of the banking industry that provides financial services directly to consumers, rather than to large businesses. Retail bankers help consumers establish a personalized financial strategy by finding the best way to manage their financial assets, such as credit cards, bank accounts, loans, investments, and small businesses.

The ability to identify unique client banking requirements depends on a strong relationship between a retail banker and their client. Retail bankers seek a full picture of their clients, including their needs and wants, their current financial plan, and how they envision growing their assets. Only with these insights can bankers develop the right financial plans for clients.

Meet the Cumulus Team

Cumulus Cloud Corporation, headquartered in Pittsburgh, Pennsylvania, is a well-diversified financial services giant that operates nationwide. If you’ve earned a badge in the Inspire Customer Loyalty with Financial Services Cloud trail, you probably remember some key team members.

Nora Clark is a retail banker at Cumulus. She works hard to understand her clients’ financial goals. Nora’s day-to-day tasks include building her client base, nurturing relationships, and keeping client portfolios up to date.

Matt O’Brienn has been a Salesforce admin at Cumulus for three years. He makes sure its Salesforce org runs smoothly so that bankers can focus on customers. He’s always looking for ways to streamline work for users.

Nora is working with a new client called Buttercream Bakery, a family business that sells cakes and pastries. Mark and Sarah Smyth own and operate the business, having opened their first location in 2005. Since then, Buttercream has added a second location and grown to more than 20 staff.

Nora has managed to collect lots of information about the bakery, but sifting through it and connecting the dots is overwhelming.

[Alt text: Buttercream Bakery shop front selling bakery items: shop counter, bakery items, customer service, sales person.]

Before Nora can create a strategic financial plan for Buttercream Bakery, she needs to know some key info: What subsidiaries do they own and who are their main points of contact? What are their open opportunities? Do they have any debt refinancing or major financial goals for the future?

Challenges with Technology and Relationship Building

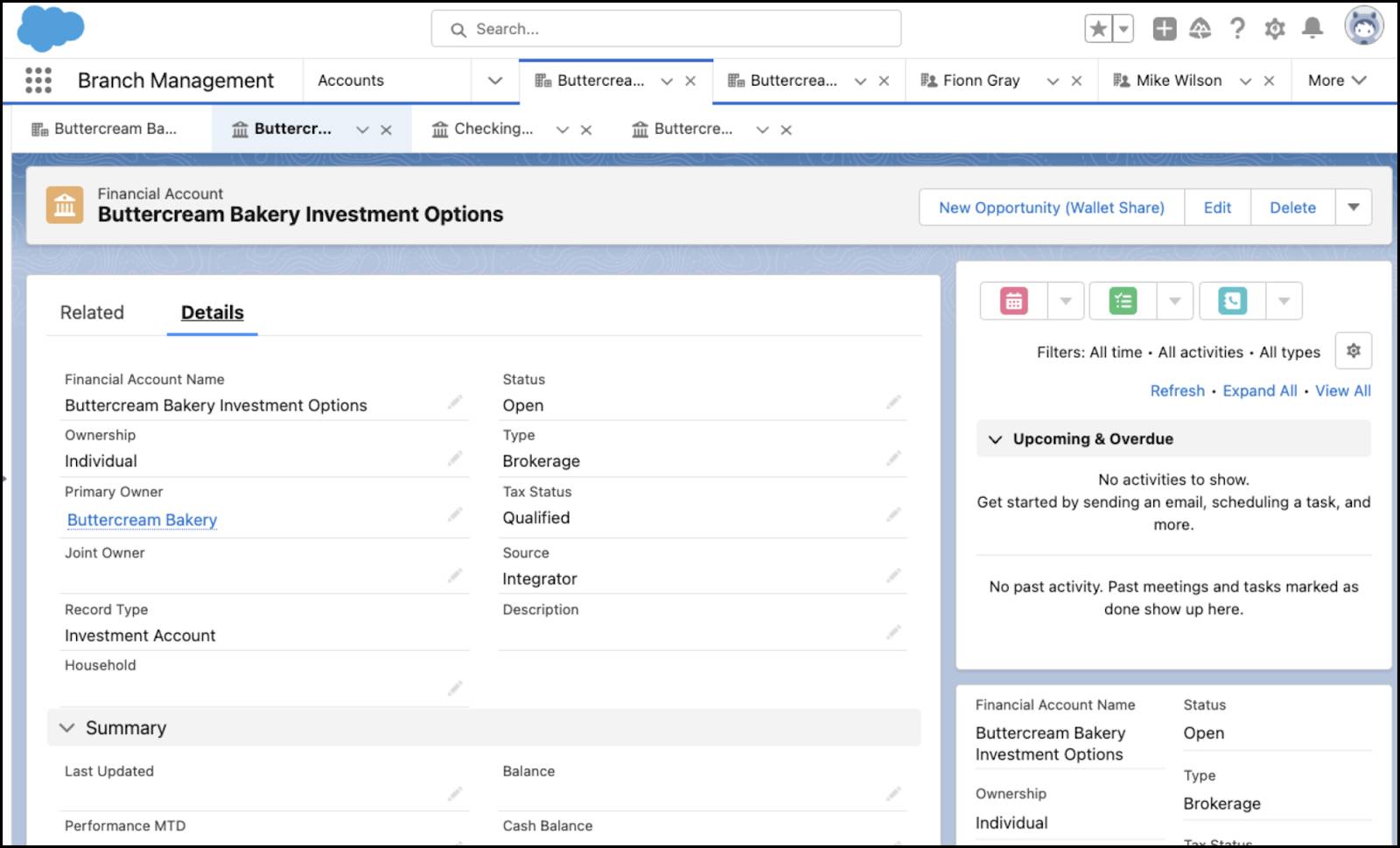

As with any industry, retail banking has its challenges. Nora works long hours and spends a lot of time researching her clients before upcoming meetings. Navigating between records in Salesforce takes time. For example, Nora can see that Buttercream Bakery has two locations. However, to get a closer look at the contacts, financial accounts, and opportunities at each location, she needs to open multiple browser tabs.

[Alt text: Financial Account record for Buttercream Bakery: Investment details.]

It’s time-consuming to compare data in different windows. This keeps Nora from seeing all of her client’s data at once for a full picture of their business.

She’s meeting with Mark and Sarah next week. Here’s what Nora knows so far about their business.

- Recently expanded to a third location

- Hired two new employees

- Looking to upgrade baking equipment to match the new location

Gathering business and relationship data about a client is important for relationship building. And Nora dreams of a visual representation where she can see client data in a single, unified view. This way, when it’s time to jump into a conversation, she’s ready. Matt knows exactly how to solve this problem: A Retail Banker ARC Graph.

Winning with ARC

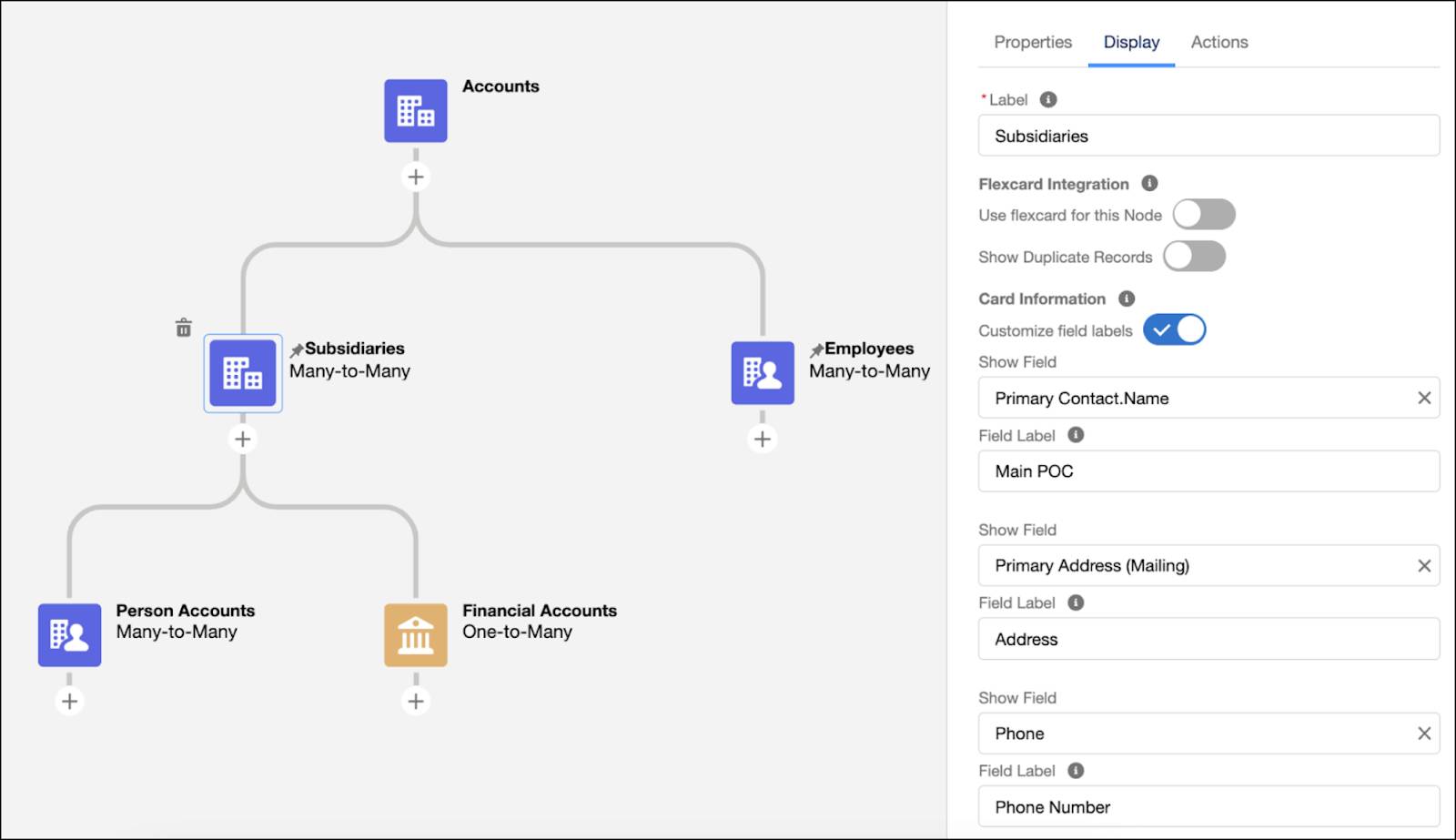

Give your retail bankers an organized view of their client data using Actionable Relationship Center, or ARC for short. Here’s the ARC Relationship Graph Builder, where you customize ARC graph nodes using standard and custom Salesforce objects to show your users relevant client relationship data.

[Alt text: Actionable Relationship Center graph builder: ARC nodes, display tab properties.]

On the Display tab, you define the fields your users see on each node. And on the Actions tab, you can customize the object and record actions that let your users respond and engage with records. Add the ARC Relationship Graph component to page layouts so your users can easily view, edit, delete, and create records during client interactions.

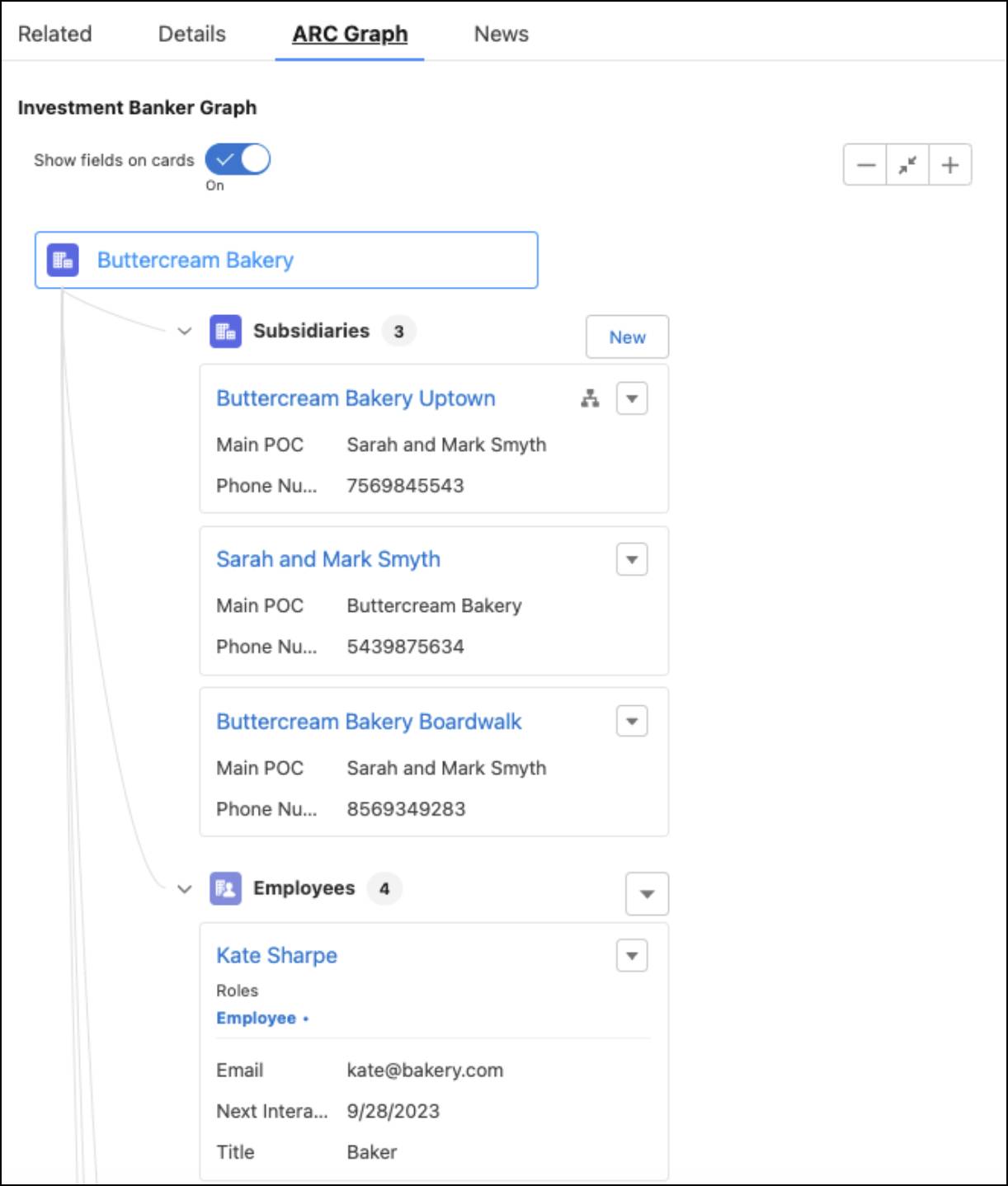

With ARC, your users can spend their time more efficiently. Instead of jumping between multiple screens to piece together client relationship data, they see all the important details in a single view.

Here’s an example of an ARC graph. Each card represents a Salesforce record.

[Alt text: Actionable Relationship Center graph on a record page: Subsidiaries, employees.]

You can create multiple relationship graphs for an object and add the graphs to page layouts for users to view based on their Salesforce profile.

With ARC, Nora can easily see multiple relationship graphs for Buttercream Bakery, including subsidiaries, employees, and financial accounts. With these insights, she's ready to start crafting the new financial plan for owners Mark and Sarah. First thing tomorrow morning, she’ll tackle the job.