Map Client Relationships

Learning Objectives

After completing this unit, you’ll be able to:

- Sign up for a Developer Edition org with Financial Services Cloud.

- View a client’s financial relationships.

- Create a client record.

- Set up a household record.

Sign Up for a Developer Edition Org with Financial Services Cloud

To complete this module, you need a special Developer Edition org that contains Financial Services Cloud and our sample data. Get the free Developer Edition and connect it to Trailhead now so you can complete the challenges in this module. Note that this Developer Edition is designed to work with the challenges in this badge, and may not work for other badges. Always check that you’re using the Trailhead Playground or special Developer Edition org that we recommend.

- Sign up for a free Developer Edition org with Financial Services Cloud.

- Fill out the form.

- For Email, enter an active email address.

- For Username, enter a username that looks like an email address and is unique, but it doesn't need to be a valid email account.

- After you fill out the form, click Sign me up. A confirmation message appears.

- When you receive the activation email (this might take a few minutes), open it and click Verify Account.

- Complete your registration by setting your password and challenge question.

Tip: Save your username, password, and login URL in a secure place—such as a password manager—for easy access later.

- You are logged in to your Developer Edition.

Now connect your new Developer Edition org to Trailhead.

- Make sure you're logged in to your Trailhead account.

- In the Challenge section at the bottom of this page, click the playground name and then click Connect Org.

- On the login screen, enter the username and password for the Developer Edition you just set up.

- On the Allow Access? screen, click Allow.

- On the Want to connect this org for hands-on challenges? screen, click Yes! Save it. You are redirected back to the challenge page and ready to use your new Developer Edition to earn this badge.

Now that you have a Financial Services Cloud-enabled org, you’re ready to blaze new trails with your clients!

Households in Financial Services Cloud

If you work in banking or help clients manage their wealth, you understand that people often make financial decisions in the context of their relationships. That’s why Financial Services Cloud lets you map your clients’ relationships. One way you do that is by setting up household records. A household is a group of people who live together, or a group of people with related financial interests.

In the sample data in our Financial Services Cloud trial org, we have a client named Rachel Adams. We use her in our examples in this module. Rachel is the primary member of a household that includes both herself and her husband, Nigel. But Rachel has relationships with others as well. She’s also a member of her father’s household, although she doesn’t live with him. Her relationships in Financial Services Cloud also include related contacts and related accounts.

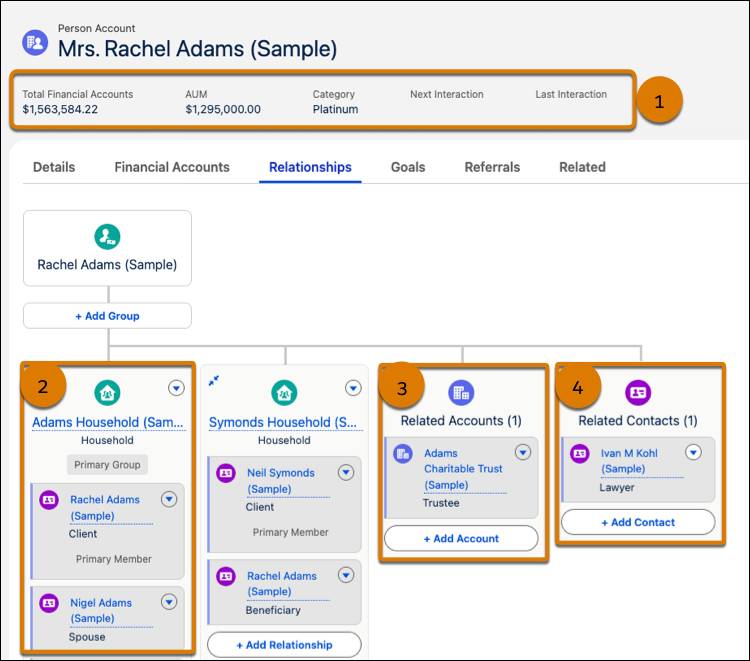

Information about Rachel, her household, and related records looks like this in the Wealth Management app in the trial org.

- Summary information (1)—Information about Rachel Adams. Total Financial Accounts is the amount of all her financial accounts rolled up together. AUM shows her total assets under management at your firm. Her category is Platinum. You can also see her client interactions, including the last interaction and the next interaction scheduled in the future.

- Primary household (2)—Rachel’s primary household, where she lives with her husband, Nigel.

- Related accounts (3)—Accounts not directly included in her primary household. In this case, it’s the Adams Charitable Trust.

- Related contacts (4)—Others related to the financial world of Rachel Adams. In this case, it’s her lawyer, Ivan M. Kohl.

View Household Details

We just saw Rachel’s client record with her household relationships. Now let’s look at Rachel’s primary household, the Adams household, in more detail in your trial org.

- From the App Launcher (

), find and select Wealth Management.

), find and select Wealth Management.

- Select Accounts in the navigation bar.

- Change the list view to All Accounts.

- Find and select Adams Household (Sample).

- Select the Financial Accounts tab.

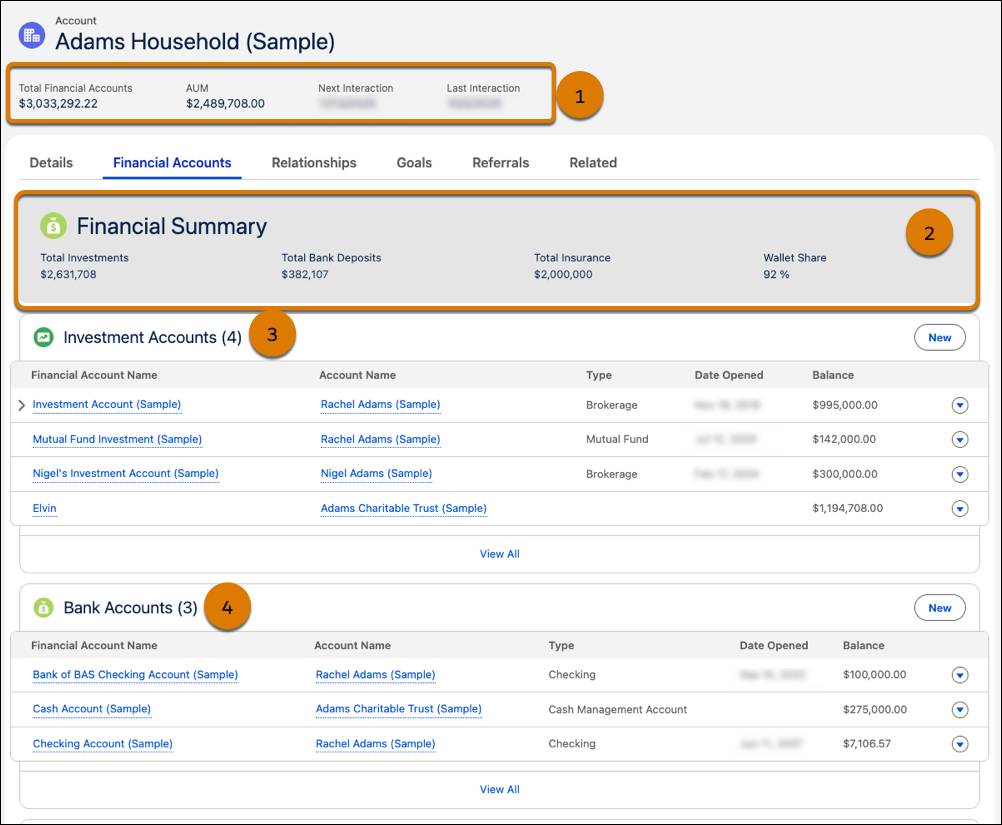

Here’s the Adams household record in the Wealth Management app.

- General summary information (1)—Information for both members of the Adams household: Rachel and Nigel. It shows Total Accounts, Assets under Management, and the dates of client interactions.

- Financial summary (2)—Summary of the financial information for all members of the household. This information includes all investments, all bank deposits, insurance information, and the household’s wallet share at your firm.

- Investment accounts (3)—List of investment accounts and information about each one. One key field is Held Away. A financial advisor cares when accounts are held away at another firm. Those accounts are good opportunities to bring in-house. Select the action menu next to a held away account to create a Wallet Share opportunity. Then you can work with the client to bring that account into your company.

- Bank accounts (4)—List of checking or savings accounts.

Scroll down to see other types of accounts in the Adams household, including insurance policies, financial roles, and assets and liabilities.

If you’re using the Retail Banking Console instead of Wealth Management, you will see different information. The Financial Summary displays information about Total Bank Accounts, Total Outstanding Credit, and Total Number of Financial Accounts. Likewise, if you scroll down to view the account types, you will see different account types. The types include savings accounts, checking accounts, credit card accounts, and more.

Now that you’ve seen what a household looks like, let’s walk through the process of setting up a simple two-person household in Financial Services Cloud.

Create a Client Record

Kotori Mizono is a client associate who supports financial advisors. One of her advisors asked her to start the process of welcoming a new client, Claire Johnson, by creating a client record. Here’s what Kotori does.

- From the App Launcher (

), find and select Wealth Management.

), find and select Wealth Management.

- Select Accounts in the navigation bar.

- Click New.

- Select Person Account and click Next.

- Specify these values for the new client.

- First Name:

Claire - Last Name:

Johnson - Occupation:

CFO - Birthdate: 4/4/1958

- Save your work.

Claire’s new account shows up in Accounts in Kotori’s Wealth Management app.

Set Up a Household

Claire Johnson is part of a household. She lives with her husband, Timothy Johnson. This is how Kotori sets up the household and adds Timothy to it.

- On the Accounts list view, select New.

- Select Household and click Next.

- In Account Name, enter

Claire Johnson Household.

- Save your work.

After creating the Claire Johnson household record, Kotori adds Claire.

- On the Claire Johnson Household record, select the Relationships tab.

- Under Claire Johnson Household, click + Add Relationship.

- Add Claire to the household using the following values.

- Member name: Claire Johnson

- Role in Group: Client

- Activities & Objects to Roll Up: All

- Primary Member: Enabled

- Primary Group: Enabled

- Save your work.

The Claire Johnson household is now Claire’s primary household. All her financial account totals and activities roll up into this household. She can be a member of another household, such as her parents’ household, but her accounts don’t roll up there.

Now Kotori adds Timothy to the Claire Johnson household.

- Under Claire Johnson Household in the Relationships tab, select + Add Relationship.

- Under Who Are the Members of This Group, select Add Row.

- In the Search Accounts field, select + New Account.

- Select Person Account and click Next.

- Enter these details.

- First Name:

Timothy - Last Name:

Johnson

- First Name:

- Save your work.

- Back on the Household page, specify these details in Timothy’s row.

- Role in Group: Spouse

- Activities & Objects to Roll Up: All

- Primary Member: Disabled, because each household can only have one primary member. In this instance, that’s Claire Johnson.

- Primary Group: Enabled

- Save your work.

Kotori created a household with two members. A household can have as many members as required, and you can always add more.

Remember how we talked about households having related contacts who don’t live there, like Rachel’s lawyer, Ivan M. Kohl? Add related accounts and contacts the same way as you add a member. Unless a related account or contact lists the household as their primary household, their accounts won’t roll up there.

You’ve explored households and seen how members fit into them. You saw how Kotori created two new client records and put them into a household. Now you’re ready to view your clients’ financial accounts and goals in the next unit, but first complete the hands-on challenge here.

Resources

- Trailhead: CRM for Lightning Experience

- Trailhead: Deliver Financial Services on the Platform for High-Touch Client Relationships