Set Up the Product Model

Learning Objectives

After completing this unit, you’ll be able to:

- Describe how a claim is related to the product model and claim model.

- Explain the role of a root product and child specs in the claims process.

- Explain how attributes relate to a potential claim.

Before You Start

Before you start this module, consider completing the following recommended content.

Start with the Product Model

You may wonder why we want to talk about the product model in a module about modeling a claim.

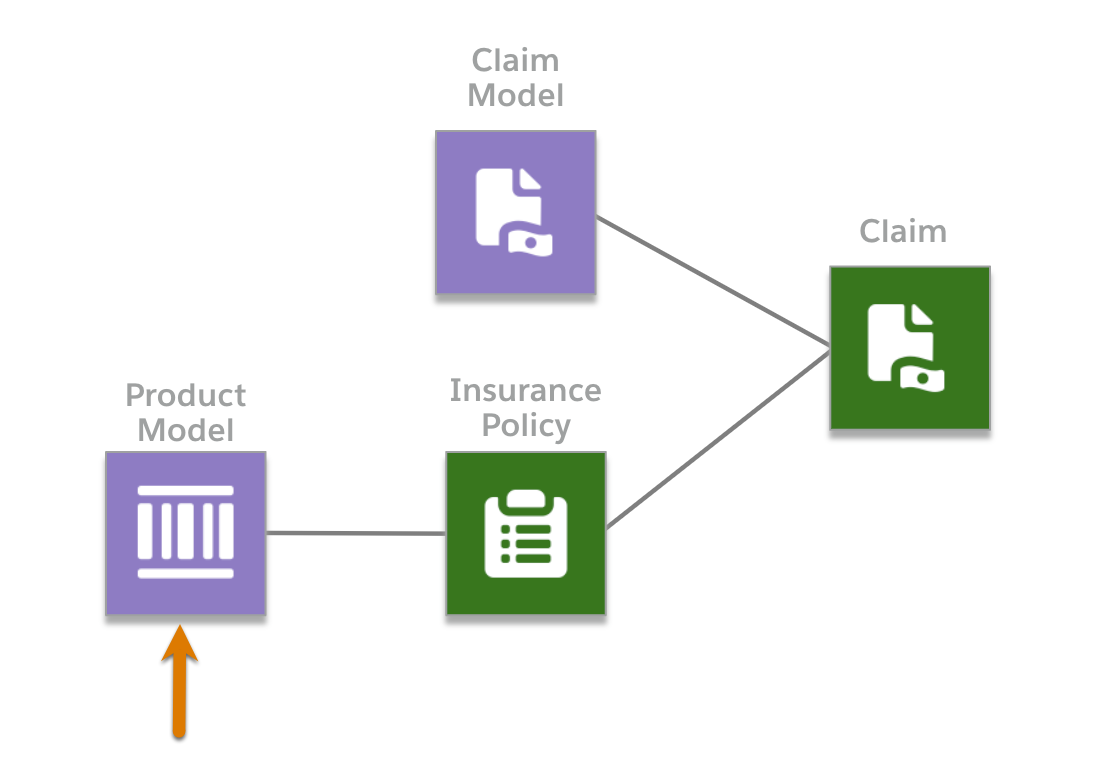

A claim owes much of its structure and data to a policy record, which contains vital details about what is covered, who is covered, and the extent to which they are covered. The product model defines the possible shape of the policy record. The claim model then adds specific claim-specific layers to this definition. But much of what is critical for the claim occurs when modeling the insurance product.

Across this module, you learn the process for modeling all the components needed to support future claims. This unit gets things started by introducing the product model, which is the basis for the policy that customers issue claims against. A product model consists of a root product and child specs—let’s find out more.

Identify the Root Product Specs

You may remember Cumulus Insurance, a large, well-diversified provider of insurance services nationwide. It offers a variety of insurance plans, including auto, business, and homeowners coverage.

Cumulus has recently implemented the Digital Insurance Platform to transform its legacy quoting and policy administration systems. Now, it wants to design a claims solution to upgrade its claims system.

Enter Justus Pardo, a highly skilled solution architect and an expert on the Digital Insurance Platform.

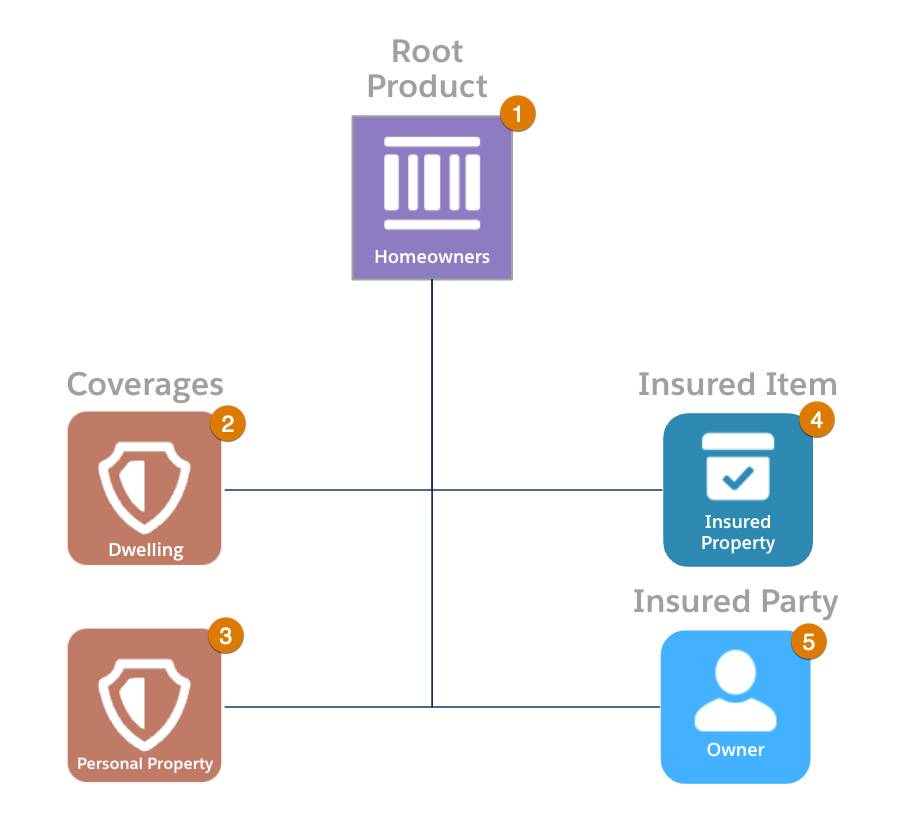

Justus begins with a homeowners product model where the homeowner is the root product. The root product has four child specs: two coverages, a single insured item, and an insured party. This simplified model highlights all the essential components needed for the claims process and will serve as the basis for policies that claimants can issue claims against.

Here are the details of each spec.

Name |

Spec Type |

Description |

|---|---|---|

Homeowners (1) |

Root Product |

Serves as the parent product to all other specs. Also contains any policy terms that apply across all coverages. |

Dwelling (2) |

Coverage |

Contains the coverage terms for any damage to the home. |

Personal Property (3) |

Coverage |

Contains the coverage terms for any loss or damage to personal property. |

Insured Property (4) |

Insured Item |

Stores information about the insured home. |

Owner (5) |

Insured Party |

Stores information about the owner of the insured property. |

A product model can contain additional coverages, insured specs, and rules for advanced implementations. Modelers can define more complex relationships between the specs to support multi-instance policies, where a policy contains multiple insured parties or insured items.

For example, a standard product model for auto supports multiple drivers (insured parties) and automobiles (insured items), with each driver associated with a different car. To configure such a scenario, the product modeler sets up the appropriate hierarchy between all the specs.

For more information about more advanced topics related to product hierarchy in a product model, check out Product Modeling for Insurance Quoting.

Define the Attributes

After defining the root product and child specs, Justus considers the attributes. Remember, attributes are the components that define the specs. You can add them to root products, coverages, insured items, and insured parties.

-

Root Product attributes define the terms that apply across the entire policy.

-

Coverage attributes define the terms of a specific coverage.

-

Insured Item attributes define facts about the covered item.

-

Insured party attributes define facts about the covered individual.

For the homeowners product, Justus adds several attributes. The following table explains how its various attributes relate to a potential claim.

Name |

Spec Type |

Attribute Description |

|---|---|---|

Homeowners |

Root Product |

The Deductible defines how much the policyholder must pay before the insurer pays the claim. It applies to all coverages because it is placed on the root product and not on a specific coverage. |

Dwelling |

Coverage |

The Dwelling Limit defines the maximum amount the policyholder can receive for a Dwelling claim. It applies to this specific coverage. |

Personal Property |

Coverage |

The Personal Property limit defines the maximum amount the policyholder can receive for a personal property claim. Three sub-limits (Furs, Jewelry, and Guns) for specific types of personal property define the maximum amount a policyholder can receive for a claim on each property type. |

Insured Property |

Insured item |

Contains several attributes that store general facts about the insured property. These attributes may play a role in rating the product and evaluating rules but do not play an essential role in claims. Facts only known at the time of claim belong to the claim property spec, not the insured item. For example, if you want to collect information about specific damage to an insured property, you add it to the claim property spec. |

Owner |

Insured Party |

Contains attributes that store facts about the insured party. These attributes also do not play an essential role in claims. Facts related to claimed injuries belong to the claim injury spec. |

For now, that’s all you need to know about how a product model relates to claims. In the next unit, dive deeper into attribute configurations by defining the limits and deductibles as power attributes.