Get Started with Benefits Verification

Learning Objectives

After completing this unit, you’ll be able to:

- List the common reasons for claim denial.

- Explain the difficulties in verifying patient benefits and eligibility.

- List the advantages of Benefits Verification.

Verifying Eligibility

Benefits and eligibility verification is the process of checking a patient’s active health coverage with an insurance company. It also verifies a patient's covered services.

Del Sol Clinic is a regional healthcare provider that offers a range of healthcare services across southern California. Due to outdated manual processes, Del Sol struggles to efficiently and accurately verify patient benefits and eligibility. This poor verification system takes up too much time, costs too much money, leads to poor patient satisfaction, and even puts Del Sol in legal and ethical jeopardy.

Let’s take a look at Del Sol’s flawed verification system by meeting Luke Sandoval. He’s in his early 50s and recently took a new job coaching tennis at a local university, switching his health insurance plan to a new payer organization, Cumulus Health Plans.

Over the past year, Del Sol has provided physical therapy to help Luke treat his chronic knee pain. The treatment has been effective so far, and today he has another session.

Alex, the medical receptionist at Del Sol, manually checks the coverage verification from Luke's previous appointment. Alex assumes Luke’s coverage is the same, and he admits him for his treatment session.

When Del Sol sends Luke’s claim for processing, his former insurer cites expired coverage and denies the claim. Denial of the claim means that Del Sol doesn’t get paid. Moreover, Luke has to explain the situation to his new insurer over a series of calls, resulting in a prolonged and poor patient experience. Plus, Del Sol must now manually rework the original claim, which wastes even more time and resources.

This scenario is just an example of the effort and challenges that healthcare providers like Del Sol Clinic deal with daily.

Insurance eligibility verification plays a crucial role in ensuring accurate and timely reimbursement from payers to healthcare providers like Del Sol. Providers always want to avoid situations where the patients’ insurance requests are turned down. Reducing denials not only ensures good patient experience, but also helps Del Sol maintain cash flow. Most importantly, verifying eligibility helps ensure that patients like Luke get the timely healthcare they need.

Understanding Eligibility

In healthcare, a payer is a person, organization, or entity that pays for the care products and services administered by a healthcare provider. Payers seek to reduce cost through the denial of claims.

Here’s a list of the most common reasons a healthcare payer denies a patient’s claim.

-

Expired eligibility: The patient’s health insurance coverage has expired, and the patient and provider are unaware of this change. This is what happened with Luke.

-

Non-covered benefits: The patient has a plan that doesn’t cover the procedure that the patient opted for.

-

Out-of-network practice: The patient is unaware of changes in the insurer’s network or insurance plans that have defined the required procedure or practice as out of its network.

-

Improper authorization: The patient’s insurance coverage with a company was terminated, and the patient is now covered by a new payer. In this case, a new authorization is required.

-

Pre-authorization or pre-certification not obtained: The patient fails to complete all the requisites or to obtain the required approvals for the chosen procedure. Based on a patient’s plan, different insurers can have different pre-authorization or pre-certification requisites for certain procedures.

-

Insufficient or incorrect information: The patient’s demographic data or employment status has changed or was incorrectly entered in the claim.

-

Delayed claim filing: The patient or provider files the claim later than the predefined timeline of the insurance company.

-

Duplicate claims: The patient or provider organization resubmits the same claim leading to duplicate claims.

-

Inadequate medical necessity: The patient’s medical necessity is considered inappropriate or insufficient.

Benefits and Eligibility Verification Challenges

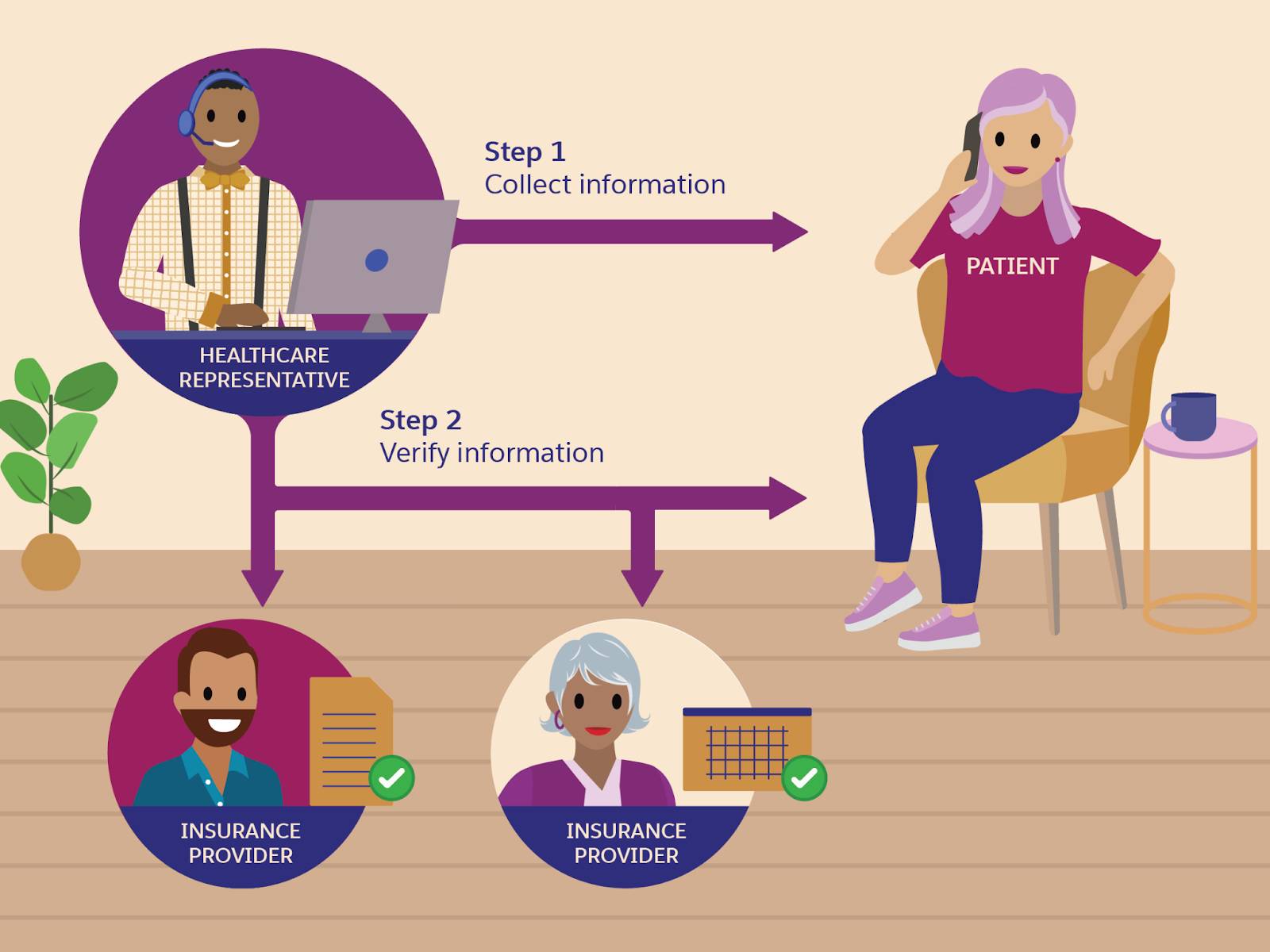

Front desk executives and call center agents working for healthcare providers verify patient benefits and eligibility as part of the patient onboarding process and also periodically throughout the patient journey. For simplicity’s sake, let’s call them healthcare representatives.

The first step is to collect the patient’s demographic and insurance information. The second step is to verify whether the patient’s insurance policies are active. A typical verification process involves these steps:

- Verify the patient’s demographic information

- Verify the patient’s insurance coverage on all primary and secondary (if applicable) payers

- Update the patient’s record in the system

- Contact the patient for additional information, if necessary

Traditionally, benefits verification has been a manual process. Healthcare representatives coordinate with patients, health providers, and insurance providers by phone, internal spreadsheets, and through the insurance provider’s portal. The work to obtain details from patients and then confirm coverage at the insurer’s end is time-consuming, tedious, and error-prone, as healthcare representatives must handle different systems and applications, and manually copy and paste information.

At any step in the process, a simple clerical error such as a missing digit or a misspelling can be the difference between an approved or rejected claim. Also, these manual processes don't guarantee complete coverage information.

As we saw in the case of Luke and Del Sol Clinic, a patient’s benefits and eligibility can change at any moment. The insurance plans and programs can differ substantially in the range of services they cover, procedures they follow, and reimbursements they provide. This variation presents a significant challenge in benefits verification. The smallest error in verification can cause unfavorable claims, wrongful claim denials, and revenue leakage for the provider. Thus, while it’s important to verify the coverage when scheduling the appointment, it’s equally essential to reverify the coverage at the time of admission or visit.

For providers like Del Sol, it’s increasingly critical that their benefits-verification system supports enhancing authorization and benefits management. Providers can take preventive action to create clean claims and reduce incidents of denied claims. Also, they can keep the cash flowing for a healthy revenue cycle through streamlined processes.

Minimizing Claim Denials

Verification of benefits (VOB) is an important way in which healthcare providers can render payment from insurance companies.. With VOB, providers can estimate what the patient owes and what the insurance reimburses based on contractual agreements.

The easiest way to ensure smooth operations for the healthcare organization staff is to make sure all the relevant details are at their fingertips. Salesforce helps do just that!

Benefits verification automates a bulk of the verification process, supports a variety of service types and benefit models, and seamlessly integrates the process into the end-to-end patient access workflow. With the Benefits Verification component, providers avoid missed revenue due to inaccurate coverage. Also, they can easily complete the following tasks:

- Verify benefits at a glance and in real time, directly on the patient record.

- Connect with verification partners easily by integrating with third-party benefits and eligibility services.

- Check benefits for medical services, pharmacy, and medical equipment to ensure patients have the required coverage before their visit.

- Schedule asynchronous benefits verification.

Now that you’ve learned the advantages that Benefits Verification can offer, head to the next unit to explore how to set up the feature.

Resources